What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

What is the guidance on paying registration fees through the VCB Bank App in Vietnam?

Step 1: Check TIN

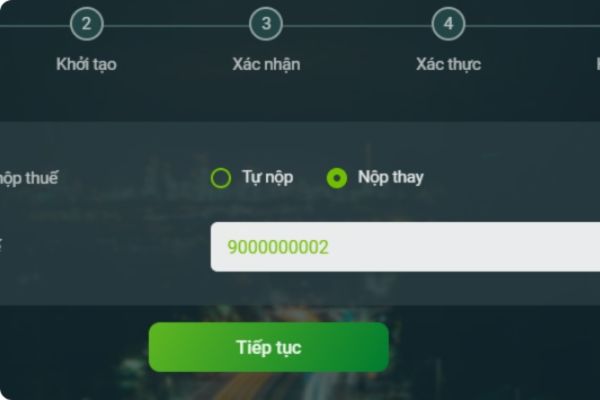

Self-payment: If you wish to pay the tax for yourself and the TIN is registered with the bank, select the Self-payment option.

Pay on behalf: If you wish to pay the tax on behalf of someone else, enter the TIN of the person for whom the tax must be paid and choose Pay on behalf.

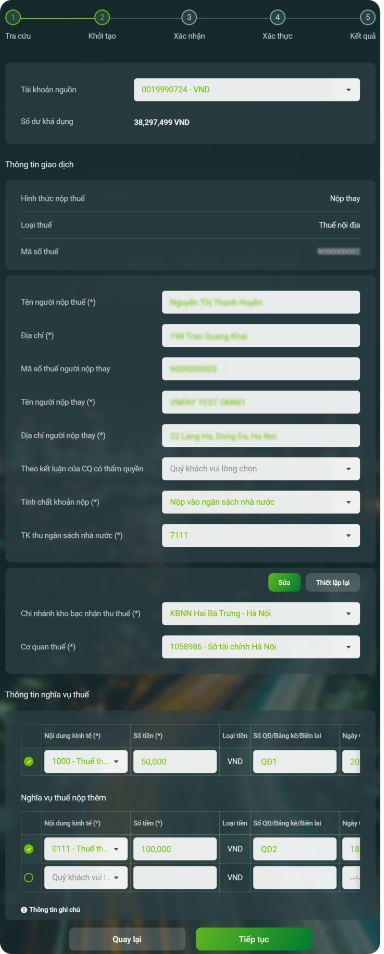

Step 2: Initiate Transaction

Select source account: Choose the account to be used for tax payment. You can change the source account if desired by pressing Edit.

When you press Edit, you may update information such as: Treasury receiving the tax, Tax authority, State budget revenue account, and the tax obligation table.

Press Reset to restore the default information provided by the Tax authority.

Press Continue to proceed to the next step.

In case there is no information returned from the Tax authority: Ensure to enter all fields correctly and completely, then press Continue.

Step 3: Confirm Information

Carefully check the transaction information entered.

Select the desired payment method and press Continue.

Step 4: Confirm Transaction

Password authentication: Enter the application login password.

Smart OTP authentication: If registered for VCB-Smart OTP, enter the VCB-Smart OTP password, the system will automatically generate a transaction authentication code.

SMS OTP authentication: Enter the OTP code sent to your phone number.

Press Continue to complete the transaction.

Step 5: Transaction Result

The application will display the transaction result, including the following information: Tax type, TIN, dossier code, taxpayer's name, name of the treasury receiving the payment, transaction code, and amount.

Press Perform new transaction if you need to start another transaction.

Press Print Receipt to display the receipt template and print it if needed.

Information is for reference only.

What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam? (Image from the Internet)

When is the time for paying registration fees in Vietnam?

According to Article 4 Decree 10/2022/ND-CP, organizations and individuals with assets subject to registration fees as stipulated in Article 3 Decree 10/2022/ND-CP must pay registration fees when registering ownership or use rights with competent state agencies, except in cases eligible for registration fee exemption as prescribed in Article 10 Decree 10/2022/ND-CP.

