What is the guidance on filling in 3 PL items on HTKK - PL on VAT reduction in Vietnam according to Resolution 142/2024/QH15?

What is the guidance on filling in 3 PL items on HTKK - PL on VAT reduction in Vietnam according to Resolution 142/2024/QH15?

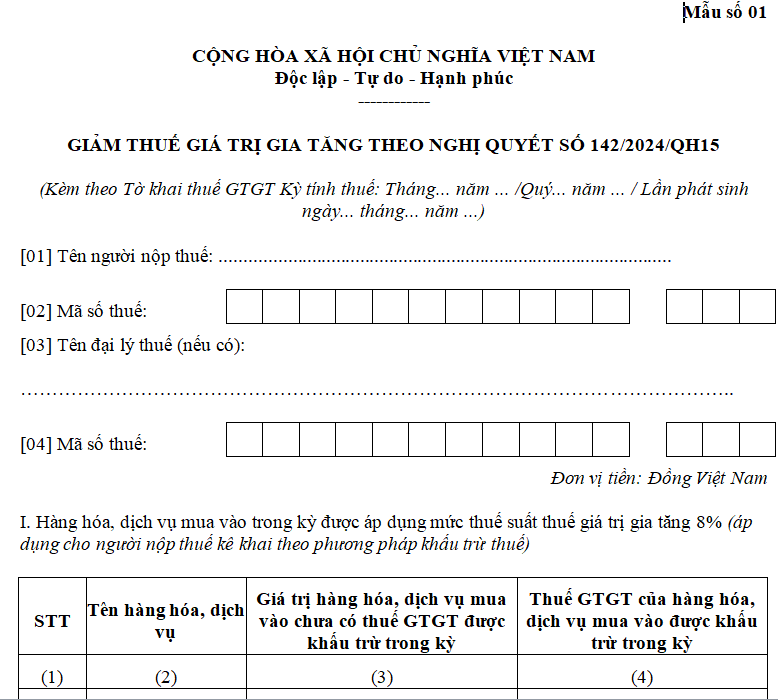

The appendix form for VAT reduction according to Resolution 142/2024/QH15 on the HTKK software is the VAT reduction appendix stipulated in Appendix IV issued together with Decree 72/2024/ND-CP:

Download the VAT reduction appendix form according to Resolution 142/2024/QH15

The method for filling in 3 PL items on HTKK - PL on VAT reduction according to Resolution 142/2024/QH15 is as follows:

Item 1: This section is designated for goods or services purchased with a tax rate of 8% (applicable to taxpayers declaring according to the tax deduction method):

Goods and services name (2): Enter the names of goods and services purchased during the period, subject to an 8% VAT rate.

Value of goods and services purchased before deductible VAT during the period (3): Enter the value of goods and services purchased without including VAT deductible during the period.

VAT on goods and services purchased deductible during the period (4): After entering the goods and services names subject to tax reduction and the pre-tax value in columns (2) and (3), HTKK software will automatically calculate the VAT at an 8% rate in column (4).

Item 2: This section is designated for goods or services sold during the tax declaration period.

Goods and services name (2): Enter the names of goods and services sold during the period subject to an 8% VAT rate.

Value of goods and services without VAT (3): Enter the value of goods and services sold excluding VAT.

VAT rate according to regulations (4): The VAT rate of goods and services before applying the VAT reduction according to Resolution 142/2024/QH15 (10%).

VAT rate after reduction (5): The VAT rate of goods and services after applying the VAT reduction according to Resolution 142/2024/QH15 (8%).

VAT on goods and services sold with reduction (6): After entering the goods and services names with tax reduction and the pre-tax value in columns (2) and (3), HTKK software will automatically calculate the VAT reduction in column (6).

Item 3: The VAT difference of goods and services sold and purchased during the period is subject to an 8% VAT rate: After completing the information in items (I) and (II), HTKK software will automatically calculate the VAT difference of goods and services sold and purchased during the period subject to an 8% VAT rate.

What is the guidance on filling in 3 PL items on HTKK - PL on VAT reduction in Vietnam according to Resolution 142/2024/QH15? (Image from Internet)

What is the current VAT reduction rate in Vietnam?

Based on Clause 2 Article 1 of Decree 72/2024/ND-CP, the VAT reduction rate is regulated as follows:

VAT Reduction

...

2. VAT Reduction Rate

a) Business establishments calculating VAT using the deduction method are applied a VAT rate of 8% for goods and services stipulated in Clause 1 of this Article.

b) Business establishments (including business households and individuals) calculating VAT using the percentage method on revenue are reduced by 20% percentage to calculate VAT when issuing invoices for goods and services subject to VAT reduction stipulated in Clause 1 of this Article.

The VAT rate is reduced by 2% applicable to business establishments for goods and services stipulated in Clause 1 Article 1 of Decree 72/2024/ND-CP that calculate VAT using the deduction method.

In the case where business establishments (including business households and individuals) calculate VAT using the percentage on revenue method, a 20% reduction in the percentage to calculate VAT is applied when issuing invoices for goods and services that are reduced under Clause 1 Article 1 Decree 72/2024/ND-CP.

When is Decree 72 on VAT reduction applicable in Vietnam?

According to the provision in Clause 1 Article 2 of Decree 72/2024/ND-CP as follows:

Implementation Effectiveness and Organization

1. This Decree takes effect from July 1, 2024, to the end of December 31, 2024.

2. Ministries according to their functions and tasks and the People's Committees of provinces and centrally-governed cities direct relevant agencies to deploy, propagate, guide, check, and supervise so consumers understand and benefit from the VAT reduction under this Decree, concentrating on solutions to stabilize the supply and demand of goods and services subject to VAT reduction to maintain market price stability (prices excluding VAT) from July 1, 2024, to the end of December 31, 2024.

3. If issues arise during implementation, the Ministry of Finance is responsible for guidance and resolution.

4. Ministers, heads of ministerial-level agencies, heads of agencies under the Government of Vietnam, Chairmen of People’s Committees of provinces, centrally-governed cities, enterprises, organizations, and individuals are responsible for implementing this Decree.

Decree 72/2024/ND-CP takes effect from July 1, 2024, to the end of December 31, 2024.

This also means that the VAT reduction to 8% is only applicable until the end of December 31, 2024.

From January 1, 2025, the VAT rate for reduced goods and services will revert to 10% (unless there are other administrative documents).

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?