When is the corporate income tax return prepared in Vietnam?

When is the corporate income tax return prepared in Vietnam?

Based on Clause 6, Article 8 of Decree 126/2020/ND-CP (amended by Clause 3, Article 1 of Decree 91/2022/ND-CP)

Types of taxes declared monthly, quarterly, annually, separately, and upon tax finalization

...

6. Types of taxes and collections declared for the annual finalization and finalization up to the time of dissolution, bankruptcy, cessation of operations, termination of contracts, or reorganization of enterprises. In the case of a change in the type of enterprise (excluding state-owned enterprises undergoing privatization) where the new enterprise inherits all tax liabilities of the converted enterprise, no tax finalization declaration is required at the time of decision on enterprise conversion; the enterprise will declare and finalize at the end of the year. Specifically:

...

b) Corporate income tax (excluding corporate income tax derived from capital transfer by foreign contractors; corporate income tax declared according to the revenue percentage method separately or monthly as stipulated at Point đ, Clause 4 of this Article). Taxpayers must self-determine the provisional quarterly corporate income tax (including the temporary allocation of corporate income tax to provinces where there are dependent units, business locations, or real estate transfers different from the main headquarters of the taxpayer) and offset the provisional amounts against the annual tax finalization.

Taxpayers required to prepare quarterly financial statements according to the accounting law, based on the quarterly financial statements and tax law regulations, must determine the provisional amount of corporate income tax each quarter.

Corporate income tax is an annual finalization tax, except in the following cases:

- Corporate income tax from capital transfer by foreign contractors declared monthly;

- Corporate income tax that does not regularly occur and the enterprise employs a revenue percentage tax calculation method, declared separately or monthly (if there are multiple occurrences in a month).

Point a, Clause 1, Point a, Clause 2, and Clause 3, Article 44 of the Tax Management Law 2019 specify:

- Deadline for annual tax finalization declaration: No later than the last day of the third month from the end of the calendar year (i.e., March 31) or fiscal year.

- If the enterprise has irregular corporate income tax occurrences and employs a revenue percentage tax method, the filing deadlines are:

+ separately: No later than the 10th day from the date of the tax obligation;

+ Monthly: No later than the 20th day of the following month of the tax obligation occurrence.

When is the corporate income tax return prepared in Vietnam? (Image from the Internet)

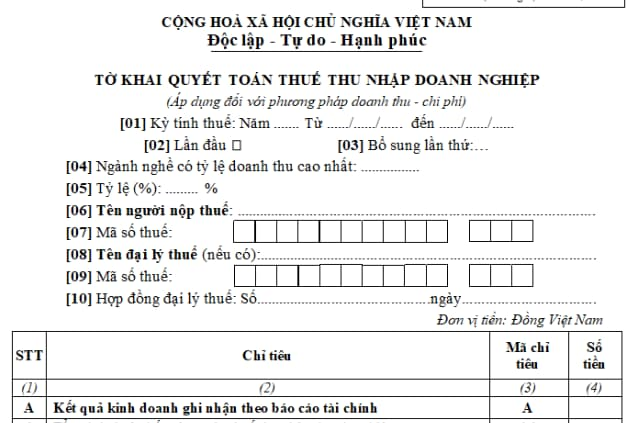

Which form is used for the annual corporate income tax finalization return?

Currently, enterprises that pay taxes using the revenue-expense method, when declaring the annual corporate income tax (CIT) finalization, must use the CIT finalization declaration Form 03/TNDN (as specified in Appendix 2 issued with Circular 80/2021/TT-BTC).

Download the corporate income tax return Form 03/TNDN here.

What is the revenue to calculate assessable income in Vietnam?

According to Article 8 of Decree 218/2013/ND-CP, revenue to calculate assessable income is defined as follows:

Revenue for calculating taxable income is conducted according to the provisions of Article 8 of the Corporate Income Tax Law 2008.

- Revenue for determining taxable income includes all sales, processing fees, service provision money, including subsidies, surcharges, and premiums that enterprises are entitled to, regardless of whether the money has been collected or not.

For enterprises declaring and paying value-added tax by the deduction method, revenue for corporate income tax calculation excludes value-added tax. For enterprises declaring and paying VAT by the direct method on added value, revenue for corporate income tax includes VAT.

- The time to determine revenue for calculating taxable income for goods sold is the time of transfer of ownership or use rights to the purchaser.

Time to determine revenue for calculating taxable income for services is the time the service provision is completed or the time the service invoice is issued.

- Revenue for determining taxable income for some cases is specifically defined as follows:

+ For installment sales, it is determined by the one-time sale price of goods, excluding interest from installment payments;

+ For goods and services used for internal exchange and consumption (excluding goods and services used for continued production and business processes), it is determined according to the selling price of similar or equivalent products, goods, and services at the time of exchange or internal consumption;

+ For processing activities, it includes all amounts collected from processing activities such as wages, and costs for fuel, power, auxiliary materials, and other expenses for processing;

+ For leasing assets, golf course business, and other service businesses where customers pay in advance for multiple years, the revenue is the amount paid periodically by the lessee or buyer according to the contract. If payment is made in advance for multiple years, revenue for taxable income calculation is allocated over the number of years paid in advance or determined according to one-time revenue. If the enterprise benefits from tax incentives, determining the tax amount eligible for incentives must be based on total corporate income tax payable divided by the number of years paid in advance.

+ For credit activities and financial leasing, it is the interest on loans and rental revenue accrued;

+ For transportation activities, it includes all revenues from passenger, goods, and luggage charges incurred during the tax period;

+ For electricity and clean water, it is the amount stated in the VAT invoice;

+ For insurance and reinsurance business activities, it is the amount receivable from original insurance premiums, service agency fees, reinsurance premiums, commission revenues, and other revenues from insurance activities minus returned or reduced insurance fees, reinsurance premiums, and commission transfers.

In case of co-insurance, revenue for taxable income calculation is the premium divided proportionately to co-insurance, exclusive of VAT.

For insurance contracts with periodic payments arrangements, revenue for taxable income calculation is the receivable amount incurred in each period;

+ For construction and installation activities, it is the value of the project, components, or volume of the construction and installation work completed.

If construction and installation exclude material, machinery, and equipment, revenue for tax calculation excludes these items' value;

+ For business activities under cooperation contracts without forming a legal entity:

(i) If the parties in the cooperation contract divide business outcomes by sales of goods and services, revenue for tax calculation is the revenue shared by each party per contract;

(ii) If the business outcomes are divided by post-tax profits, the revenue for determining taxable income is the sales value of goods and services per contract;

- For casino businesses and electronic games with prizes, and betting businesses, it is the total revenue from these activities, including special consumption tax, minus prize payouts to customers;

- For securities business, it includes earnings from brokerage services, proprietary trading, underwriting services, investment advisory services, fund management, issuance of fund certificates, market organization services, and other securities services as per law;

- For oil and gas search, exploration, and exploitation activities, it is the total revenue from selling oil and gas at market-based transaction contract prices during the tax period;

- For derivative financial services, it is the revenue from providing derivative financial services during the tax period.

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?