File for Requesting the Issuance of the License for Provision of Payment Intermediary Services from July 01, 2024 Includes Which Documents?

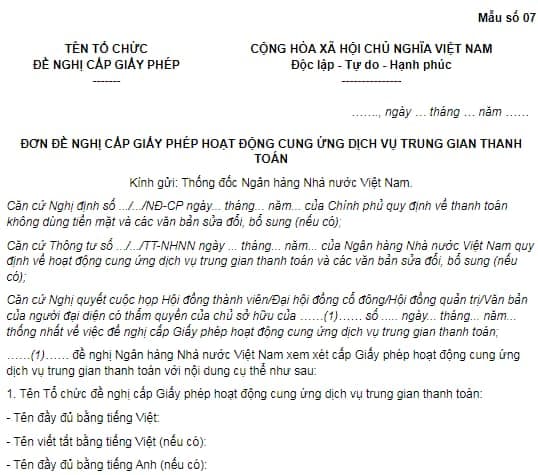

Template 07 for Requesting a New License for Payment Intermediary Services Effective from July 1, 2024

On May 5, 2024, the Government of Vietnam issued Decree 52/2024/ND-CP regarding non-cash payments.

In the Appendix issued along with Decree 52/2024/ND-CP, the latest template for requesting a license for payment intermediary services, effective from July 1, 2024, is stipulated as follows:

Download the latest template for requesting a license for payment intermediary services, effective from July 1, 2024, here.

File for requesting a license for payment intermediary services from July 1, 2024?

File for Requesting a License for Payment Intermediary Services from July 1, 2024?

Clause 2, Article 24 of Decree 52/2024/ND-CP stipulates the file for requesting a license for payment intermediary services from July 1, 2024, as follows:

- Request form for the license according to Template 07 issued along with Decree 52/2024/ND-CP.

- Resolution of the Board of Members, Board of Directors, General Meeting of Shareholders, document of the authorized representative of the owner in accordance with the authority stipulated in the company's Charter regarding the approval of the Scheme for providing payment intermediary services and the Technical Solution Explanation.

- Scheme for providing payment intermediary services according to Template 08 issued along with Decree 52/2024/ND-CP.

- Technical Solution Explanation.

- Personnel file:

+ Curriculum Vitae according to Template 09 issued along with Decree 52/2024/ND-CP.

+ Copies of documents proving the capacity, professional qualifications of the legal representative, General Director (Director), Deputy General Director (Deputy Director), and key personnel implementing the Scheme for providing payment intermediary services; judicial record card or equivalent document of the legal representative, General Director (Director) as per legal regulations (not exceeding 6 months before the application for the license).

+ Document from the authorized representative of the unit where the legal representative, General Director (Director) has worked or is working, confirming the position and time of holding the position or a copy of the document proving the position and time of holding the position at the unit of the legal representative, General Director (Director).

- Copies of documents proving the organization applying for the license has been legally established and operating, including: establishment license or enterprise registration certificate or equivalent document; organizational and operational charter of the organization; investment certificate of foreign investors (if any).

- Commitment document and supporting documents from the owner, founding members, and founding shareholders of the organization to ensure maintaining the actual value of charter capital.

- For financial switching services and electronic clearing services: a plan by an organization to settle clearing results among involved parties according to Template 08 issued along with this Decree; connection agreement with participating organizations, committed not to connect with more than two financial switching service providers, electronic clearing service providers; documents proving information infrastructure and server system compliant with point g clause 2 Article 22 of Decree 52/2024/ND-CP.

- For international financial switching services: internal regulations on standards for selecting international payment systems to be connected for implementing international financial switching of transactions; internal regulations on business processes with risk management measures for the international financial switching service applied for permission; a copy of documents proving the international payment system operator is legally established and operating abroad, certified by competent authorities of the country or territory where the operator is established or headquartered; a plan by an organization to settle clearing results among involved parties according to Template 08 issued along with Decree 52/2024/ND-CP.

Procedure for Issuing a License for Payment Intermediary Services from July 1, 2024

The procedure for issuing a license for payment intermediary services from July 1, 2024, is as follows:

- In case the application is submitted via postal service or directly to the One-Stop Division of the State Bank, the organization applying for the license must send 02 sets of the application and 06 CDs (or 06 USBs) containing scanned copies of the complete application file. Based on the license application, the State Bank cooperates with relevant ministries and agencies to appraise the application based on the conditions stipulated in clause 2 Article 22 of Decree 52/2024/ND-CP.

+ Within 05 working days from the date of receiving the application for the license, the State Bank sends a written confirmation to the organization acknowledging the receipt of a complete and valid application. If the application is incomplete or invalid, the State Bank sends a written request to the organization for additional documents. The time taken for submitting additional documents is not counted as part of the application appraisal period.

Within 60 days from the date the State Bank issues a written request for additional documents but the organization fails to resubmit or the additional documents do not meet the requirements, the State Bank will return the original application to the organization;

+ Within 90 working days from the date of receiving the complete and valid application, the State Bank will appraise the application. If the organization fails to resubmit the application within 60 days from the date the State Bank issues a written request for clarification, the State Bank will return the application.

Within 90 working days from the date of receiving the supplemental and completed application, the State Bank shall appraise and issue the license as per regulations. If the license is not issued, the State Bank shall send a written response to the organization, stating the reasons;

+ From the date the State Bank receives the complete and valid application, the organization applying for the license may submit additional and completed applications up to 02 times; the time for submitting additional applications should not exceed 60 days from the date the State Bank issues a written acknowledgment of the receipt of a valid application.

Decree 52/2024/ND-CP comes into effect from July 1, 2024.

LawNet