What is the method for calculating environmental protection fees for emissions in Vietnam from 2025?

What is the method for calculating environmental protection fees for emissions in Vietnam from 2025?

Pursuant to Article 5 of Decree 153/2024/ND-CP (effective from January 5, 2025), the method for calculating environmental protection fees for emissions from 2025 is stipulated as follows:

- The environmental protection fee for emissions payable in the fee payment period is calculated according to the following formula: F = f + C.

Where:

+ F is the total fee payable in the fee payment period (quarter or year).

+ f is the fixed fee stipulated in Clause 1, Article 6 of Decree 153/2024/ND-CP (quarterly or annually).

+ C is the variable fee, calculated quarterly.

The variable fee for an emission facility (C) is the total variable fee for each emission stream (Ci) determined by the formula: C = ΣCi.

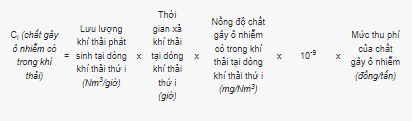

The variable fee for each emission stream (Ci) is the total variable fee of the environmental pollutants stipulated in Clause 2, Article 6 of Decree 153/2024/ND-CP contained in the emissions at each emission stream (i) and is determined by the formula:

Ci = Ci (Dust) + Ci (SOx) + Ci (NOx) + Ci (CO)

The variable fee of each environmental pollutant in the emissions at each emission stream (i) is determined as follows:

Where:

+ The emission time at the ith emission stream is the total time of emitting in the fee calculation period at the ith emission stream as declared by the fee payer.

+ The emission flow rate and concentration of each environmental pollutant in the emission at each emission stream occurring in the fee payment period are determined as follows:

+ For facilities conducting periodic monitoring: The emission flow rate is determined according to the flow rate recorded in the environmental permit; the concentration of each environmental pollutant in the emissions is determined based on periodic monitoring data every 3 months according to regulations in Article 98 of Decree 08/2022/ND-CP.

In case the emission facility has a periodic monitoring frequency of every 6 months according to regulations in Article 98 of Decree 08/2022/ND-CP, the declaration and calculation of fees for the quarter without monitoring are based on the monitoring data of the previous monitoring period.

For facilities performing automatic, continuous monitoring: The emission flow rate and concentration of each environmental pollutant in the emissions are determined based on the average value of measurement results (according to the technical characteristics of each type of equipment).

- For emission facilities subject to automatic, continuous monitoring or periodic monitoring according to the environmental permit (hereinafter referred to as emission monitoring subjects): The environmental protection fee for emissions payable is the total fee payable (F) as determined by the formula stipulated in Clause 1, Article 5 of Decree 153/2024/ND-CP.

- For emission facilities not subject to emission monitoring: The environmental protection fee for emissions payable is the fixed fee (f) stipulated in Clause 1, Article 6 of Decree 153/2024/ND-CP.

>> Decree 153/2024/ND-CP will be effective from January 5, 2025.

What is the method for calculating environmental protection fees for emissions in Vietnam from 2025? (Image from the Internet)

What entities are subject to environmental protection fees in Vietnam?

According to the provisions in Clause 2, Article 2 of Decree 53/2020/ND-CP, the subjects to environmental protection fees are as follows:

- The subjects to environmental protection fees under this Decree are industrial wastewater discharged into the receiving source as per legal regulations, and domestic wastewater, except for exemptions provided for in Article 5 of Decree 53/2020/ND-CP.

- Industrial wastewater refers to wastewater from factories, locations, production facilities, processing centers (collectively referred to as facilities) of organizations, households, individuals, including:

+ Facilities processing: Agricultural products, forestry products, aquatic products, foodstuffs, alcohol, beer, beverages, tobacco.

+ Livestock and poultry farms in accordance with legal provisions on livestock; slaughterhouses for livestock and poultry.

+ Aquaculture facilities required to prepare environmental impact assessments or environmental protection plans as per regulations.

+ Handicraft production facilities in craft villages.

+ Facilities: Tanning, leather recycling, textiles, dyeing, garment.

+ Facilities: Mining, mineral processing.

+ Production facilities: Paper, pulp, plastic, rubber; components, electrical and electronic equipment.

+ Facilities: Mechanics, metallurgy, metal processing, machinery and parts manufacturing.

+ Facilities: Preliminary waste treatment, ship breaking, ship cleaning, and waste disposal.

+ Facilities: Basic chemicals, fertilizers, pharmaceuticals, pesticides, construction materials, office supplies, household goods.

+ Clean water plants, power plants.

+ Centralized wastewater treatment systems in urban areas.

+ Centralized wastewater treatment systems in industrial zones, industrial clusters, export processing zones, economic zones, fishing ports, high-tech zones, and other zones.

+ Other production, processing facilities generating wastewater from production and processing activities.

- Domestic wastewater is wastewater from activities of:

+ Households, individuals.

+ State agencies, public service providers, armed forces units, other organizations (including headquarters, branches, offices of these agencies, units, organizations), excluding production, processing facilities under these agencies, units, organizations.

+ Facilities: Car washing, motorcycle washing, car repair, motorcycle repair.

+ Medical facilities, hospitals; hotels, restaurants; training, research facilities.

+ Other business, service establishments not belonging to the provisions in Clause 2, Article 2 of Decree 53/2020/ND-CP.

What are regulations on authority to collect environmental protection fees in Vietnam?

According to Article 3 of Decree 53/2020/ND-CP, the authority to collect environmental protection fees is specified as follows:

Organizations collecting environmental protection fees for wastewater include:

- Departments of Natural Resources and Environment, Divisions of Natural Resources and Environment collect environmental protection fees for industrial wastewater from facilities under management on the local area. Based on actual management circumstances, the Department of Natural Resources and Environment reports to the People's Committee of provinces, cities directly under the central government to direct the Department of Natural Resources and Environment, Division of Natural Resources and Environment to organize the collection of environmental protection fees for wastewater from facilities in the area.

- Organizations providing clean water collect environmental protection fees for domestic wastewater from organizations, households, individuals using the clean water supplied by them.

- People's Committees of wards, commune-level towns collect environmental protection fees for domestic wastewater from organizations, business households, individuals conducting business in the area using self-extracted water for use.