What is the highest personal income tax rate in Vietnam?

What is the highest personal income tax rate in Vietnam?

Based on Article 14 of Decree 65/2013/ND-CP (amended by Clause 4 Article 6 of Decree 12/2015/ND-CP) and Clause 1 Article 18 of Circular 111/2013/TT-BTC, the highest personal income tax rate applicable to residents and non-residents is prescribed as follows:

- For resident individuals: Personal income tax rates are applied according to the following progressive tax rate table:

| Tax Bracket | Taxable Income/Year (million VND) | Taxable Income/Month (million VND) | Tax Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

- For non-resident individuals: The personal income tax rate for income from wages and salaries arising in Vietnam is 20%.

Thus, the highest personal income tax rates are as follows:

- For non-resident individuals: The highest tax rate is 20%, applicable uniformly across taxable income thresholds.

- For resident individuals: The highest tax rate is 35%, applicable to wages and salaries with taxable income over 80 million VND/month and over 960 million VND/year.

What is the highest personal income tax rate in Vietnam? (Image from the Internet)

Which allowances and supports are exempt from personal income tax in Vietnam?

Pursuant to point b, clause 2, Article 3 of Decree 65/2013/ND-CP amended by clause 3, Article 2 of Decree 12/2015/ND-CP, the following allowances and supports are not subject to personal income tax (PIT):

- Monthly preferential allowances and one-time allowances according to legal regulations on preferential treatment for people with meritorious services;

- Monthly allowances, one-time allowances for individuals participating in resistance, national protection, international missions, youth volunteers who have completed their tasks;

- Defense and security allowances; allowances for armed forces;

- Hazardous and dangerous allowances for industries, occupations, or jobs in workplaces with hazardous, dangerous factors;

- Attraction allowance, regional allowance;

- Sudden hardship allowance, occupational accident allowance, occupational disease allowance, one-time allowance for childbirth or adoption, allowance due to decreased working capacity, one-time retirement allowance, monthly pension, severance allowance, job loss allowance, unemployment allowance, and other allowances as prescribed by the Labor Code and Social Insurance Law;

- Allowances for individuals protected under social protection laws;

- Service allowances for senior leaders;

- One-time allowances for individuals transferred to work in regions with particularly difficult socio-economic conditions, one-time support for officials working on sea and island sovereignty as per legal regulations. One-time relocation allowances for foreigners residing in Vietnam, Vietnamese working abroad, and Vietnamese residing abroad for long-term returning to work in Vietnam;

- Allowances for village health workers;

- Special occupational allowances.

These allowances and supports that are not counted as taxable income must be prescribed by a competent state agency.

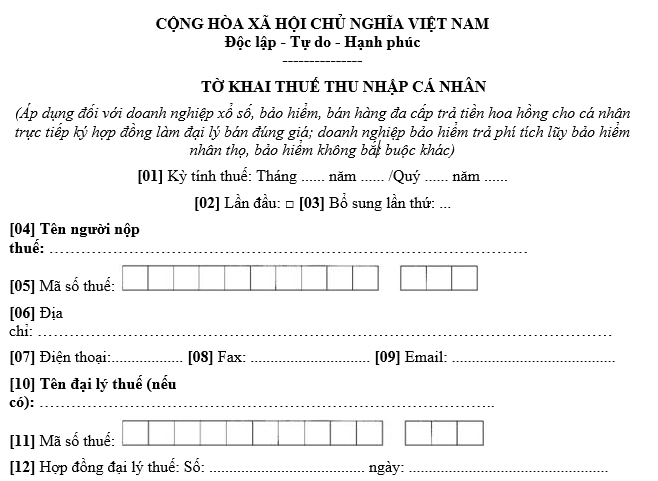

Which enterprises use Form 01/XSBHDC on personal income tax withholding declaration in Vietnam?

Form 01/XSBHDC Personal Income Tax Withholding Declaration is applied to enterprises in lottery, insurance, multi-level marketing that pay commissions to individuals directly signing contracts as agents selling at fixed prices; insurers paying cumulative life insurance, other optional insurance fees as stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC, is as follows:

Download Form 01/XSBHDC Personal Income Tax Withholding Declaration: Click here

.jpg)

- Are hazardous allowances subject to personal income tax in Vietnam?

- Shall the TIN be deactivated due to bankrupcy in Vietnam?

- What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

- Vietnam: Is tax liability imposed when failing to present accounting books?

- What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

- Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

- What is the guidance on first-time taxpayer registration for foreign subcontractors who directly declare and pay contractor tax in Vietnam?

- What are cases where a 10% PIT is withheld in Vietnam?

- How to submit the dependant registration application for persons with income from wages and salaries in Vietnam?

- What are guidelines for first-time taxpayer registration for dependants declared directly at the tax authority in Vietnam?