Vietnam: Who shall be considered a dependant when his average monthly income from all sources does not exceed 1,000,000 VND?

Vietnam: Who shall be considered a dependant when his average monthly income from all sources does not exceed 1,000,000 VND?

Based on Point đ, Clause 1, Article 9 of Circular 111/2013/TT-BTC, the provision states as follows:

Deductions

...

dd) An individual is considered a dependant as guided in subpoints d.2, d.3, d.4, Point d, Clause 1 of this Article, and must meet the following conditions:

dd.1) For individuals of working age, they must simultaneously meet the following conditions:

dd.1.1) Being disabled and incapable of working.

dd.1.2) Having no income or an average monthly income not exceeding 1,000,000 VND from all sources throughout the year.

dd.2) For individuals beyond working age, they must have no income or an average monthly income not exceeding 1,000,000 VND from all sources throughout the year.

e) Disabled individuals, incapable of working as guided in subpoint đ.1.1, Point đ, Clause 1 of this Article, are those subjects governed by the law on persons with disabilities, people with illnesses rendering them incapable of working (such as AIDS, cancer, chronic kidney failure,...).

...

Individuals with income below 1 million considered as dependants include:

- The spouse of the taxpayer

- Biological parents; parents-in-law (or mother-in-law, father-in-law); stepparents, adoptive parents of the taxpayer

- Other individuals with no shelter whom the taxpayer is directly supporting:

+ Biological siblings of the taxpayer.

+ Paternal grandparents; maternal grandparents; aunts, uncles, and uncles by blood relationship of the taxpayer.

+ Niece or nephew of the taxpayer, including the children of biological siblings.

+ Other individuals to be directly supported according to legal regulations.

Vietnam: Who shall be considered a dependant when his average monthly income from all sources does not exceed 1,000,000 VND? (Image from the Internet)

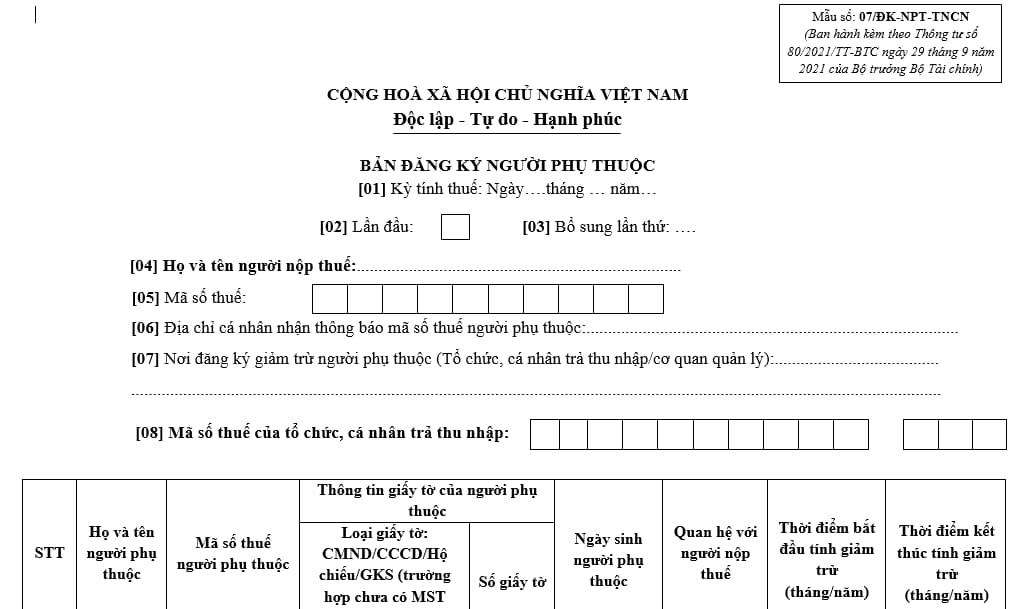

What is the registration form for dependants in the personal income tax declaration in Vietnam?

The current dependant registration form is Form 07/DK-NPT-TNCN specified in Section 7, Appendix II issued together with Circular 80/2021/TT-BTC as follows:

Download Form 07/DK-NPT-TNCN, dependant registration form: Here

Which income is not eligible for personal exemptions when calculating personal income tax in Vietnam?

Based on provisions in Clause 1, Article 19 of Law on Personal Income Tax 2007 (amended and supplemented by Clause 4, Article 1 of Law on Amendments to Law on Personal Income Tax 2012) and Clause 4, Article 6 of Law on Amendments to Tax Laws 2014, personal exemptions are amounts deducted from taxable income before calculating tax on income from business, salary, and wages of individuals considered as tax residents.

Thus, it means that the following types of income as per Article 2 of Circular 111/2013/TT-BTC will not be eligible for personal exemptions:

(1) Income from capital investment, including:

- Loan interest received.

- Dividend of shares.

- Additional value of capital contribution received upon dissolution of an enterprise, restructuring, division, splitting, merging, or consolidating enterprises, or withdrawal of capital.

- Income from capital investment in other forms, except income from interest on bonds of the Government of Vietnam.

(2) Income from capital transfer, including:

- Income from transferring capital portions in economic entities.

- Income from transferring securities.

- Income from capital transfer in other forms.

(3) Income from real estate transfer, including:

- Income from transferring land use rights and assets attached to the land.

- Income from transferring ownership or use rights of houses (including future-formed housing).

- Income from transferring land lease rights, water surface lease rights.

- Other incomes received from real estate transfer under any form.

(4) Income from winning prizes, including:

- Lottery winnings.

- Prizes from promotional programs.

- Prizes from betting forms.

- Prizes from games, contests with rewards, and other forms of winning prizes.

(5) Income from copyright, including:

- Income from transferring, licensing subjects of intellectual property rights.

- Income from technology transfer.

(6) Income from franchising.

(7) Income from receiving inheritance, including securities, capital contribution in economic entities, business establishments, real estate, and other assets required to register ownership or use rights.

(8) Income from receiving gifts, including securities, capital contributions in economic entities, business establishments, real estate, and other assets required to register ownership or use rights.

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?