What are cases of cancellation of erroneous e-invoices in Vietnam? What are the procedures and deadlines for cancellation of erroneous e-invoices?

What are cases of cancellation of erroneous e-invoices in Vietnam?

According to Clauses 1 and 2, Article 19 of Decree 123/2020/ND-CP, the conditions under which e-invoices can be canceled include:

- When the seller discovers that an e-invoice assigned a tax authority code, but not yet sent to the buyer, contains errors.

- When an e-invoice either with a tax authority code or without one has been sent to the buyer, and the buyer or seller discovers errors.

What are cases of cancellation of erroneous e-invoices in Vietnam? What are the procedures and deadlines for cancellation of erroneous e-invoices? (Image from Internet)

What are the Procedures and Deadlines for Canceling erroneous e-invoices?

The procedure for canceling an e-invoice with errors is stipulated in Article 19 of Decree 123/2020/ND-CP as follows:

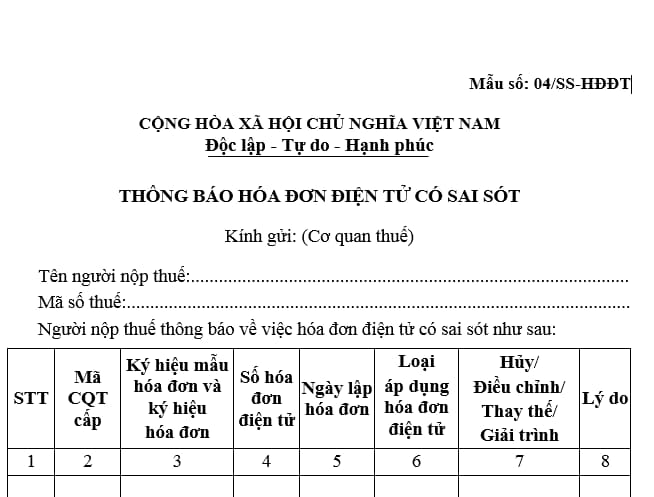

Step 1: Notify the tax authority of the invoice errors using Form No. 04/SS-HDDT, Appendix IA issued with Decree 123/2020/ND-CP.

Download the Invoice Error Notification Form here.

Step 2: Issue a new e-invoice, digitally sign it, and send it to the tax authority for a new invoice code to replace the previously issued invoice and send it to the customer.

Step 3: Cancel the erroneously reported e-invoice.

Step 4: To minimize risks during tax authority audits or inspections, businesses should create an agreement memorandum with customers confirming the cancellation of the invoice.

Step 5: Ensure the invoice has been canceled by checking if the tax authority has updated the error notification status to accepted, and verify the invoice status on the website https://hoadondientu.gdt.gov.vn/.

The deadline for canceling an erroneous e-invoice is stipulated in point a, Clause 1, Article 7 of Circular 78/2021/TT-BTC as follows:

- Notify the adjustment for each erroneous invoice or for multiple erroneous e-invoices and send the notification according to Form No. 04/SS-HDDT to the tax authority at any time, but no later than the last day of the tax declaration period in which the e-invoice adjustment occurs.

Are there penalties for late submission of notification for erroneous invoices in Vietnam?

According to Article 29 of Decree 125/2020/ND-CP, the penalties for late submission of notification for erroneous invoices are as follows:

Penalties for Violations Regarding Preparation, Submission of Notifications, and Reports on Invoices

- A warning will be issued for submitting notifications or reports on invoices past the prescribed deadline from 01 to 05 days, from the expiration date as regulated if there are mitigating circumstances.

- A fine from VND 1,000,000 to VND 3,000,000 for one of the following acts:

a) Submitting notifications or reports on invoices past the prescribed deadline from 01 to 10 days, from the end of the prescribed period, except as provided in Clause 1 of this Article;

b) erroneously preparing or incompletely filling out the contents of notifications or reports on invoices as prescribed to the tax authority.

In cases where organizations or individuals self-detect errors and make conformable replacement notifications, reports sent to the tax authority before the tax authority or competent agency issues a decision for tax inspection, at the tax payer's premises, there will be no penalty.

- A fine from VND 2,000,000 to VND 4,000,000 for submitting notifications or reports on invoices to the tax authority past the prescribed deadline from 11 to 20 days, from the end of the prescribed period.

- A fine from VND 4,000,000 to VND 8,000,000 for submitting notifications or reports on invoices to the tax authority past the prescribed deadline from 21 to 90 days, from the end of the prescribed period.

- A fine from VND 5,000,000 to VND 15,000,000 for one of the following acts:

a) Submitting notifications or reports on invoices to the tax authority past the prescribed deadline from 91 days or more, from the end of the prescribed period;

b) Not submitting notifications or reports on invoices to the tax authority as prescribed.

According to the above regulations, late submission of a cancellation notification for invoices will incur penalties as follows:

- Late from 01 to 05 days from the end of the prescribed period with mitigating circumstances: Warning

- Late from 01 to 10 days from the end of the prescribed period: VND 1,000,000 to VND 3,000,000

- Late 11 to 20 days from the end of the prescribed period: VND 2,000,000 to VND 4,000,000

- Late from 21 to 90 days from the end of the prescribed period: VND 4,000,000 to VND 8,000,000

- Late 91 days or more from the end of the prescribed period: VND 5,000,000 to VND 15,000,000

- Will failure to operate at the registered address result in the TIN deactivation in Vietnam?

- What are regulations on the retention of invoices printed by the tax authority for individuals not being accounting units in Vietnam?

- What is the authority to impose suspension from exit from Vietnam for failing to fulfill tax obligations?

- What are regulations on late payment interest in Vietnam?

- What conditions must the tax authority ensure when carrying out audits at the premises of taxpayers in Vietnam?

- Are imports that are grant aid subject to customs procedures suspension in Vietnam?

- What is the form number of the electronic VAT invoice in Vietnam?

- Is failing to present invoices related to determining the amount of tax payable subject to tax imposition in Vietnam?

- Where to download the form of correction invoices in Vietnam in 2024? What are cases of issuing a correction invoice?

- How to write the explanation section about the issues suggested for review in the end-of-year self-assessment for members of Communist Party of Vietnam for 2024? Can members of Communist Party of Vietnam with particularly difficult circumstances be exempt from membership fees