What is the VAT rate on endodontic treatment services in Vietnam?

What is the VAT on endodontic treatment services in Vietnam?

Based on the regulations in Clause 9, Article 4 of Circular 219/2013/TT-BTC regarding non-taxable VAT objects as follows:

Non-taxable VAT objects

...

9. Medical services, veterinary services, including medical examination, treatment, and disease prevention services for humans and animals, family planning services, health care services, rehabilitation for patients, elderly care services, disabled care services; patient transportation, medical room and bed rental services of medical facilities; testing, x-ray, imaging, blood and blood products used for patients.

Elderly and disabled care services include medical, nutritional care, and organizing cultural, sports, entertainment, physical therapy, and rehabilitation activities for the elderly and disabled.

In cases where the medical service package (as prescribed by the Ministry of Health) includes the use of medicinal drugs, the revenue from medicinal drugs within the medical service package is also not subject to VAT.

...

Thus, endodontic treatment services are not subject to VAT.

What is the VAT on endodontic treatment services in Vietnam? (Image from the Internet)

Does a business only providing endodontic treatment services need to submit a tax return in Vietnam?

Based on the regulations in Clause 3, Article 7 of Decree 126/2020/ND-CP, supplemented by Clause 2, Article 1 of Decree 91/2022/ND-CP, taxpayers do not have to submit a tax return in the following cases:

Tax declaration dossier

...

3. Taxpayers are not required to submit a tax declaration dossier in the following cases:

a) Taxpayers only have operations or businesses that are not subject to tax according to tax laws for each type of tax.

b) Individuals have income exempt from tax according to the laws on personal income tax and regulation at Point b Clause 2 Article 79 of the Law on Tax Administration except individuals receiving inheritance, gifts that are real estate; real estate transfer.

c) Export processing enterprises only have export operations and are not required to submit VAT returns.

d) Taxpayers temporarily suspend operations or business as stipulated in Article 4 of this Decree.

đ) Taxpayers submitting a dossier to terminate the tax code's validity, except for cases of business activity termination, contract termination, enterprise reorganization as stipulated in Clause 4 Article 44 of the Law on Tax Administration.

e) Personal income tax declarers being organizations or individuals paying income in cases of monthly or quarterly personal income tax declarations where no personal income tax deduction arises for the income recipients.

Therefore, if a business only provides endodontic treatment services that are non-subject to VAT, it does not have to submit a VAT tax return.

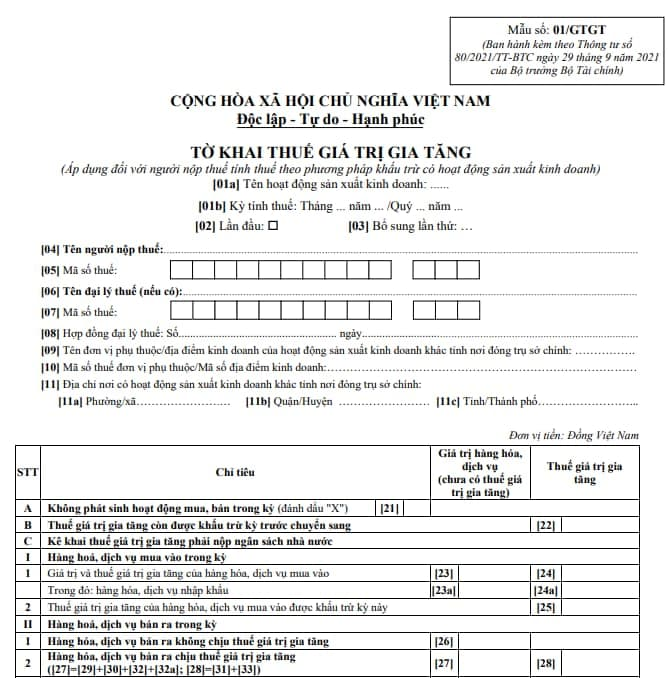

What form is the VAT declaration in Vietnam for the year 2024?

The VAT declaration form for the year 2024 is Form No. 01/GTGT stipulated in Appendix II issued with Circular 80/2021/TT-BTC:

Download VAT return form 01/GTGT: Here

Note: The VAT declaration form (Form No. 01/GTGT) is applicable to taxpayers calculating VAT by the credit method engaged in production and business activities.

The procedure for filing the VAT declaration (Form No. 01/GTGT) is as follows:

[1] Taxpayers select one of the following activities:

- General production and business activities.

- Lottery operations, computer lottery.

- Oil and gas exploration and exploitation activities.

- Infrastructure investment projects, housing for transfer outside the province where the headquarters is located.

- Power plant manufacturing outside the province where the headquarters is located.

[2] Enter the VAT calculation period, specifically: enter the month, year for taxpayers subject to monthly VAT declarations or enter the quarter, year for taxpayers subject to quarterly VAT declarations.

[3] Enter the full name if the taxpayer is an individual; if the taxpayer is an organization, record the organization's name according to the Business Registration Certificate/Business Household Registration Certificate/Establishment Decision or equivalent documents.

[4] Enter the taxpayer's complete tax identification number.

[5] Enter the name of the tax agent if the taxpayer has signed a contract with a tax agent to file VAT on behalf of the taxpayer.

[6] Taxpayers only declare information of dependent units/business locations located in a different province than the headquarters (name, tax code, address) at Indicators [09], [10], and [11] in the following cases:

- Declare VAT for real estate transfer activities of infrastructure investment projects, housing for transfer (including cases of advance collection from customers according to progress) at the location where real estate transfer activities occur.

- Declare VAT at the location where the power plant is located.

Note: In cases where there are multiple dependent units, business locations across many districts managed by the Tax Department, select one representative unit for declaration in these indicators. In cases where there are multiple dependent units, business locations across many districts managed by the Area Tax Department, select one representative unit for the district managed by the Area Tax Department for declaration in these indicators.

[7] Declare the value of goods and services not eligible for VAT declaration and payment according to VAT law.

[8] Declare the reduced deductible tax amount at indicator II on the supplementary declaration (if any).

[9] Declare the increased deductible tax amount at indicator II on the supplementary declaration (if any).

Note, for indicators [37] and [38] in the table: In cases where the tax authority or competent authority has issued a tax conclusion or decision to be adjusted for previous tax periods, declare in the tax return of the period receiving the tax conclusion or decision (supplementary tax returns are not required).

[10] Declare the amount of VAT yet to be deducted and not requested for refund of the investment project transferred for the taxpayer to continue deducting (is the amount of VAT yet to be deducted, not qualified for refund, and not refunded but has been separately declared in the investment project tax return) when the investment project comes into operation or the amount of VAT yet to be deducted and not requested for refund of business activities of dependent unit when terminating operations,…

[11] Declare the total tax amount declared at indicators [28a] and [28b] of VAT return forms No. 02/GTGT.