Fee rates for the registration of secured transactions by land use rights and assets attached to land in Ho Chi Minh City

Implementing the Collection of Registration Fees for Secured Transactions by Land Use Rights and Assets Attached to Land in Ho Chi Minh City, Correct?

On April 18, 2023, the People's Council of Ho Chi Minh City issued Resolution 01/2023/NQ-HDND regarding the registration fee rates for secured transactions (for registration activities undertaken by local authorities) by land use rights and assets attached to land in Ho Chi Minh City.

The People's Committee of Ho Chi Minh City is assigned to:

- Implement and organize the consistent execution of this Resolution across Ho Chi Minh City in compliance with legal regulations; ensure accurate, complete, transparent, and prompt fee collection;

- Effectively conduct propaganda work, fostering public consensus in fee collection implementation;

- Continuously enhance inspection of the management and use of retained fee revenues by the collection unit, ensuring efficient and proper use;

- In cases where state policies change, if the retained fee revenues are insufficient to cover the operational costs of the fee-collecting organization or the unused funds carry over to subsequent years, the People's Committee of Ho Chi Minh City should report to the People's Council of Ho Chi Minh City to adjust the retention rate accordingly.

Specifically, the Department of Natural Resources and Environment is tasked with organizing fee collection for agencies, organizations, and individuals upon request for registration of security measures by land use rights and assets attached to land at competent state authorities in accordance with the law; ensure accurate, complete, transparent, and prompt fee collection.

Conduct effective propaganda work, fostering public consensus in fee collection implementation.

Regularly inspect the management and use of retained fee revenues by the collection unit to ensure efficient and proper use.

Fee exemptions are granted to children, poor households, the elderly, the disabled, persons with meritorious services to the revolution, ethnic minorities in socio-economically extremely difficult communes within Ho Chi Minh City according to the provisions of Decision 36/2021/QD-TTg on criteria for determining poor districts, extremely difficult communes in coastal, sandy, and island areas for the 2021-2025 period.

What are the fee rates for registration of secured transactions by land use rights and assets attached to land in Ho Chi Minh City? (Image from the Internet)

What are the Fee Rates for the Registration of Secured Transactions by Land Use Rights and Assets Attached to Land in Ho Chi Minh City?

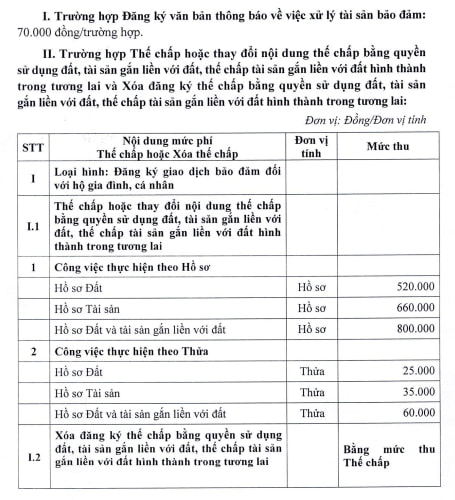

The fee rates for the registration of secured transactions by land use rights and assets attached to land in Ho Chi Minh City are stipulated in the Appendix issued together with Resolution 01/2023/NQ-HDND.

Fee rates for the registration of secured transactions by land use rights and assets attached to land in Ho Chi Minh City are calculated based on the dossier or according to the parcel:

View the full fee rates for the registration of secured transactions by land use rights and assets attached to land in Ho Chi Minh City here.

When is the Time for Fee Declaration, Collection, Payment, Settlement, and Management, Use of Fees?

According to Article 2 of Resolution 01/2023/NQ-HDND, the provisions for fee declaration, collection, payment, settlement, and management, use of fees are as follows:

- Agencies, organizations, and individuals requesting state authorities to carry out the procedures must pay fees within one working day from the date of receiving the fee notice from the registration authority;

- Fees are paid into the fee-holding account awaiting budget payment of the fee-collecting organization open at the State Treasury;

- The actual time for fee declaration, collection, payment, settlement, and management, use of fees is no later than the 5th day of each month, the fee-collecting organization must deposit the fees collected from the previous month into the fee-holding account awaiting budget payment opened at the State Treasury;

- The fee-collecting organization declares, submits the collected fees monthly, settles fees annually according to the provisions of the Law on Tax Administration 2019, Decree 126/2020/ND-CP.

Additionally, the fee-collecting organization is permitted to retain 85% of the collected fees to cover fee collection activities and submit 15% to the budget.

The management and use of the retained fee amount follow the provisions of the Law on Fees and Charges 2015 and Decree 120/2016/ND-CP.

LawNet