What are cases eligible for registration fee exemption in Vietnam?

According to Article 10 Decree 10/2022/ND-CP, the following are cases eligible for registration fees exemption:

[1] Houses and land are headquarters of diplomatic missions, consular offices, representative offices of international organizations under the United Nations system, and residences of heads of diplomatic missions, consular offices, and representative offices of international organizations under the United Nations system in Vietnam.

[2] Assets (excluding houses and land) of the following foreign organizations or individuals:

+ Diplomatic missions, consular offices, representative offices of international organizations under the United Nations system.

+ Diplomatic officers, consular public employees, technical administrative personnel of diplomatic missions, consular offices, representative offices of international organizations under the United Nations system, and their family members who are not Vietnamese citizens or not residing in Vietnam eligible for Vietnamese diplomatic or official identification cards issued by the Vietnamese Ministry of Foreign Affairs.

+ Foreign organizations or individuals not stipulated under points a and b of this clause but exempt from or not required to pay registration fees under international commitments of which the Socialist Republic of Vietnam is a member.

[3] Land allocated or leased by the State where land rent is paid once for the entire lease term for the following purposes:

+ Use for public purposes according to land law regulations.

+ Exploration, mineral extraction; scientific research based on permits or confirmations issued by competent state agencies.

+ Investment in infrastructure construction (regardless of land inside or outside industrial zones, export processing zones), investment in house construction for transfer, including cases where organizations or individuals receive transferred land to continue infrastructure construction investment, or investment in house construction for transfer. These cases, if registered for ownership or use for lease or self-use, must pay registration fees.

[4] Land allocated, leased, or recognized by the State for agricultural production, forestry, aquaculture, or salt production purposes.

[5] Agricultural land use rights transfers between households, individuals within the same commune, ward, commune-level town to facilitate agricultural production under the provisions of the Land Law.

[6] Agricultural land reclaimed by households, individuals that is consistent with land use plans approved by competent state agencies, free from disputes, and where certificates of land use rights are issued by competent state agencies.

[7] Land leased from the State in the form of paying annual land rent or rented from organizations, individuals with lawful land use rights.

[8] Houses and land used for community activities by religious organizations, beliefs recognized or licensed by the State.

[9] Land used for cemeteries or graveyards.

[10] Houses, land inherited or gifted between: spouses; biological parents with biological children; adoptive parents with adopted children; parents-in-law with daughters-in-law; parents-in-law with sons-in-law; paternal grandparents with grandchildren; maternal grandparents with grandchildren; siblings, upon being granted certificates of land use rights, house ownership and other assets attached to land by competent state authorities.

[11] Houses of households, individuals formed through private housing development as stipulated in the Housing Law.

[12] Leased financial assets transferred to the lessee at the end of the lease term through asset transfer or sale; when the lessee is exempt from paying registration fees; a case where the financial leasing company purchases assets from units that have paid registration fees and subsequently leases them back to the selling unit, the financial leasing company is exempt from registration fees.

[13] Houses, land, special assets, specialized assets, assets serving specific management tasks dedicated to national defense, security.

[14] Houses, land forming public assets used as offices by state agencies, armed forces, public service providers, political organizations, professional bodies, and social organizations.

[15] Compensated or resettled houses, land (including houses, land purchased with compensation money) when the State recovers houses, land according to legal regulations.

The registration fee exemption in these cases applies to subjects whose houses, land are reclaimed.

[16] Assets of an organization or individual already granted ownership, use certificates when re-registering ownership, use rights are exempt from paying registration fees in the following circumstances:

+ Assets have been certified by competent authorities of the Democratic Republic of Vietnam, the Government of Vietnam, the Provisional Revolutionary Government of the Republic of Southern Vietnam, the Socialist Republic of Vietnam, or authorized persons under past policies and now reissue new certificates without changing the asset owner.

