What is the current list of accounting account system for small and medium enterprises in Vietnam?

- What are the general rules in applying the accounting regime to small and medium enterprises in Vietnam?

- The latest list of accounting account system for small and medium enterprises in Vietnam?

- Can small and medium enterprises open sub-accounts without approval?

- Can enterprises choose a foreign currency for accounting books in Vietnam?

What are the general rules in applying the accounting regime to small and medium enterprises in Vietnam?

Pursuant to Article 3 of Circular No. 133/2016/TT-BTC, the general rules in applying the accounting regime to small and medium enterprises are prescribed as follows:

- Small and medium enterprises may apply the accounting policies specified in Circular No. 200/2014/TT-BTC dated December 22, 2014 of the Ministry of Finance and amendments thereto as long as their supervisory tax authorities are informed and such accounting policies are applied consistently throughout the fiscal year.

A small and medium enterprise that wishes to turn back to applying the accounting policies must do it in the beginning of the fiscal year and inform its supervisory tax authority.

- Small and medium enterprises shall, pursuant to accounting rules and contents of the balance sheet specified in this Circular, record their transactions in a way that is appropriate for their operation and management requirements.

- In the cases where an enterprise undergoes changes in a fiscal year and is no longer regulated by this Circular, it may apply this Circular until the end of the current fiscal year and apply an appropriate accounting policy from the succeeding fiscal year.

What is the current list of accounting account system for small and medium enterprises in Vietnam?

The latest list of accounting account system for small and medium enterprises in Vietnam?

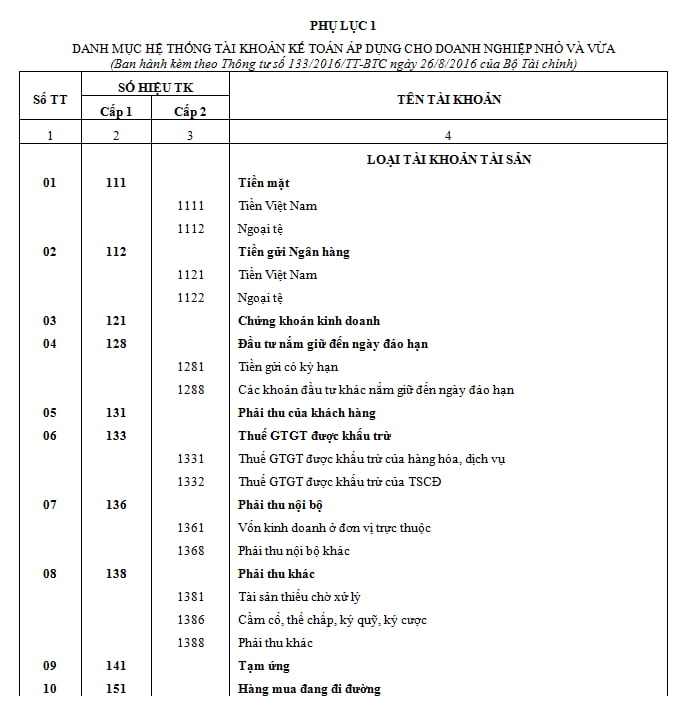

The list of accounting account system exclusively for small and medium enterprises is specified in Appendix 1 issued together with Circular No. 133/2016/TT-BTC, specifically as follows:

View the entire list of accounting account system for small and medium enterprises in Vietnam: Click here.

Note: The list of accounting account system applies to the following entities:

Small and medium enterprises (including micro-enterprises) in all fields and all economic sectors as prescribed by the law on supporting small and medium enterprises, except for State-owned enterprises, enterprises in which the State owns more than 50% of charter capital, public companies in accordance with the law on securities, cooperatives and unions of cooperatives as prescribed in the Law on Cooperatives.

Small and medium enterprises in specific fields such as electricity, oil and gas, insurance, securities, etc. have been issued or approved by the Ministry of Finance to apply specific accounting regimes.

In addition, small and medium enterprises can choose to apply the corporate accounting system according to Circular No. 200/2014/TT-BTC but must notify the tax agency managing the business and must be done consistently throughout the fiscal year.

Can small and medium enterprises open sub-accounts without approval?

Pursuant to Clause 2, Article 10 of Circular No. 133/2016/TT-BTC stipulating as follows:

Registration of changes to accounting policy

1. Regarding the balance sheet:

a) In the cases where an enterprise wishes to add a sub-account or change the name, symbol, contents, transaction accounting method of a sub-account, it must obtain a written approval by the Ministry of Finance.

b) An enterprise may add sub-accounts to accounts without sub-accounts specified in the Enterprise Account System in Appendix 1 enclosed herewith without approval by the Ministry of Finance.

Thus, an enterprise may add sub-accounts to accounts without sub-accounts specified in the Enterprise Account System without approval by the Ministry of Finance.

Can enterprises choose a foreign currency for accounting books in Vietnam?

According to Article 5 of Circular No. 133/2016/TT-BTC and Article 6 of Circular No. 133/2016/TT-BTC on this content as follows:

Accounting currency

The accounting currency is Vietnamese Dong (national symbol: “đ”; international symbol: “VND”) shall be used to prepare the accounting books and financial statements of enterprises. In the cases where most of an accounting unit’s revenues and expenses are foreign currencies and the standards specified in Article 6 of this Circular are met, one of the foreign currencies may be used as accounting currency.

Thus, in the cases where most of an accounting unit’s revenues and expenses are foreign currencies and the standards specified in Article 6 of Circular No. 133/2016/TT-BTC are met, one of the foreign currencies may be used as accounting currency.

Specifically:

- An enterprise whose revenues and expenses are primarily in foreign currencies may decide on an accounting currency pursuant to the 2015 Law on Accounting and take legal responsibility for such selection. The supervisory tax authority of such enterprise must be informed of this decision.

- An accounting currency:

+ is primarily used in the unit’s goods sale and/or service provision; greatly affects the prices for goods and/or services; is usually the currency of selling prices and payments therefor; and

+ is primarily used in the unit’s purchases of goods and/or services; greatly affects the costs of labour, materials and other operating expenses; is usually the currency of payments for such costs.

LawNet