When is the delivery and internal transfer note used in Vietnam?

When is the delivery and internal transfer note used in Vietnam?

Based on Clause 3, Article 13 of Decree 123/2020/ND-CP, regulations on the cases of using delivery and internal transfer notes for specific situations as per management requirements are as follows:

(1) Entrusted Importation without VAT payment:

In cases where the entrusted importation is received, if the business establishment has not paid VAT at the import stage, when returning entrusted import goods, the entrusted receiver establishes the delivery and internal transfer note as required to serve as documentation for goods circulation on the market.

(2) Entrusted Export Cases:

When delivering goods to the entrusted receiver, the establishment with entrusted export goods utilizes the delivery and internal transfer note.

(3) Businesses Declaring and Paying VAT using Deduction Method with Export Goods and Services (including processing facilities for export goods):

When exporting goods or services, the business must use electronic VAT invoices. When dispatching goods to transport to the border gate or the location for export procedures, the business uses the delivery and internal transfer note as stipulated for goods circulation on the market.

(4) Organizations Declaring and Paying VAT using Deduction Method for Transfers to Agents:

When a dependent unit of an agricultural, forestry, or fishery business, particularly registered for VAT declaration using the deduction method, transfers goods to the headquarters, the delivery and internal transfer note is used instead of the electronic VAT invoice.

(5) Mobile Sales:

Organizations or individuals conducting mobile sales issues should utilize the delivery and internal transfer note as required, and electronic invoices are issued upon sales.

When is the delivery and internal transfer note used in Vietnam? (Image from the Internet)

What is the format for the delivery and internal transfer note in Vietnam?

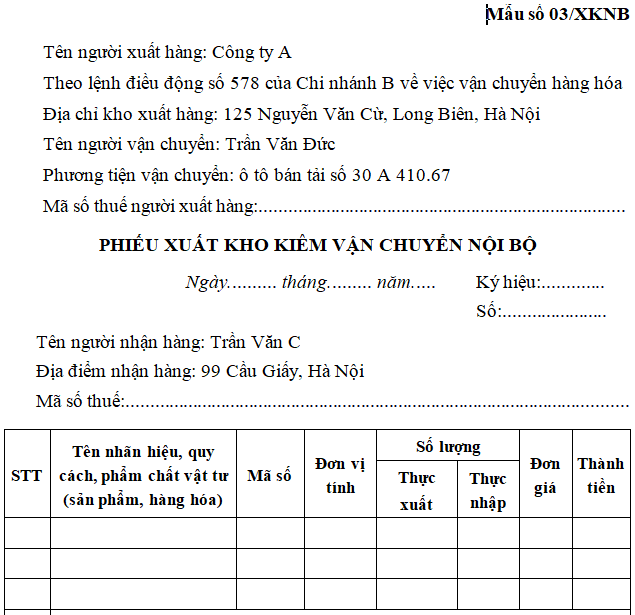

Currently, the format for the delivery and internal transfer note is specified as Form 03/XKNB, issued together with Decree 123/2020/ND-CP, as shown below:

Download Form 03/XKNB for the delivery and internal transfer note: Here

Is the delivery and internal transfer note considered an invoice in Vietnam?

Pursuant to Article 89 of the Law on Tax Administration 2019 concerning electronic invoices:

Electronic Invoice

...

- Electronic invoices include value-added tax invoices, sales invoices, electronic stamps, electronic tickets, electronic cards, electronic receipts, delivery and internal transfer notes, or other electronic documents by different names.

...

Simultaneously, according to Clause 6, Article 8 of Decree 123/2020/ND-CP guiding types of invoices:

Type of Invoices

Invoices as regulated in this Decree include the following types:

- Value-added tax invoices are for organizations declaring VAT by the deduction method used for activities:

a) Domestic sales and service provision;

b) International transport activities;

c) Sales to tax-free zones and cases deemed as exports;

d) Export of goods and services abroad.

- Sales invoices for organizations and individuals such as:

a) Organizations and individuals declaring and calculating VAT using the direct method for activities:

- Domestic sales and service provision;

- International transport activities;

- Sales to tax-free zones and cases deemed as exports;

- Export of goods and services abroad.

b) Organizations and individuals in tax-free zones selling goods and services domestically and when selling goods, providing services between organizations and individuals in tax-free zones, exporting goods and providing services abroad, stating on invoices “For organizations and individuals in tax-free zones.”

- Electronic invoices for public asset sales are used when selling the following assets:

a) Public assets in state agencies, organizations, units (including state-owned houses);

b) Infrastructure assets;

c) Public assets managed by enterprises not considered state capital at enterprises;

d) Project assets using state funds;

đ) Assets established as national ownership;

e) Public assets recovered by decision of competent authorities;

g) Materials, reclaimed materials from public asset handling.

- Electronic invoices for national reserve sales used by agencies, units within the state reserve system for selling national reserves as prescribed by law.

- Other types of invoices, include:

a) Stamps, tickets, cards with forms and contents specified in this Decree;

b) Freight transportation fee receipts; international transport fee receipts; banking service fee receipts except for those specified at point a of this clause, having forms and contents created according to international customs and relevant legal provisions.

- Documents printed, issued, used, and managed like invoices including delivery and internal transfer notes, consignment delivery vouchers to agents.

...

According to the above regulations, the delivery and internal transfer note is printed, issued, used, and managed like an invoice, and the electronic delivery and internal transfer note is a type of electronic invoice.

- What are latest guiding documents on the Law on Personal Income Tax of Vietnam?

- What is a Tax Treaty? What are the responsibilities and powers of the tax authority in Vietnam in managing transfer pricing?

- What are cases eligible for 100% health insurance coverage in Vietnam from July 1, 2025? Do foreigners receive a personal income tax reduction when paying health insurance?

- What is the working regime of the General Department of Taxation of Vietnam?

- What is the method for calculating environmental protection fees for emissions in Vietnam from 2025?

- How many Deputy Directors does the General Department of Taxation of Vietnam have?

- What is the fireworks schedule for New Year's Eve 2025 in Ho Chi Minh City? Are fireworks subject to environmental protection tax?

- What are conditions for issuing an electricity license in Vietnam from February 1, 2025? Are revenues from electricity trading eligible for corporate income tax incentives in Vietnam?

- What are bases for formulation of medium-term and annual public investment plans in Vietnam from January 01, 2025? What are conditions for application of CIT incentives in Vietnam?

- Vietnam: What does the application for amendments to tax registration together with alternation of supervisory tax authority include?