What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

What is an e-tax transaction account in Vietnam?

According to Clause 4, Article 3 of Circular 19/2021/TT-BTC, the term “e-tax transaction account” is defined as the username and password to log into the General Department of Taxation's e-portal, provided by the tax authority to the taxpayer for executing e-tax transactions.

An e-tax transaction account includes one (1) main account and a maximum of ten (10) sub-accounts.

+ The main account is issued by the tax authority to the taxpayer as regulated in Article 10 of Circular 19/2021/TT-BTC (amended by Clause 1, Article 1 of Circular 46/2024/TT-BTC and rectified by Section 2 of Official Dispatch 9166/BTC-TCT of 2024).

+ Sub-accounts are registered by the taxpayer through the main account to delegate authority for each e-tax service.

What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

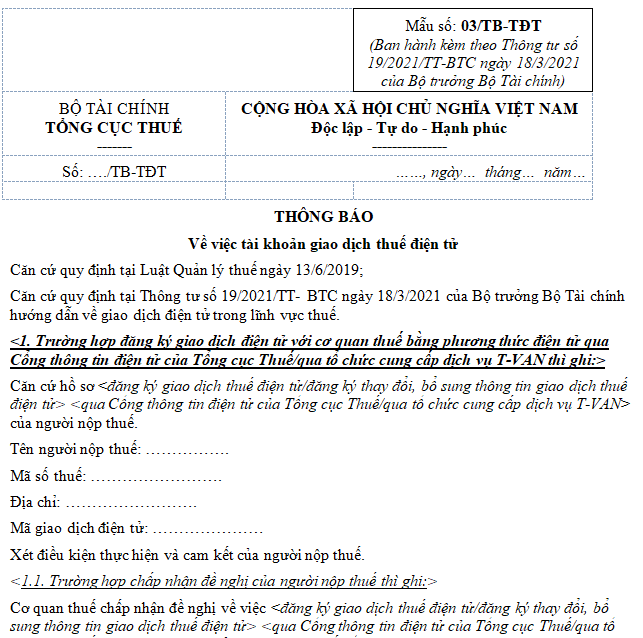

The Notice form for e-tax transaction account is implemented according to Form 03/TB-TDT issued with Circular 19/2021/TT-BTC.

DOWNLOAD >>> Form 03/TB-TDT

What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)? (Image from the Internet)

Vietnam: What should taxpayers with an e-tax transaction account do if there are changes or additions to the information?

According to Article 11 of Circular 19/2021/TT-BTC regarding the registration for changing or adding e-transaction information:

- Taxpayers who have been issued e-tax transaction accounts as regulated in Article 10 of Circular 19/2021/TT-BTC (amended by Clause 1, Article 1 of Circular 46/2024/TT-BTC and rectified by Section 2 of Official Dispatch 9166/BTC-TCT of 2024) are responsible for promptly updating all information with the tax authority as soon as changes occur.

+ Taxpayers access the General Department of Taxation's e-portal to update changes or additions in e-tax transaction registration information with the tax authority (using Form No. 02/DK-TDT issued with Circular 19/2021/TT-BTC), digitally sign and send to the tax authority.

+ Within 15 minutes of receiving the taxpayer's change or addition information, the General Department of Taxation's e-portal sends a notice (according to Form No. 03/TB-TDT issued with Circular 19/2021/TT-BTC) about the acceptance or non-acceptance of registration change or addition information to the taxpayer.

- Taxpayers who have registered for e-transactions with the tax authority through the e-portal of the competent state authority, if there are changes or additions to the registered information, they shall comply with the regulations of the competent state authority.

- Taxpayers granted e-tax transaction accounts through T-VAN service providers as per Article 42 of Circular 19/2021/TT-BTC, if there are changes or additions to the registered e-tax transaction information, they shall follow the regulations in Article 43 of Circular 19/2021/TT-BTC.

- Regarding changes or additions to information about transaction accounts in banks or intermediary payment service providers for e-tax payments, taxpayers must register with the bank or intermediary payment service provider where the taxpayer has an account as per Clause 5, Article 10 of Circular 19/2021/TT-BTC, specifically:

+ Taxpayers registering for e-tax payments through the General Department of Taxation's e-portal, or T-VAN service providers must also register to use tax payment services with the bank or intermediary payment service provider where the account is held according to the regulations of the bank or intermediary payment service provider. Taxpayers can choose to register for e-tax payments at one or multiple banks or intermediary payment service providers where they have transaction accounts.

+ The bank or intermediary payment service provider where the taxpayer opens an account sends a notice (according to Form No. 04/TB-TDT issued with Circular 19/2021/TT-BTC) about the acceptance or non-acceptance of e-tax payment registration for the taxpayer through the General Department of Taxation's e-portal within no later than three (3) working days from the date of receiving the taxpayer's registration.

+ In case of non-acceptance, taxpayers, based on the non-acceptance notice for e-tax payments from the bank or intermediary payment service provider, must complete the registration information or contact the managing tax authority, bank, or intermediary payment service provider where the account is held for guidance and support.

- Taxpayers register to change the method of e-tax transactions according to Clause 4, Article 4 of Circular 19/2021/TT-BTC and the provisions of this Article.