What do the unemployment insurance benefits in Vietnam have? Who are the compulsory participants in unemployment insurance in Vietnam?

What do the unemployment insurance benefits in Vietnam have? Who are the compulsory participants in unemployment insurance in Vietnam? I'm looking forward to the answers. Question from Ms. Chi in Tay Ninh.

What do the unemployment insurance benefits in Vietnam have?

Pursuant to Article 42 of the 2013 Employment Law regulating unemployment insurance benefits:

Unemployment insurance benefits

1. Unemployment allowance.

2. Job counseling and recommendation support.

3. Vocational training support.

4. Support for training and retraining to improve qualifications of occupational skills for job maintenance for workers.

Therefore, currently, unemployment insurance has the following 04 benefits:

- Unemployment allowance.

- Job counseling and recommendation support.

- Vocational training support.

- Support for training and retraining to improve qualifications of occupational skills for job maintenance for workers.

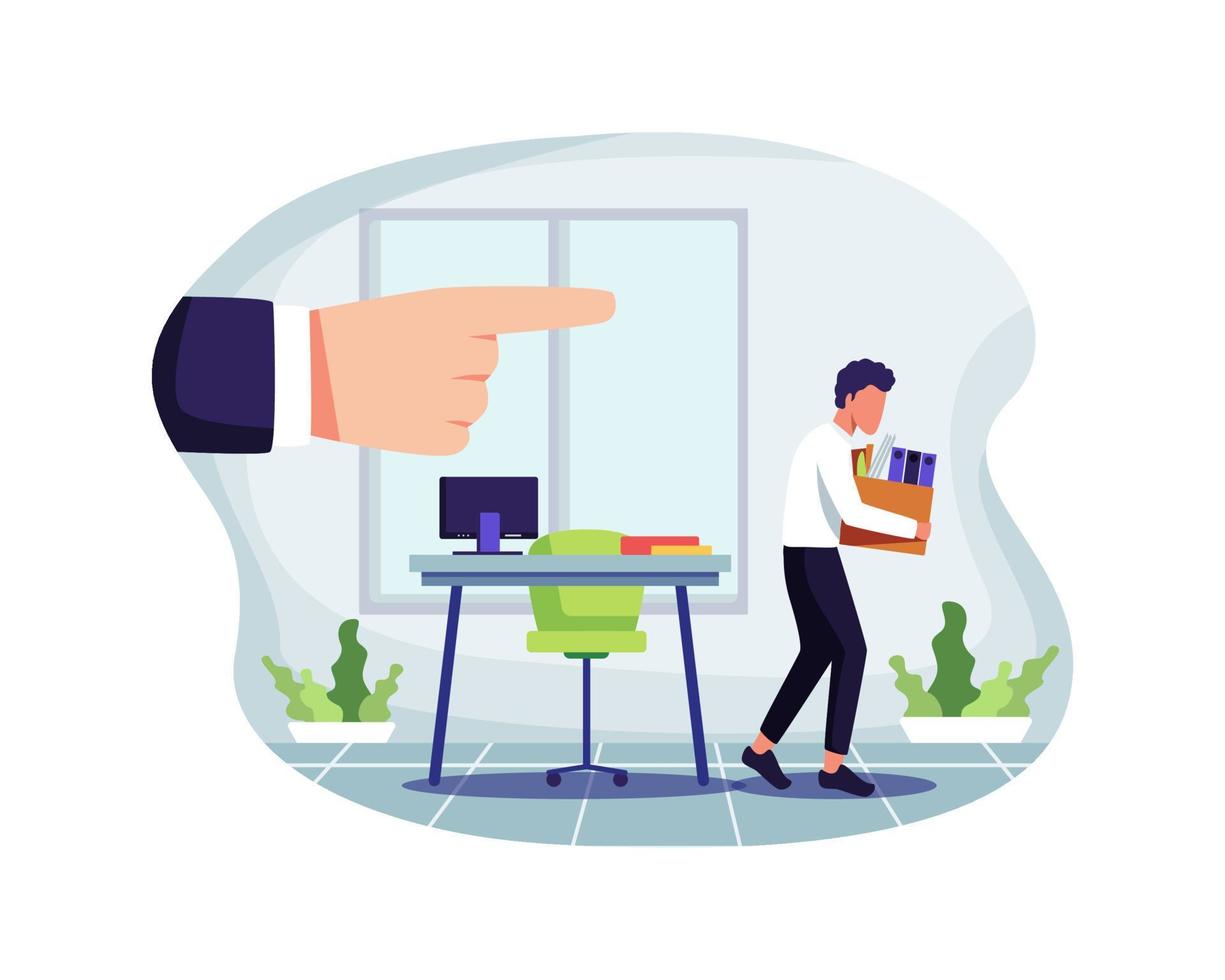

What do the unemployment insurance benefits in Vietnam have? Who are the compulsory participants in unemployment insurance in Vietnam? (Image from the Internet)

Who are the compulsory participants in unemployment insurance in Vietnam?

