What is the VAT declaration form for computer-generated lottery business in Vietnam?

What is computer-generated lottery?

Based on Section 2, Part 1 of Circular 44/2009/TT-BTC, the definition of computer-generated lottery is as follows:

GENERAL PROVISIONS

...

- Interpretation of terms

In this Circular, the following terms are understood as follows:

a) computer-generated lottery is a type of self-selected lottery by machine, allowing the buyer or seller of tickets (at the request of the buyer) to select a set of numbers to participate in the prize draw according to the Rules of participation applicable to each type of lottery product published by the Capital Lottery Company.

b) Ticket vending machine is a specialized electronic device used to record the numbers participating in the prize draw; it performs two-way communication with the server and prints tickets for participants in the lottery.

c) The server is an electronic device used to store and process the information of customers participating in the lottery.

...

computer-generated lottery is a type of self-selected lottery by machine, allowing the buyer or seller of tickets (at the request of the buyer) to select a set of numbers to participate in the prize draw according to the Rules of participation for each type of lottery product announced by the Capital Lottery Company.

What is the VAT declaration form for computer-generated lottery business in Vietnam? (Image from the Internet)

What is the VAT declaration form for computer-generated lottery business in Vietnam?

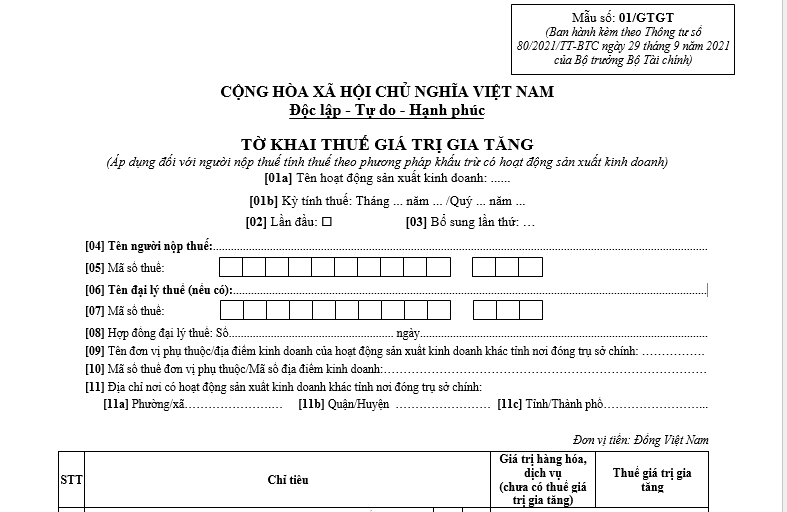

The VAT declaration form for computer-generated lottery business is form number 01/GTGT issued with Circular 80/2021/TT-BTC.

Download form number 01/GTGT VAT declaration form for computer-generated lottery business

* Instructions on how to fill in the VAT declaration form for computer-generated lottery business:

- Item [01a]: The taxpayer selects one of the following activities:

- Regular business activities- Traditional lottery, computer-generated lottery activities- Oil and gas exploration and extraction activities- Infrastructure investment projects, housing projects for transfer outside the province where the head office is located- Power plant production that is located outside the province where the head office is located.

-

Items [09], [10], [11]: Declare information of dependent units, business locations situated in provinces different from the province where the head office is located for cases stipulated at Points b and c, Clause 1, Article 11 of Decree 126/2020/ND-CP. If there are multiple dependent units, business locations in many districts managed by the Tax Department, choose one representative unit to declare in this item. If multiple dependent units, business locations in many districts are managed by the District Tax Branch, choose one representative unit for the district managed by the District Tax Branch to declare in this item.

-

Item [32a]: Declare the value of goods and services exempt from VAT declaration and calculation per VAT law.

-

Items [37] and [38]: Declare according to the tax credit adjusted increase/decrease at Indicator II on the Supplementary Declaration. If the tax authority or a competent authority has issued conclusions, and tax handling decisions with adjustments to previous tax periods, declare in the tax declaration file of the tax period receiving those conclusions, and tax handling decisions (Supplementary Declaration not required).

-

Item [39a]: Declare VAT amounts that can be carried over but have not been claimed for refund for investment projects to allow the taxpayer to continue carrying over (VAT amounts not eligible for refund, not refunded, which the taxpayer has separately declared on investment project tax declarations) when the investment project goes into operation, or extraordinary items that can be carried over but have not been claimed for refund of business activities of dependent units when operations cease, etc.

-

Item [40b]: Declare the total tax declared on indicators [28a] and [28b] of the VAT Declaration form number 02/GTGT issued with Circular 80/2021/TT-BTC.

What are procedures for VAT declarations and payments for computer-generated lottery business in Vietnam?

According to Point a, Clause 3, Article 13 of Circular 80/2021/TT-BTC, VAT declarations and payments for computer-generated lottery business are stipulated as follows:

Tax declaration, calculation, allocation, and VAT payment

...

- Tax declaration, payment:

a) For computer-generated lottery business:

Taxpayers shall conduct centralized VAT declarations for computer-generated lottery business nationwide and submit the tax declaration file according to form number 01/GTGT, the VAT allocation appendix required for various localities where revenue sources benefit from computer-generated lottery business according to form number 01-3/GTGT issued with Annex II of this Circular to the directly managing tax authority; pay the allocated tax amount for each province where computer-generated lottery business are conducted pursuant to Clause 4, Article 12 of this Circular.

b) For real estate transfer activities:

b.1) Taxpayers shall declare VAT and submit the VAT declaration file to the tax authority in the province where the real estate transfer is located according to form number 05/GTGT issued with Annex II of this Circular; pay declared taxes into the state budget in the province where the real estate transfer is located.

...

Thus, the VAT declaration and payment for computer-generated lottery business is conducted as follows:

- Taxpayers conduct centralized VAT declarations for computer-generated lottery business nationwide;

- Taxpayers submit the tax declaration file according to form number 01/GTGT, the VAT allocation appendix required for localities benefiting from revenue sources from computer-generated lottery business according to form number 01-3/GTGT issued with Annex II of Circular 80/2021/TT-BTC to the directly managing tax authority;

- Taxpayers pay the allocated tax amount for each province where computer-generated lottery business are conducted pursuant to Clause 4, Article 12 of Circular 80/2021/TT-BTC.