What are the conditions for a public company to issue shares under an employee stock option plan in Vietnam?

- What are the conditions for a public company to issue shares under an employee stock option plan in Vietnam?

- What is the report form on the issuance of shares under an employee stock option plan in a public company in Vietnam?

- What is included in the report on the issuance of employee stock option plan shares in a public company in Vietnam?

What are the conditions for a public company to issue shares under an employee stock option plan in Vietnam?

Pursuant to Article 64 of Decree No. 155/2020/ND-CP stipulating the conditions for a public company to issue shares under an employee stock option plan as follows:

- The employee stock option plan is approved by the General Meeting of Shareholders.

- The total employee stock option plan shares in every 12 months do not exceed 5% of the outstanding shares of the company.

- There are criteria and list of employees eligible for employee stock option plan, rules for determination of quantity of employee stock option plan shares and execution time that are approved by the General Meeting of Shareholders (or the Board of Directors if authorized by the General Meeting of Shareholders).

- When issuing employee stock option plan shares, the equity must be sufficient for increasing share capital. To be specific:

+ The equity used for issuing employee stock option plan shares shall be determined according to the latest financial statement which is audited by an accredited audit organization, including the following sources: share premium, development investment fund; undistributed post-tax profit; other funds (if any) used for increasing charter capital as prescribed by law;

+ In case the public company is a parent company which issues employee stock option plan shares from share premium, development investment fund, other funds, the funding source shall be determined according to the parent company’s financial statement;

+ In case the public company is a parent company which issues employee stock option plan shares from undistributed post-tax profit, the profit used for issuing employee stock option plan shares must not exceed the undistributed post-tax profit on the audited consolidated financial statement. In case the profit used for issuing employee stock option plan shares is lower than the undistributed post-tax profit on the consolidated financial statement and higher than the undistributed post-tax profit on the parent company’s financial statement, profit shall only be distributed after profits have been transferred from the subsidiary companies to the parent company.

- When issuing employee stock option plan shares, the total value of the sources mentioned in Clause 4 Article 64 of Decree No. 155/2020/ND-CP must not fall below the total increase in share capital under the plan approved by the General Meeting of Shareholders.

- The issuer must open an escrow account to receive payment of the employees for the shares, except issuance of bonus shares to employees.

- The issuance satisfies regulations on foreign ownership ratio in case employee stock option plan shares are issued to employees who are foreign investors.

- The employee stock option plan shares will be restricted from transfer for at least 01 year from the ending date of the offering.

- The conditions specified in Clause 4 Article 60 of Decree No. 155/2020/ND-CP are satisfied.

What are the conditions for a public company to issue shares under an employee stock option plan in Vietnam?

What is the report form on the issuance of shares under an employee stock option plan in a public company in Vietnam?

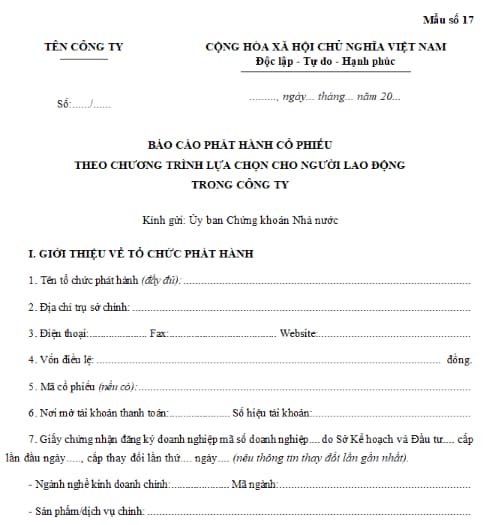

The report on the issuance of shares according to Form No. 17 of the Appendix issued together with Decree No. 155/2020/ND-CP is as follows:

Download the form of report on the issuance of shares under an employee stock option plan in a public company in Vietnam: Click here.

What is included in the report on the issuance of employee stock option plan shares in a public company in Vietnam?

Pursuant to Article 65 of Decree No. 155/2020/ND-CP stipulating as follows:

- The report form No. 17 in the Appendix hereof.

- The decision of the General Meeting of Shareholders to approve the employee stock option plan which must specify: the quantity of employee stock option plan shares, issue price or rules for determination thereof or authority of the Board of Directors to determine the issue price. If the employee stock option plan does not specify the issue price, it shall be determined in accordance with the Law on Enterprises. Persons having interests relevant to the issuance must not vote.

- The decision of the General Meeting of Shareholders (or the Board of Directors if authorized by the General Meeting of Shareholders) to approve the criteria and list of employees eligible for employee stock option plan, rules for determination of quantity of employee stock option plan shares and execution time. Persons having interests relevant to the issuance must not vote on these issues.

- The latest annual financial statement audited by an accredited audit organization in case of issuance of bonus shares to employees.

- The decision of the competent authority of the subsidiary company to approve the distribution of profits, the statements confirmed by the banks proving that profits have been transferred from the subsidiary companies to the parent company in case undistributed post-tax profit is used for issuance of bonus shares to employees and the funding source is lower than undistributed post-tax profit on the consolidated financial statement and higher than the undistributed post-tax profit on the separate financial statement of the parent company.

- Written confirmation by the bank or foreign bank branch of the opening of an escrow account to receive payment for the bonus shares issued to employees.

- The decision of the General Meeting of Shareholders or the Board of Directors (if authorized by the General Meeting of Shareholders) to approve the plan for assuring conformable foreign ownership ratio in case of issuance of shares to employees who are foreign investors.

- The documents specified in Clause 3, 7 Article 61 of Decree No. 155/2020/ND-CP.

LawNet