Vietnam: What are guidelines for amending and supplementing VAT declaration on the HTKK software in 2024?

Can supplementary value-added tax declarations be submitted after the deadline for submission of tax dossier in Vietnam?

Based on Article 47 of the 2019 Tax Administration Law concerning supplementary tax declarations as follows:

Supplementary Tax Declarations

- Taxpayers who find errors or omissions in their previously submitted tax documents to the tax authorities are allowed to file supplementary tax declarations within 10 years from the expiration date of the original tax declaration deadline for the taxable period with errors or omissions, but before the tax authority or competent authority announces the decision on inspection or examination.

- If the tax authority or competent authority has announced a tax inspection or examination decision at the taxpayer's headquarters, the taxpayer is still allowed to file supplementary tax declarations; the tax authority will impose administrative sanctions for tax management violations as specified in Articles 142 and 143 of this Law.

...

From the above regulations, it can be seen that if a business discovers errors in its initial value-added tax (VAT) declaration, it is still allowed to file a supplementary VAT declaration within 10 years from the expiration date of the original VAT declaration deadline for the taxable period with errors, but before the tax authority or competent authority announces the decision on inspection or examination.

Vietnam: What are guidelines for amending and supplementing VAT declaration on the HTKK software in 2024? (Image from the Internet)

Vietnam: What are guidelines for amending and supplementing VAT declaration on the HTKK software in 2024?

The condition for performing a supplementary adjustment declaration on the HTKK software is that the declaration for the period with errors must exist on the HTKK software on the relevant computer.

(1) Overview of the steps to file supplementary VAT declarations include:

- Step 1: Access the HTKK software, select the incorrect declaration

- Step 2: Select the erroneous period

- Step 3: Choose the status of the supplementary declaration, select the number of times for supplementary declaration, and review the date of KHBS creation

- Step 4: Click “Agree” to enter the adjustment declaration

- Step 5: Adjust the declaration

- Step 6: Enter the electronic transaction code on the “01-KHBS” tab:

- Step 7: Click “Summarize KHBS”

- Step 8: Determine the outcome of the supplementary adjustment declaration

- Step 9: Record the reason for the adjustment

- Step 10: Press “Save” to verify information

- Step 11: Export XML and submit the supplementary declaration online

- Step 12: Pay the additional tax amount after adjustment and any late payment penalties (if applicable).

(2) The procedure for filing supplementary adjusted VAT for 2024 is as follows:

- Step 1: Access the HTKK software, then select the erroneous VAT declaration:

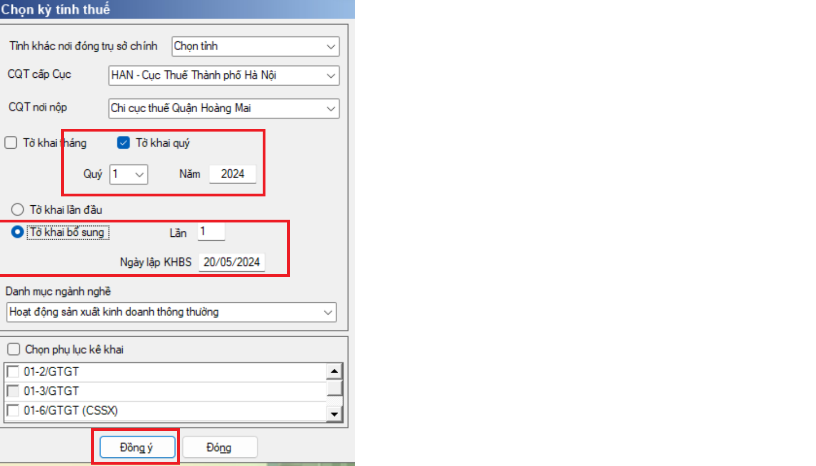

- Step 2: Select the erroneous period

Example: An error was made in the VAT declaration for Q3/2024 => When making an adjustment, select Q3/2024.

- Step 3: Choose the status of the supplementary declaration, select the number of times for supplementary declaration, and check the creation date of KHBS (supplementary declaration)

+ Choose the declaration status: From the time the business receives the notification of acceptance for the “First time” tax declaration, if you wish to resubmit your declaration for that tax period, you must select the status as Supplementary Declaration

+ Select the number of times for supplementary declaration:

The first time creating a supplementary declaration for an erroneous period is time 1 => keep increasing for subsequent errors discovered

+ Check the creation date of KHBS (supplementary declaration): The software defaults to the date on the computer (still allows edits).

Note: The supplementary date cannot be later than the current date (meaning you can't enter a KHBS creation date later than the computer's date).

Additionally, regarding appendices: If any appendices were already declared in the initial or supplementary N-1 declaration, during the N supplementary declaration, the software will by default check that appendix and allow the taxpayer to attach additional non-declared appendices.

- Step 4: Click “Agree” to enter the adjustment declaration

- Step 5: Adjust the declaration

The software will use the data from the latest VAT declaration (form 01/GTGT Download) for the relevant tax period as default data on the adjustment declaration:

+ For the first supplementary declaration, the data from the first declaration is used

+ For the second supplementary declaration, data from the first supplement is used

+ For the nth supplementary declaration, data from the n-1th supplement is used

- Step 6: Enter the electronic transaction code on the “01-KHBS” tab:

Perform this on the supplementary declaration tab (Form 01-KHBS Download)

In Indicator [02]: Enter the electronic transaction code of the original erroneous declaration that needs supplementation and adjustment.

