Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

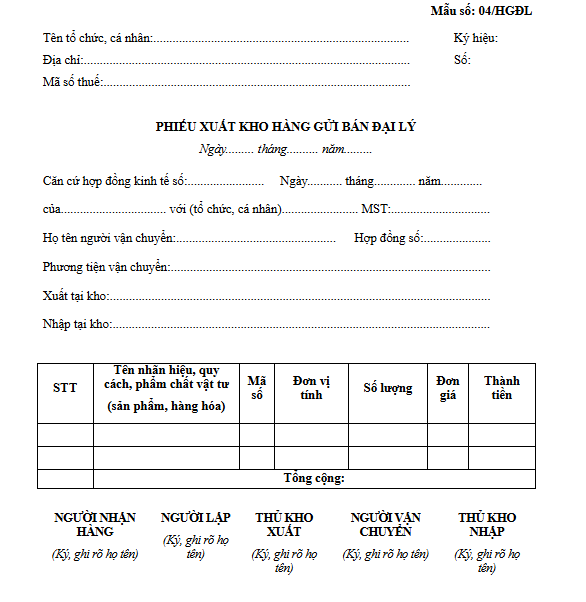

Currently, the form for delivery notes for goods sent to sales agents is specified in Form 04/HGDL issued with Decree 123/2020/ND-CP, as shown below:

Download Form 04/HGDL for goods delivery notes cum internal transportation: Here

Where to download the latest form for delivery notes for goods sent to sales agents in Vietnam? (Image from the Internet)

What are regulations on the electronic delivery notes for goods sent to sales in Vietnam?

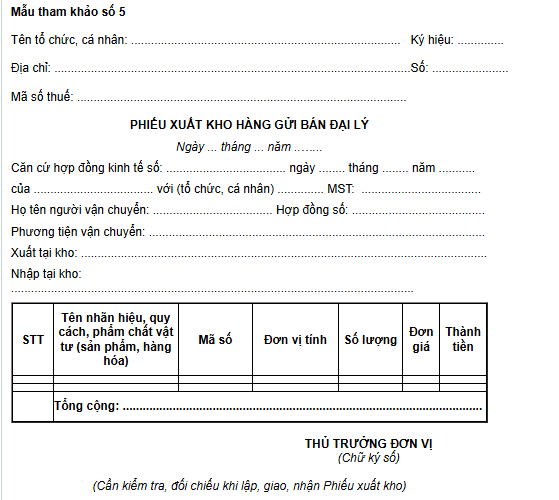

For the electronic delivery notes for goods sent to sales, currently based on Form No. 05 Appendix 2 regarding the sample electronic invoices/receipts for reference issued with Circular 78/2021/TT-BTC specifies the reference sample as follows:

Download the electronic delivery notes for goods sent to sales: Download

Shall the delivery notes for goods sent to sales be used as an invoice in Vietnam?

According to Article 8 Decree 123/2020/ND-CP, the guidance on types of invoices is as follows:

Types of Invoices

Invoices specified in this Decree include the following types:

- Value-added tax invoices are for organizations declaring value-added tax by the credit method for activities:

a) Selling goods, providing services domestically;

b) International transportation activities;

c) Export to non-tariff zones and cases considered as export;

d) Export of goods, providing services abroad.

- Sales invoices are for organizations, individuals as follows:

a) Organizations, individuals declaring and calculating value-added tax by the direct method for activities:

- Selling goods, providing services domestically;

- International transportation activities;

- Export to non-tariff zones and cases considered as export;

- Export of goods, providing services abroad.

b) Organizations, individuals in non-tariff zones when selling goods, providing services domestically, and when selling goods, providing services among organizations, individuals in non-tariff zones with each other, exporting goods, providing services abroad, invoices must clearly state "For organizations, individuals in non-tariff zones".

- Electronic invoices for selling public assets are used when selling the following assets:

a) Public assets at agencies, organizations, units (including state-owned housing);

b) Infrastructural assets;

c) Public assets assigned by the state to enterprises for management without calculating into the state capital portion in the enterprise;

d) Assets of projects using state capital;

đ) Assets with ownership established for the whole people;

e) Public assets repossessed under the decision of the authoritative agency/person;

g) Materials, supplies recovered from handling public assets.

- Electronic invoices for selling national reserve goods are used when agencies, units under the national reserve system sell national reserve goods according to the law.

- Other types of invoices, include:

a) Stamps, tickets, cards with the form and content specified in this Decree;

b) Freight receipt vouchers for air cargo; international transport fee receipts; banking service fee receipts unless regulated in point a of this clause has a form and content prepared according to international practice and relevant legal provisions.

- Documents printed, issued, used, and managed like invoices include goods delivery notes cum internal transportation, delivery notes for goods sent to sales agents.

7. The Ministry of Finance guides the display templates of invoice types for the subjects mentioned in Article 2 of this Decree for reference in implementation.

Thus, the delivery notes for goods sent to sales is a document printed, issued, used, and managed similarly to an invoice.