What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?

What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam?

During Tet, enterprises often need to send official announcements regarding the holiday schedule to all employees and partners. Drafting a clear and professional Tet Holiday Announcement for the Gregorian New Year 2025 or the Lunar New Year 2025 plays an important role, helping everyone easily grasp the information and arrange their rest plans reasonably.

The content of the document typically includes the start and end dates of the holiday period, regulations on work handover, along with important notes related to safety and information security throughout the holiday period. The aim of the announcement is to ensure that all employees are fully aware of the holiday schedule, thus preparing well for the vacation and helping the enterprise operate efficiently upon returning to work.

Currently, there is no specific regulation regarding the format of the 2025 Tet holiday announcement template for enterprises. You can refer to some 2025 Tet holiday announcement templates for enterprises below:

(1) The New Year's Tet Holiday 2025 announcement template for enterprises is as follows:

New Year's Tet Holiday 2025 announcement template for enterprises (template number 1)...Download

New Year's Tet Holiday 2025 announcement template for enterprises (template number 2)...Download

(2) The Lunar New Year Tet Holiday 2025 announcement template for enterprises is as follows:

Lunar New Year Tet Holiday 2025 announcement template for enterprises...Download

(3) The 2025 Tet Holiday announcement template for partners and customers is as follows:

2025 Tet Holiday announcement template for partners and customers...Download

Note: Information is for reference only!

What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? (Image from Internet)

Where are the places of tax payment for enterprises in Vietnam?

According to Article 12 of Decree 218/2013/ND-CP regarding the place of tax payment as follows:

Place of tax payment

- Enterprises file tax at the locality where their head office is located. In case enterprises have dependent accounting production facilities in different provinces or cities under central authority from where the head office is located, the tax amount will be filed both at the head office and at the production facility.

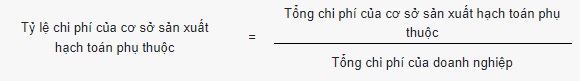

The corporate income tax amount filed in the province or city under central authority where a dependent accounting production facility is located is determined by multiplying the corporate income tax payable in the period by the ratio of costs incurred at the dependent production facility to the total costs of the enterprise.

The tax filing regulation in this paragraph does not apply to works, projects, or construction facilities under dependent accounting.

The division, management, and use of the revenue source from corporate income tax are implemented according to the provisions of the State Budget Law.

- Dependent accounting units of enterprises that perform sector-wide accounting and have income beyond main business activities shall file tax in the province or city under central authority where those business activities occur.

- The Ministry of Finance provides guidance on the Place of tax payment as regulated in this Article.

As such, enterprises file corporate income tax at:

- The locality where their head office is located.

In case enterprises have dependent accounting production facilities in different provinces or cities under central authority from where the head office is located, the tax amount will be filed both at the head office and at the production facility.

Note: This regulation does not apply to works, projects, or construction facilities under dependent accounting.

- The province or city under central authority where business activities occur: For dependent accounting units of enterprises that perform sector-wide accounting and have income beyond main business activities.

How to determine the ratio of expenses incurred by the dependent cost-accounting production establishment and total expenses incurred by the enterprise in Vietnam?

Pursuant to the regulations in Article 13 of Circular 78/2014/TT-BTC, the ratio of costs incurred at a dependent accounting production facility to the total costs of the enterprise (hereafter referred to as the cost ratio) is determined as follows:

- The data to determine the cost ratio is based on the tax settlement data of the previous year closest to the tax year as self-determined by the enterprise to serve as the basis for determining the tax payable and used for declaring and paying corporate income tax in subsequent years.

- In cases where an operating enterprise has dependent accounting production facilities in various localities, the data to determine the cost ratio of the head office and the dependent accounting production facilities is self-determined by the enterprise based on the corporate income tax settlement data of 2008, and this ratio is used stably from 2009 onwards.

- In cases where newly-established enterprises, or operating enterprises that establish or reduce dependent accounting production facilities in various localities, must self-determine the cost ratio for the first tax period concerning these changes. From the subsequent tax period, the cost ratio is used stably according to the above principle.

Dependent accounting units of enterprises performing sector-wide accounting with income beyond main business activities file tax in the province or city under central authority where the production and business activities arise.