Enter the electronic transaction code from the tax return acceptance notice according to form 01-2/TB-TDT Download of the initial declaration. To get this electronic transaction code, perform the following search:

+ Method 1: Check on the thuedientu.gdt.gov.vn system

+ Method 2: Verify in the receipt or confirmation of electronic tax documents sent to the business email

Note: Currently, if the electronic transaction code is not entered on the supplementary declaration 01/KHBS, a warning will appear upon pressing “Save” (informing that "Input is mandatory")

However, if no electronic transaction information is entered on the supplementary declaration 01/KHBS Download, it is still possible to export the declaration and submit the supplementary incorrect declaration online.

- Step 7: Click “Summarize KHBS”

The software consolidates the data into the supplementary declaration (01/KHBS Download) and the supplementary explanation statement.

After pressing "Summarize KHBS," the software will display a message "Data successfully consolidated into KHBS," then click "Close"

- Step 8: Determine the result of the supplementary adjustment declaration (form 01/KHBS Download)

Instructions for determining: Section A. Determining the increase/decrease in tax payable and late payment interest, increase/decrease in deductible tax, increase/decrease in tax refunds requested:

I. Determine the increase/decrease in tax payable and late payment interest:

Tax payable on the adjustment declaration increases/decreases: at the total line, Indicator number [10] Increase/decrease in tax payable

+ Case 1: Indicator number [10] > 0 => Increase in the additional VAT payable

Must pay the positive amount incurred at Indicator [10], along with any late payment penalty at section 3, part I (if applicable) (the software calculates automatically, but allows edits -> Must check and confirm again (if the software calculation is incorrect))

+ Case 2: Indicator number [10] < 0 => Result: decrease in VAT payable

Case 2.1: Tax amount has not been paid from the erroneous declaration being adjusted: perform an offset and pay according to the adjusted amount

Case 2.2: Tax amount has already been paid from the erroneous declaration being adjusted: the business monitors the negative amount at Indicator [10] and offsets in subsequent periods when a tax payable arises (This case is determined to have overpaid tax)

II. Deductible tax is adjusted up/down: at the total line, Indicator number [12] Increase/decrease in deductible tax

+ Case 3: Indicator number [12] > 0 => Result: Increased amount of VAT deductible:

Enter the positive amount at Indicator [12] on this supplementary declaration “01/KHBS” into Indicator [38] – Increase adjustment on the 01/GTGT declaration for the current VAT declaration period (period performing adjustment supplement)

+ Case 4: Indicator number [12] < 0 => Result: Decreased amount of VAT deductible:

Enter the negative amount at Indicator [12] on this supplementary declaration “01/KHBS” into Indicator [37] – Decrease adjustment on the 01/GTGT declaration for the current VAT declaration period

- Step 9: Record the reason for the adjustment

Perform this in appendix 01-1/KHBS Download supplementary explanation statement

- Step 10: Press “Save” to verify information

- Step 11: Export XML and submit the supplementary declaration online

- Step 12: Pay the additional tax amount after adjustment and any late payment penalties (if applicable)

Is it required to pay late payment interests when supplementary tax declarations are submitted in Vietnam?

According to Clause 1, Article 59 of the 2019 Tax Administration Law, taxpayers who file supplementary VAT declarations must pay late payment interests in the following cases:

Handling of Late Tax Payment

- Cases requiring late payment interests include:

a) Taxpayers who delay tax payments beyond the stipulated deadline, deferred payment deadline, the deadline specified in the tax authority's notice, the deadline in the tax assessment decision or the handling decision of the tax authority;

b) Taxpayers who file supplementary tax declarations increasing the tax payable, or when the tax authority, competent state authority verifies under-reporting of tax payable, must pay late payment interests on the increased tax payable amount from the day following the final day of the tax payment deadline of the period with errors or from the expiration of the initial customs declaration deadline;

c) Taxpayers who file supplementary tax declarations decreasing refunded tax, or when the tax authority, competent state authority verifies that the refunded tax is less than the previously refunded amount, must pay late payment interests on the recovered refunded tax from the date of receiving a refund from the state budget;

...

Taxpayers who file supplementary VAT declarations are required to pay late payment interests if they fall into any of the cases mentioned above.

- Is it required to pay import duties for goods from Southeast Asian countries to Vietnam before customs clearance?

- Shall businesses leasing out houses to students and low-income earners receive a 2% VAT reduction in Vietnam?

- Are gifts of movables required for registration from relatives exempt from personal income tax in Vietnam?

- Is the taxpayer required to have a digital signature for e-tax transactions in Vietnam?

- Do e-documents in e-tax transactions have the same value as paper documents in Vietnam?

- What are the latest tax registration application forms in Vietnam according to Circular 86 2024?

- What is the organizational structure of the Ministry of Home Affairs of Vietnam from March 1, 2025? What is the current tax professional training and retraining regime for Vietnamese tax officials?

- What is the Vietnam import tariff-rate quotas for salt and poultry eggs from March 2, 2025?

- What are 03 ways to look up e-invoices of Petrolimex in Vietnam in 2025?

- What are important contents on province merger, organizational machinery arrangement in Vietnam according to Conclusion 126?