+ Assets of state enterprises, public service providers converted into joint-stock companies or reorganized under state enterprise and public service provider regulations.

+ Assets previously certified as owned by family members or households shared and divided among family members under legal regulations for re-registration; assets unified between spouses after marriage; assets divided between spouses upon divorce based on legally effective judgments or decisions by the Court.

+ Assets of organizations or individuals granted ownership, use certificates when reissued due to lost, torn, unreadable certificates. Organizations and individuals are not required to declare or process registration fee exemptions when receiving reissued certificates in this scenario.

+ In cases where re-certification leads to an increase in land area but the boundaries of the parcel remain unchanged, the additional land area is exempt from registration fees.

+ Organizations or individuals assigned land by the State who are granted certificates of land use rights must convert to paying land rent once for the entire lease term following the Land Law from the effective date of this Decree.

+ During re-registration of land use rights due to State-approved changes in land use purposes without changing the land user or without subject to land levy payment according to land levy legal regulations.

[17] Assets transferred to another organization or individual who registers ownership, use rights are exempt from paying registration fees when:

+ Organizations, individuals, cooperative members contribute their assets to enterprises, credit organizations, cooperatives; enterprises, credit organizations, cooperatives are dissolved, divided or return assets to member organizations, individuals previously contributed.

+ Assets transferred internally within an enterprise, or among administrative unit entities or units according to authority's decisions.

[18] Assets of organizations or individuals who have paid registration fees and are divided, contributed due to division, merger, name change of organizations following authority decisions.

[19] Assets of organizations or individuals who have paid registration fees moved to another location for use without changing the owner.

[20] Charity houses, solidarity housing, houses supported in a humanitarian capacity, including land associated with the house registered in the recipient's name.

[21] Fire engines, ambulances, X-ray mobile units, rescue vehicles (including tow trucks, transport vehicles); trash trucks, water spraying vehicles, road sweeping trucks, vacuum trucks, waste suction trucks; specialized vehicles, equipment for war invalids, sick soldiers, disabled individuals registered under war invalids, sick soldiers, disabled individual names.

[22] Aircraft used for business purposes of transporting goods or passengers.

[23] Fishing vessels (including vessels for exploiting aquatic resources, fishing support vessels); hulls, engine assemblies, engine blocks of fishing vessels are replaced and must be registered with competent state agencies.

[24] Hulls, mainframe assemblies, engine disciplines, engine blocks stipulated in Clause 8, Article 3 of Decree 10/2022/ND-CP are replaced and must be re-registered during warranty periods.

[25] Workshops of production facilities; warehouses, canteens, parking facilities of production or business facilities. Workshops in this clause are identified under the construction classification law.

[26] Housing, homestead land of poor households; housing, homestead land of ethnic minorities in difficult communes, wards, commune-level towns, Central Highlands; housing, homestead land of families, individuals in communes under the socio-economic development program in specially difficult areas, mountainous, remote areas.

[27] Watercraft without engines, total cargo capacity up to 15 tons; watercraft with engines, main engine total capacity up to 15 horsepower; watercraft with a carrying capacity of up to 12 people; high-speed passenger boats (High-speed passenger vessels), garbage collection vessels, watercraft transporting containers.

These vehicles are identified under inland waterway traffic laws and guidance documents (including hulls, mainframe assemblies, engine assemblies, engine blocks correspondingly installed as replacements for these vehicles).

[28] Houses, land of private investment facilities in sectors of education - training, vocational training; healthcare; culture; sports; environment according to legal regulations registered for land use, house ownership for these activities.

[29] Houses, land of non-public facilities registered for land use, house ownership serving activities in education - training; healthcare; culture; sports; science and technology; environment; society; population, family, child protection and care according to legal regulations, except as stipulated in Clause 28, Article 10 Decree 10/2022/ND-CP.

[30] Houses, land of science and technology enterprises registered for land use, house ownership according to legal regulations.

[31] Public transport vehicles using clean energy bus systems.