The simplest and quickest way to submit an online application for unemployment benefits in Vietnam

Please provide me with the simplest and quickest way to submit an online application for unemployment benefits in Vietnam. Thank you! - Mr. Phong (Lao Cai)

The simplest and quickest way to submit an online application for unemployment benefits in Vietnam

According to Document 1399/LDTBXH-VL in 2022, there are guidelines on the reception and resolution of unemployment benefits on the National Public Service Portal.

You can refer to the detailed instructions for submitting online unemployment benefit applications on the National Public Service Portal as follows:

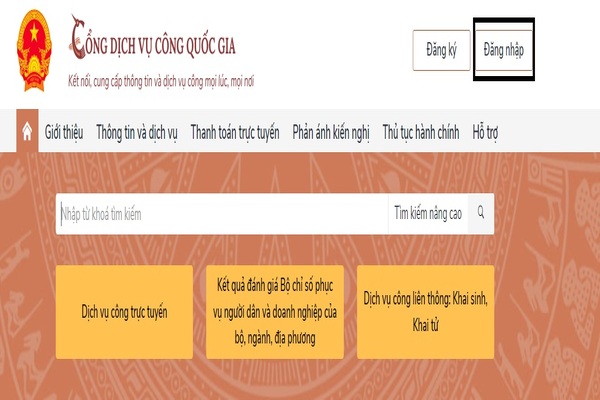

Step 1: Access the National Public Service Portal through the link: http://dichvucong.gov.vn/p/home/dvc-trang-chu.html

Step 2: Register/login to the National Public Service Portal

Step 3: Enter the search box with the content "Giải quyết hưởng trợ cấp thất nghiệp" (Resolving unemployment benefits).

Step 4: Select the List of Public Services and choose the appropriate authority to resolve the application (it is recommended to choose the Department of Labor - War Invalids, and Social Affairs, which has the jurisdiction).

Step 5: Select "Submit online" and the system will automatically transfer to the provincial-level public service system of the chosen National Public Service Portal.

Step 6: Proceed to fill in the required information and upload the necessary documents according to the instructions.

Step 7: Submit the application.

What are conditions for unemployment allowance receipt in Vietnam?

Pursuant to Article 49 of the Law on Employment in 2013 stipulating conditions for unemployment allowance receipt in Vietnam:

Conditions for unemployment allowance receipt

A worker defined in Clause 1, Article 43 of this Law who currently pays unemployment insurance premiums may receive unemployment allowance when fully meeting the following conditions:

1. Terminating the labor contract or working contract, except the following cases:

a/ He/she unilaterally terminates the labor contract or working contract in contravention of law;

b/ He/she receives monthly pension or working capacity loss allowance.

2. Having paid unemployment insurance premiums for at least full 12 months within 24 months before terminating the labor contract or working contract, for the case specified at Points a and b, Clause 1, Article 43 of this Law; or having paid unemployment insurance premiums for at least full 12 months within 36 months before terminating the labor contract, for the case specified at Point c, Clause 1, Article 43 of this Law.

3. Having submitted a dossier for receipt of unemployment allowance to an employment service center under Clause 1, Article 46 of this Law.

4. Having not yet found any job after 15 days from the date of submission of the dossier for receipt of unemployment allowance, except the following cases:

a/ He/she performs the military or public security obligation;

b/ He/she attends a training course of full 12 months or longer;

c/ He/she serves a decision on application of the measure to send him/her to a reformatory, compulsory education institution or compulsory detoxification establishment;

d/ He/she is kept in temporary detention or serves a prison sentence;

dd/ He/she goes abroad for settlement or as guest worker;

e/ He/she dies.

As regulations above, conditions for unemployment allowance receipt in Vietnam are:

- Terminating the labor contract or working contract, except the following cases: He/she unilaterally terminates the labor contract or working contract in contravention of law; He/she receives monthly pension or working capacity loss allowance.

- Satisfying the time requirements for payment of unemployment insurance premiums

- Having submitted a dossier for receipt of unemployment allowance

- Having not yet found any job after 15 days from the date of submission of the dossier for receipt of unemployment allowance, except prescribed cases.

What is the time for submission of application for unemployment benefit in Vietnam?

Pursuant to Article 46 of the Law on Employment in 2013 stipulating receipt of unemployment allowance:

Receipt of unemployment allowance

1. Within 3 months after terminating his/her labor contract or working contract, a worker shall submit a dossier for receipt of unemployment allowance to an employment service center established by the state management agency in charge of employment.

2. Within 20 days after the employment service center receives a complete dossier, the competent state agency shall issue a decision on unemployment allowance receipt; in case the worker is ineligible for receiving unemployment allowance, the center shall issue a written reply to the worker.

3. The social insurance organization shall pay unemployment allowance to the worker within 5 days after receiving a decision on unemployment allowance receipt.

Pursuant to Article 17 of the Decree 28/2015/ND-CP (amended by Clause 7 Article 1 of the Decree 61/2020/ND-CP) stipulating submission of application for unemployment benefit:

Submission of application for unemployment benefit

1. Within 03 months from the date of termination of labor contract or working contract, employees who have no jobs and need unemployment benefit shall directly submit 01 application for unemployment benefits in accordance with the provisions of Article 16 of this Decree to employment service center in the locality where employees want to receive unemployment benefits.

...

Therefore, the deadline for submitting applications for unemployment benefits is 3 months from the date of termination of the labor contract or working contract.

Note: If the application is not submitted within the 3-month period from the date of termination of the labor contract or working contract, the individual will not be eligible for unemployment benefits.

Best regards!