What are regulations on the retention of invoices printed by the tax authority for individuals not being accounting units in Vietnam?

What are regulations on the retention of invoices printed by the tax authority for individuals not being accounting units in Vietnam?

Based on Clause 3, Article 6 of Decree 123/2020/ND-CP as follows:

Storage and retention of invoices, documents

1. Invoices and documents are preserved and stored ensuring:

a) Safety, confidentiality, integrity, completeness, no changes, and no deviations throughout the retention period;

b) Stored for the correct period and in accordance with accounting law provisions.

2. Electronic invoices and documents are preserved and stored by electronic means. Agencies, organizations, and individuals have the right to choose and apply forms of storage and retention of electronic invoices and documents suitable to their operational characteristics and technology application capabilities. Electronic invoices and documents must be readily printable or searchable upon request.

3. Invoices printed by the tax authority, self-printed documents must be preserved and stored in accordance with the following requirements:

a) Unissued invoices and documents are preserved and stored in a warehouse in accordance with the document retention policies for valuable documents.

b) Issued invoices and documents in accounting units are stored according to the regulations on the retention, storage of accounting documents.

c) Issued invoices and documents in organizations, households, individuals not being accounting units are stored and preserved as the private property of those organizations, households, individuals.

According to the above regulation, preserving and storing invoices printed by the tax authority must comply with the following requirements:

[1] Unissued invoices printed by the tax authority are stored and preserved in a warehouse according to the document retention policies for valuable documents.

[2] Issued invoices printed by the tax authority in accounting units are stored in accordance with the regulations on the retention, storage of accounting documents.

[3] Issued invoices printed by the tax authority to organizations, households, individuals not being accounting units are stored and preserved as the private property of those organizations, households, individuals.

Thus, it can be seen that for invoices printed by the tax authority already issued to individuals not being accounting units, retention is carried out as the private property of that individual.

What are regulations on the retention of invoices printed by the tax authority for individuals not being accounting units in Vietnam? (Image from the Internet)

Can invoices printed by the tax authority be destroyed by burning in Vietnam?

According to Clause 11, Article 3 of Decree 123/2020/ND-CP, the regulation is as follows:

Interpretation of terms

In this Decree, the following terms are understood as follows:

...

11. Destruction of invoices, documents:

a) Destruction of electronic invoices and documents is a measure to make electronic invoices and documents no longer exist on the information system, inaccessible, and unreferable to the information contained therein.

b) Destruction of invoices printed by the tax authority, printed documents, self-printed documents is adopting measures such as burning, cutting, shredding, or other forms of destruction, ensuring the invoices, documents destroyed cannot reuse any information or data.

12. An organization providing electronic invoice services is an organization providing solutions for creating, connecting, transmitting, receiving, storing, and processing data of electronic invoices with and without codes from the tax authority. An organization providing electronic invoice services includes organizations providing electronic invoice solutions with and without tax authority codes for both sellers and buyers; organizations connecting and transmitting electronic invoice data with the tax authority.

13. The electronic invoice and electronic document database is a collection of information data about electronic invoices of organizations, businesses, and individuals when selling goods, providing services, and information about electronic documents of organizations and individuals using them.

According to the regulation, the destruction of invoices printed by the tax authority is understood as using methods such as burning, cutting, shredding, or other destruction forms, ensuring the invoices and documents destroyed cannot reuse information or data on them.

Thus, it can be seen that it is entirely possible to destroy invoices printed by the tax authority by burning them.

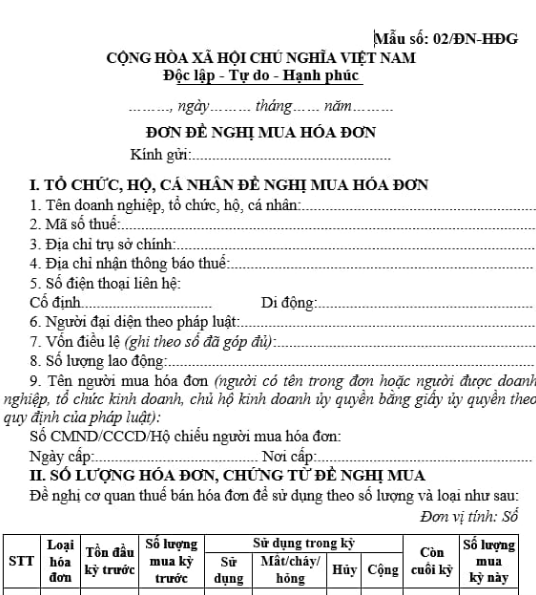

What is the latest form for the application to purchase invoices printed by the tax authority in Vietnam?

The form for the application to purchase invoices printed by the tax authority is form number 02/DN-HDG issued together with Decree 123/2020/ND-CP regulated as follows:

Download the latest form for the application to purchase invoices printed by the tax authority.