What is the Form 02A for the self-assessment of members of Communist Party of Vietnam at the end of 2024? What is the membership fee for CPV members?

What is the Form 02A for the self-assessment of members of Communist Party of Vietnam at the end of 2024?

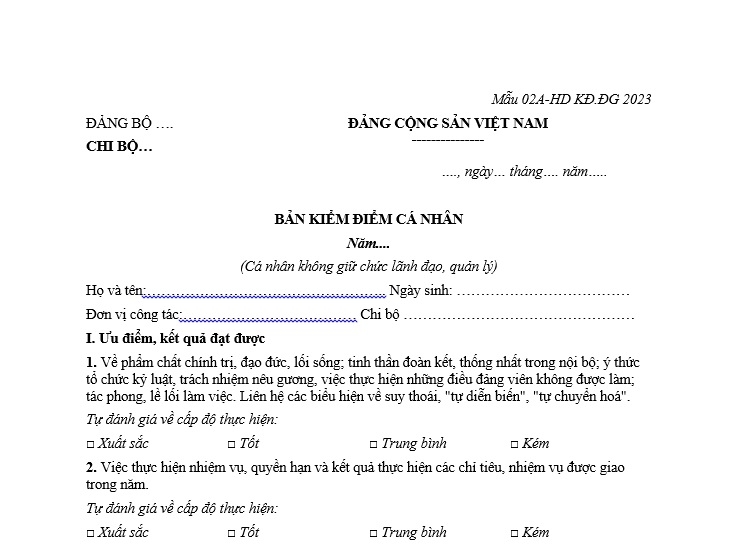

Form 02A-HD KD.DG 2023 is the form for the self-assessment of members of Communist Party of Vietnam at the end of 2024 for individuals not holding leadership or management positions, issued together with Guidance 25-HD/BTCTW of 2023. Specifically:

Form 02A for the self-assessment of members of Communist Party of Vietnam at the end of 2024... Download

See also:

>>> Form 02B for the self-assessment of members of Communist Party of Vietnam at the End of 2024?

>>> How to Write an self-assessment for members of Communist Party of Vietnam at the End of 2024?

New:

>>> How Are members of Communist Party of Vietnam Evaluated at the End of 2024?

>>> Which Form Should members of Communist Party of Vietnam Subject to Criticism at the End of 2024 Use?

What is the Form 02A for the self-assessment of members of Communist Party of Vietnam at the end of 2024? (Image from the Internet)

What is the membership fee for members of Communist Party of Vietnam?

Based on Section 1 Part B of the Regulation on party membership fees issued together with Decision 342/QD-TW of 2010, which stipulates the subjects and the monthly party membership fee rates. Specifically:

The monthly income of members of Communist Party of Vietnam for calculating the party membership fee includes: salary, certain allowances; wages; living expenses; other income. members of Communist Party of Vietnam who can determine regular income contribute party fees as a percentage (%) of monthly income (before personal income tax); those who have difficulty determining income have a specific monthly fee for each type of subject.

| Fee Payer | Monthly Party Membership Fee |

| members of Communist Party of Vietnam in administrative agencies, political-social organizations, armed forces units | Contribute monthly party fees equal to 1% of salary, allowances, wages, living expenses |

| members of Communist Party of Vietnam receiving social insurance salary | Contribute monthly party fees equal to 0.5% of social insurance salary |

| members of Communist Party of Vietnam working in enterprises, public service providers, economic organizations | Contribute monthly party fees equal to 1% of salary, wages, and other income from the unit's salary fund |

| Other members of Communist Party of Vietnam in the country (including agricultural, rural members, student members...) | Pay a fee from 2,000 VND to 30,000 VND/month. For members outside the working-age group, the fee is 50% of that for members within the working-age group. |

| members of Communist Party of Vietnam studying, living, working abroad: | |

| (1) Members working at Vietnam's representative offices abroad; members are international students sponsored by agreements or funded by the state budget | Pay 1% of monthly living expenses as party fee. |

| (2) Self-funded overseas students; labor export members; members accompanying families, members doing freelance work | Pay a monthly fee from 2 to 5 USD |

| (3) Members owning or co-owning businesses, commercial zones, service stores | Minimum monthly party fee is 10 USD |

| members of Communist Party of Vietnam in particularly difficult circumstances | If an application for exemption or reduction is submitted, the Party cell considers and reports to the grassroots level for decision. |

Members from all the above categories are encouraged to voluntarily pay higher than the prescribed fee with the agreement of the section committee.

What are regulations on management and use of Communist Party of Vietnam?

According to the stipulations in Section 2 Part B of Decision 342-QD/TW of 2010, it specifies:

(1) Deduction and submission of collected party fees

- Domestically:

+ Subordinate cells of the grassroots party committees can retain 30% to 50%, submitting 50% to 70% to the higher-level committee.

+ Grassroots party organizations in communes, wards, commune-level towns can retain 90%, submitting 10% to the higher-level committee.

+ Other Communist Party organizations can retain 70%, submitting 30% to the higher-level committee.

+ Each above-ground level can retain 50%, submitting 50% to the higher-level committee.

- Abroad:

+ Branches attached to overseas party committees can retain 30%, submitting 70% to the higher-level committee. Host country party committees can retain 50%, submitting 50% to the Overseas Party Committee.

+ Fees collected abroad must submit 100% to the Office of the Central Communist Party.

- Bloc committees under provincial and city committees submit 50% to the provincial and city financial agencies. Central bloc committees, Central Military Party Committee, Central Public Security Party Committee may retain 50%, submitting 50% to the Office of the Central Communist Party.

(2) Management and Use of Party Fees

- Fees retained at any level are used to balance the budget for party work activities at that level. For district, urban, and provincial levels directly under the Central Government, Central Military, and Central Public Security Party Committees, and party financial agencies in Central, fee income retained is not accounted for in regular expenditure quotas but is set as a reserve fund for the Communist Party at that level; the reserve fund is used to supplement the expenditures of the committee, supporting activity funds for affiliated party organizations facing difficulties; the party committee decides on expenditures from the reserve fund.

- Committees are responsible for compiling the situation of fee collection, submission, and use at their level and the entire party committee, and reporting to the higher-level committee. The Office of the Central Communist Party is responsible for compiling the situation of fee collection, submission, and use of the entire Communist Party, reporting to the Central Executive Committee.

- What are guidelines for salary arrangement of ranks of tax officials in Vietnam?

- What are 02 submission methods of Form 01/PLI on employment report for the last 6 months of 2024 in Vietnam? What is the union fee for members in people's armed forces in Vietnam?

- Who is a intermediate tax inspector in Vietnam? What are the duties?

- What is the VAT rate on endodontic treatment services in Vietnam?

- Is an information technology center subject to VAT in Vietnam?

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?