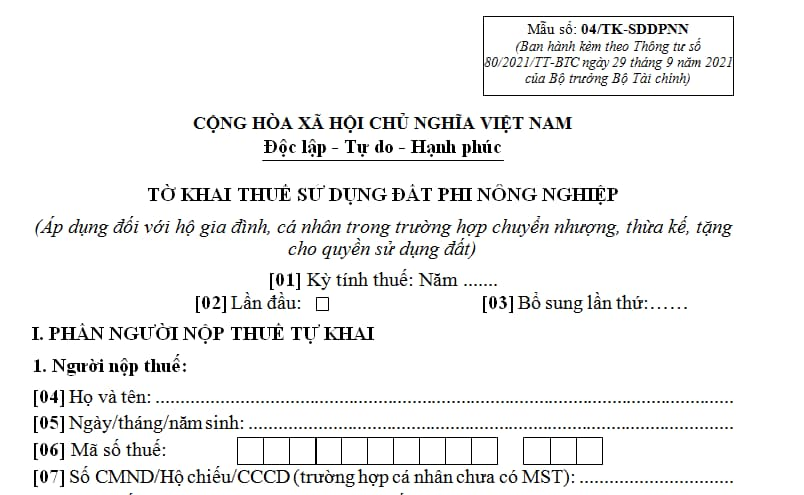

Which entities use the non-agricultural land use tax declaration form - Form 04/TK-SDDPNN in Vietnam?

Which entities use the non-agricultural land use tax declaration form - Form 04/TK-SDDPNN in Vietnam?

The non-agricultural land use tax declaration form - Form 04/TK-SDDPNN applies to households and individuals in case of land use right transfer, inheritance, or donation and is specified in Appendix 2 issued in conjunction with Circular 80/2021/TT-BTC:

Download the non-agricultural land use tax declaration form - Form 04/TK-SDDPNN: Here

Which entities use the non-agricultural land use tax declaration form - Form 04/TK-SDDPNN in Vietnam? (Image from Internet)

What types of land are subject to non-agricultural land use tax in Vietnam?

(1) Types of land subject to non-agricultural land use tax:

According to Article 2 of the Non-agricultural Land Use Tax Law 2010, the types of land subject to non-agricultural land use tax include:

- Residential land in rural and urban areas.

- Non-agricultural production and business land, including land for the construction of industrial parks; land for the construction of production and business establishments; land for mineral exploitation and processing; and land for the production of construction materials and pottery articles.

- Non-agricultural land specified in Article 3 of Non-agricultural Land Use Tax Law 2010 which is used for commercial purposes.

(2) Types of land not subject to non-agricultural land use tax:

Under the regulations in Article 3 of the Non-agricultural Land Use Tax Law 2010, the types of land not subject to non-agricultural land use tax are non-agricultural land used not for business purposes, including:

- Land used for public purposes, including traffic and irrigation land, land for the construction of cultural, healthcare, education and training, and physical training and sports works for public interests; land with historicalcultural relics or scenic places; and land for the construction of other public works under the Government’s regulations;

- Land used by religious institutions;

- Land used for cemeteries and graveyards;

- Land under rivers, canals, ditches, streams and special-use water surface;

- Land with communal houses, temples, worship halls or clans’ worship houses;

- Land for the construction of working offices or non-business works or for national defense and security purposes;

- Other non-agricultural land provided for by law.

What are the instructions for calculating the payable non-agricultural land use tax in Vietnam?

According to Article 8 of Circular 153/2011/TT-BTC, the payable non-agricultural land use tax is calculated as follows:

(1) The non-agricultural land use tax amount payable for residential land, production and business land and non-agricultural land which are used for commercial purposes shall be determined according to the following formula:

|

The payable tax amount (VND) |

= |

Arising tax amount(VND) |

- |

Exempted or reduced tax amount if any(VND) |

The arising tax amount is determined as follows:

|

Arising tax amount (VND) |

= |

Taxable land area X (m2) |

x |

The price of a square meter of land(VND/m2) |

x |

Tax rate (%) |

(2) For land of apartment buildings with many users or condominiums (including those with basements) and underground works, the payable tax amount shall be determined as follows:

|

The payable tax amount(VND) |

= |

Arising tax amount(VND) |

- |

Exempted or reduced tax amount if any (VND) |

The arising tax amount is determined as follows:

|

The arising tax amount |

= |

The area of house of each organization, household or individual |

x |

Allocation coefficient |

x |

The price of a square meter of corresponding land |

x |

Tax rate |

For underground works:

|

The arising tax amount |

= |

The area of work used by each organization, household or individual |

x |

Allocation coefficient |

x |

The price of a square meter of corresponding land |

x |

Tax rate |

(3) In case of using non-agricultural land for commercial purposes but the area of land used for commercial purposes cannot be determined, the arising tax amount shall be determined as follows:

|

The arising tax amount |

= |

The area of land used for commercial purposes |

x |

The Price of a square meter of land |

x |

Tax rate(%) |

|

he area of land used for commercial purposes |

= |

Total area of currently used land |

x |

Business turnover |

|

Total turnover in the year |

Which entities are required to pay non-agricultural land use tax in Vietnam?

According to Article 4 of the Non-agricultural Land Use Tax Law 2010, the entities are required to pay non-agricultural land use tax are specified as follows:

- Taxpayers are organizations, households and individuals that have the right to use tax-liable land specified in Article 2 of Non-agricultural Land Use Tax Law 2010.

- When organizations, households or individuals have not yet been granted land use right certi-ficates or house and land-attached asset ownership certificates (below collectively referred to as certificates), current land users will be taxpayers.

- Taxpayers in some cases are specified as follows:

+ When land is leased by the State for the implementation of investment projects, lessees will be taxpayers;

+ When persons having land use rights lease land under contracts, taxpayers shall be identified as agreed upon in these contracts. When no agreement on taxpayers is made in contracts, persons having land use rights will be taxpayers;

+ When land has been granted a certificate but is currently under dispute, pending the dispute settlement, current land users will be taxpayers. Tax payment does not serve as a ground for the settlement of disputes over land use rights;

+ When many persons have the right to co-use a land plot, the lawful representative of these co-users will be the taxpayer;

+ When a person having land use rights contributes his/her land use rights as business capital, thereby forming a new legal entity that has the right to use tax-liable land specified in Article 2 of Non-agricultural Land Use Tax Law 2010, the new legal entity will be the taxpayer.

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?