What is the guidance for looking up online land tax on the e-portal of the General Department of Taxation of Vietnam?

What is the guidance for looking up online land tax on the e-portal of the General Department of Taxation of Vietnam?

Below is the method to query land tax online on the e-portal of the General Department of Taxation of Vietnam:

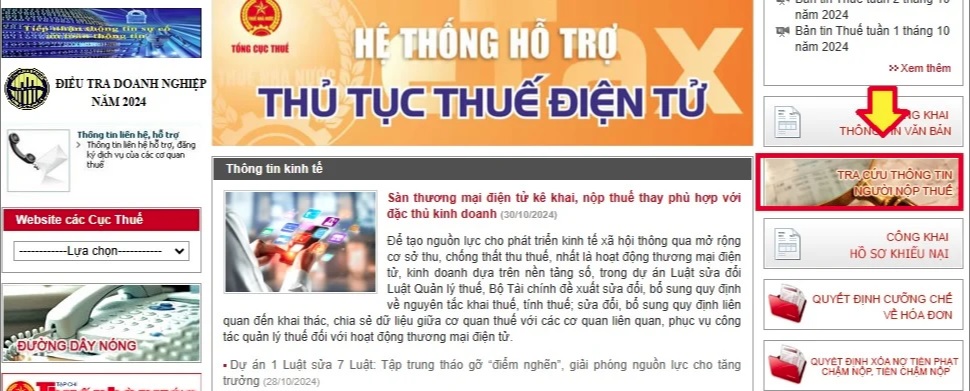

Step 01: Access the e-portal of the General Department of Taxation of Vietnam at the link: https://www.gdt.gov.vn/wps/portal

Step 02: On the homepage, the user scrolls down to find the section "Query Taxpayer Information"

Step 03: Select the query for taxpayer information

(1) For querying enterprise taxpayer information:

The user will click on "Information about the taxpayer" and fill in the details:

- Tax identification number;

- Name of the organization or individual taxpayer;

- Address of the business headquarters;

- ID card/Identity card number of the representative;

- Verification code.

(2) For querying individual taxpayer information:

The user clicks on "Information about personal income taxpayer" on the display screen and fills in the information:

- Tax identification number

- Full name

- Address

- ID card/Identity card number of the individual

- Verification code

Step 04: View the results

After completing the information entry steps and entering the verification code, the website will display the results on the screen. Specifically: as follows:

- Fully display the information about the queried subject.

- If the website displays “No matching taxpayer found,” it means the enterprise or individual has not registered tax information.

Note: Land use tax is the amount that the land user must contribute to the state budget when using land. Land use tax includes two main types: agricultural land use tax and non-agricultural land use tax.

Note: The information is for reference only!

What is the guidance for looking up online land tax on the e-portal of the General Department of Taxation of Vietnam? (Image from the Internet)

What types of land are subject to non-agricultural land tax in Vietnam?

Pursuant to Article 2 Law on Non-agricultural Land Use Tax 2010, the tax subjects are specified as follows:

Tax Subjects

- Residential land in rural areas, homestead land in urban areas.

- Non-agricultural production and business land includes: land for construction of industrial areas; land for construction of production and business facilities; land for exploitation and processing of minerals; land for production of construction materials, pottery.

- Non-agricultural land stipulated in Article 3 of this Law used for business purposes.

Thus, tax subjects for non-agricultural land include:

- Residential land in rural areas, homestead land in urban areas.

- Non-agricultural production and business land includes: land for construction of industrial areas; land for construction of production and business facilities; land for exploitation and processing of minerals; land for production of construction materials, pottery.

- Non-agricultural land as stipulated in Article 3 of the Law on Non-agricultural Land Use Tax 2010 used for business purposes.

What types of land are exempt from non-agricultural land tax in Vietnam?

According to Article 3 Law on Non-agricultural Land Use Tax 2010, the entities that are not subject to non-agricultural land tax are specified as follows:

(1) Land used for public purposes includes: land for transport, irrigation; land for construction of cultural, medical, educational, and training facilities, sports for public interests; land with historical-cultural relics, scenery sites; land for construction of other public facilities as regulated by the Government of Vietnam;

(2) Land used by religious establishments;

(3) Land for cemeteries and graveyards;

(4) Land of rivers, canals, channels, streams, and specialized water surfaces;

(5) Land with buildings such as communal houses, temples, shrines, honorary pathways, family temples;

(6) Land for construction of agency headquarters, construction of career facilities, land used for national defense and security purposes;

(7) Other non-agricultural land as prescribed by law.

Which entities are non-agricultural land tax payers when land is leased under a contract in Vietnam?

Pursuant to Article 4 Law on Non-agricultural Land Use Tax 2010, the taxpayers are specified as follows:

Taxpayers

- Taxpayers are organizations, households, and individuals with land use rights subject to tax as stipulated in Article 2 of this Law.

- In case organizations, households, and individuals have not been granted a certificate of land use rights, housing ownership rights and other assets associated with land (hereinafter referred to as the Certificate), the current land user is the taxpayer.

- Specific cases of taxpayers are regulated as follows:

a) If the State leases land for investment projects, the land leaseholder is the taxpayer;

b) In cases where the land user leases the land by contract, the taxpayer is determined in accordance with the agreement in the contract. If the contract does not stipulate an agreement about the taxpayer, the land user is the taxpayer;

c) If the land has been granted a Certificate but is in dispute, before the dispute is settled, the current land user is the taxpayer. Tax payment is not the basis for resolving disputes about land use rights;

d) If multiple persons jointly have use rights over a parcel, the legal representative of those sharing the parcel use rights is the taxpayer;

đ) In cases where the land user contributes capital by land use rights leading to the formation of a new legal entity with land use rights subject to tax as stipulated in Article 2 of this Law, the new legal entity is the taxpayer.

Thus, in cases where the land user leases land by contract, the taxpayer is determined according to the agreement in the contract.

If the contract does not include an agreement about the taxpayer, the land user is the taxpayer;

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?

- Who shall receive tax consultation results from the tax advisory councils of communes in Vietnam?

- What is the time limit for imposion of administrative penalties on tax evasion in Vietnam?

- What activities are included in the National E-commerce Week and Online Shopping Day of Vietnam - Online Friday 2024? Are incomes from business on e-commerce platforms taxable?

- What is the timeline for the National E-commerce Week and Online Shopping Day of Vietnam - Online Friday 2024? Do persons selling goods online have to pay taxes?

- What are principles for determining specific levels of road user charges in Vietnam from January 1, 2025?