Pursuant to Article 43 of the 2013 Employment Law, the compulsory participants in unemployment insurance are as follows:

Compulsory participants in unemployment insurance

1. Workers are obliged to participate in unemployment insurance when working under labor contracts or working contracts below:

a/ Labor contracts or working contracts of indefinite time;

b/ Labor contracts or working contracts of definite time;

c/ Seasonal or job-based working contracts with a term of between full 3 months and under 12 months.

In case a worker has signed and is performing more than one labor contract specified in this Clause, the worker and the employer under the labor contract signed first shall participate in unemployment insurance.

2. Workers defined in Clause 1 of this Article who are currently on pension or doing housework are not required to participate in unemployment insurance.

3. Employers obliged to participate in unemployment insurance include state agencies, public non-business units and people’s armed forces units; political organizations, socio-political organizations, socio-political-professional organizations, social organizations and socio-professional organizations; foreign agencies and organizations and international organizations operating in the Vietnamese territory; enterprises, cooperatives, households, business households, cooperative groups, other organizations and individuals that hire or employ workers under the labor contracts or working contracts specified in Clause 1 of this Article.

Therefore, workers are required to participate in unemployment insurance when working under a labor contract or working contract as follows:

- Labor contracts or working contracts of indefinite time;

- Labor contracts or working contracts of definite time;

- Seasonal or job-based working contracts with a term of between full 3 months and under 12 months.

Note: In case a worker enters into and is performing multiple labor contracts specified in this clause, the worker and the employer of the first entered labor contract are responsible for participating in unemployment insurance.

Workers who are currently on pension or doing housework are not required to participate in unemployment insurance.

What conditions must workers met to receive unemployment allowance?

Pursuant to Article 49 of the 2013 Employment Law, the conditions for unemployment allowance receipt are as follows:

Conditions for unemployment allowance receipt

A worker defined in Clause 1, Article 43 of this Law who currently pays unemployment insurance premiums may receive unemployment allowance when fully meeting the following conditions:

1. Terminating the labor contract or working contract, except the following cases:

a/ He/she unilaterally terminates the labor contract or working contract in contravention of law;

b/ He/she receives monthly pension or working capacity loss allowance.

2. Having paid unemployment insurance premiums for at least full 12 months within 24 months before terminating the labor contract or working contract, for the case specified at Points a and b, Clause 1, Article 43 of this Law; or having paid unemployment insurance premiums for at least full 12 months within 36 months before terminating the labor contract, for the case specified at Point c, Clause 1, Article 43 of this Law.

...

Therefore, workers participating in unemployment insurance are eligible for unemployment benefits when they meet the following conditions:

- Terminating the labor contract or working contract, except the following cases:

+ He/she unilaterally terminates the labor contract or working contract in contravention of law;

+ He/she receives monthly pension or working capacity loss allowance.

- Having paid unemployment insurance premiums for at least full 12 months within 24 months before terminating the labor contract or working contract, for the case specified at Points a and b, Clause 1, Article 43 of this Law; or having paid unemployment insurance premiums for at least full 12 months within 36 months before terminating the labor contract, for the case specified at Point c, Clause 1, Article 43 of this Law.

- Having submitted a dossier for receipt of unemployment allowance to an employment service center.

- Having not yet found any job after 15 days from the date of submission of the dossier for receipt of unemployment allowance, except the following cases:

+ He/she performs the military or public security obligation;

+ He/she attends a training course of full 12 months or longer;

+ He/she serves a decision on application of the measure to send him/her to a reformatory, compulsory education institution or compulsory detoxification establishment;

+ He/she is kept in temporary detention or serves a prison sentence;

+ He/she goes abroad for settlement or as guest worker;

+ He/she dies.

Best Regards!