How to fill out the Form 2A on year-end self-assessment for members of Communist Party of Vietnam in 2024? Is income from certain allowances the basis for paying membership fees?

How to fill out the Form 2A on year-end self-assessment for members of Communist Party of Vietnam in 2024?

According to Article 6 of Provisions 124-QD/TW in 2023, the assessment of CPV members without leadership or management positions must be conducted based on specific contents, including:

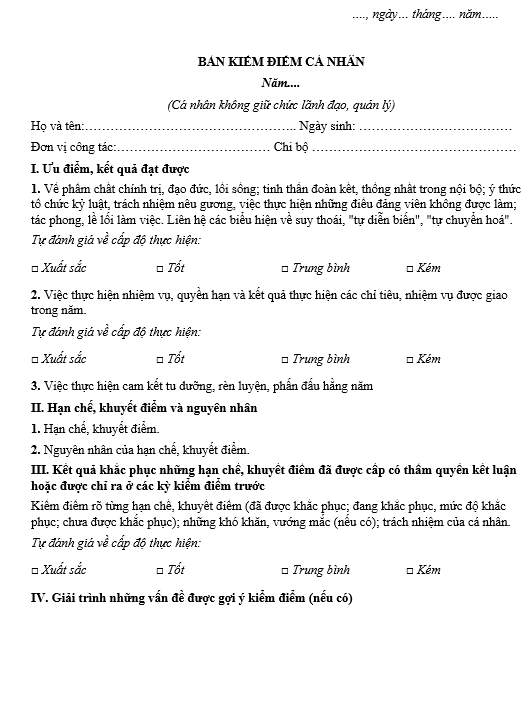

Form 2A year-end self-assessment for members of Communist Party of Vietnam ....download

(1) Political qualities, ethics, lifestyle, and spirit of solidarity:

- Assess the political qualities, ethics, and lifestyle of the CPV member, especially the implementation of solidarity and unity within the organization.

- Evaluate the discipline and responsibility for setting an example, including the implementation of things CPV members should not do.

- Check the working style and methodology of the CPV member.

- Link to signs of degradation in political ideology, ethics, lifestyle, as well as manifestations of "self-evolution" and "self-transformation" in actions and thoughts of the CPV member.

(2) Execution of duties, powers, and work outcomes:

Evaluate the results in achieving targets and duties assigned during the year, the execution of professional tasks, and responsibilities assigned by the Communist Party.

(3) Commitment to self-improvement, training, and striving:

Assess the fulfillment of the commitment to self-improvement, training, and striving annually by the CPV member.

(4) Overcoming limitations and weaknesses from the previous assessment period:

The CPV member must clarify issues pointed out by competent authorities in the previous assessment (if any), especially in overcoming the limitations and weaknesses identified.

In addition to the above contents, CPV members must also assess and clarify responsibility when violations occur, causing public concern or when there are complaints or accusations. Pay special attention to the following issues:

- Violation of principles, rules of the Communist Party.

- Manifestations of "group interest," corruption, negativity, wastage.

Signs of degradation, "self-evolution," "self-transformation."

- Involvement of collectives or individuals being disciplined, prosecuted.

- Situations where the CPV member or organization is stagnant, weak, or fails to complete the responsibilities and duties assigned.

How to fill out the Form 2A on year-end self-assessment for members of Communist Party of Vietnam in 2024? Is income from certain allowances the basis for paying membership fees? (Image from the Internet)

Is income from certain allowances the basis for paying membership fees?

According to Section 1, Part B of the Regulation on membership fee policies issued with Decision 342/QD-TW in 2010, the basis for paying membership fees by CPV members is specifically stated as follows:

- Salaries;

- Certain allowances;

- Wages;

- Living expenses;

- Other income.

Thus, through the above regulation, income from certain allowances is a basis for paying membership fees.

Which CPV members are not required to make a self-assessment report?

According to Item 1, Subsection A, Section 2 of Guidance 21-HD/BTCTW in 2019, it is stipulated that CPV members without leadership or management positions and without serious violations or shortcomings are not required to make a self-assessment report if they fall into one of the following categories:

II. CONTENT

A. SELF-CRITICISM AND CRITICISM

- Assessment Subjects

1.1. Collectives

a) At the Central Level

- Politburo, Secretariat of the Central Committee of the Communist Party; standing committees of party organizations directly under the Central Committee, party caucus, leadership of central party organizations.

- Standing bodies of Ethnic Council Committees; standing committees of the National Assembly, leadership of bodies under the Standing Committee of the National Assembly.

- Leadership: Office of the President, Office of the Government of Vietnam, Office of the National Assembly; central public service providers (People's Daily, Communist Review, Voice of Vietnam Radio, Vietnam Television, Vietnam News Agency, Ho Chi Minh National Academy of Politics, Vietnam Academy of Social Sciences, Vietnam Academy of Science and Technology, Vietnam National University, Hanoi, Vietnam National University, Ho Chi Minh City, National Political Publishing House - The Truth); agencies, units of the Communist Party, State, Fatherland Front and political-social organizations at the central level; state economic groups, state general companies, state enterprises.

- Other leadership and management collectives at the ministries and central authorities as regulated by the Central Committee, party caucus, directly governed by the Central Committee.

b) At the Local Level

- Standing party committees at the provincial, district level and equivalent; grassroots party committees; party caucus, leadership of advisory bodies to assist provincial, district party committees.

- Other leadership and management collectives at the provincial, district and grassroots levels as regulated by provincial, city committees directly under the Central Committee.

1.2. Individuals

- CPV members throughout the Communist Party (except CPV members exempted from work and party activities, CPV members suspended from party activities). Those in suspended party execution must still conduct assessments.

- Leadership, managerial officers at all levels.

...

Thus, through the above regulation, CPV members throughout the Communist Party are required to make a self-assessment report, except for the following CPV members who are not required to do so:

- CPV members exempted from work and party activities;

- CPV members suspended from party activities.

Members who are suspended from party execution must still conduct assessments.

- What are guidelines for salary arrangement of ranks of tax officials in Vietnam?

- What are 02 submission methods of Form 01/PLI on employment report for the last 6 months of 2024 in Vietnam? What is the union fee for members in people's armed forces in Vietnam?

- Who is a intermediate tax inspector in Vietnam? What are the duties?

- What is the VAT rate on endodontic treatment services in Vietnam?

- Is an information technology center subject to VAT in Vietnam?

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?