What is the self-assessment form for members of Communist Party of Vietnam in Vietnam at the end of 2024? What is the membership fee rate for members of Communist Party of Vietnam receiving social insurance benefits?

What is the self-assessment form for members of Communist Party of Vietnam in Vietnam at the end of 2024?

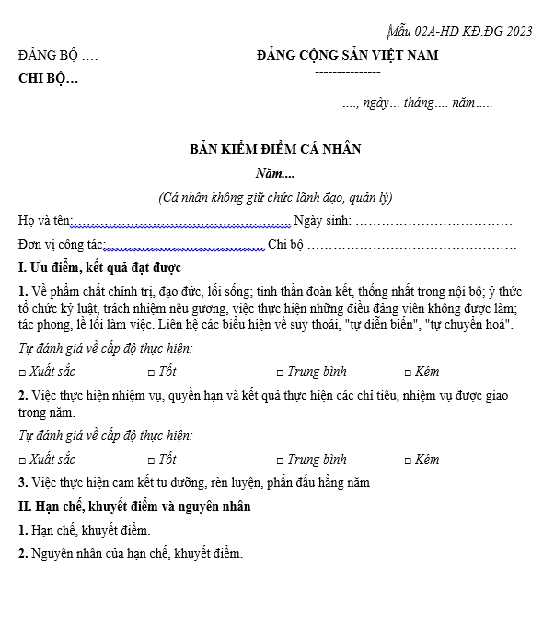

For members of Communist Party of Vietnam at the end of 2024 who do not hold leadership or management positions, the report is issued with Guidance 25-HD/BTCTW 2023 2023 and should be written using form 02A-HD KD.DG 2023.

form 02A-HD KD.DG 2023 ....Download

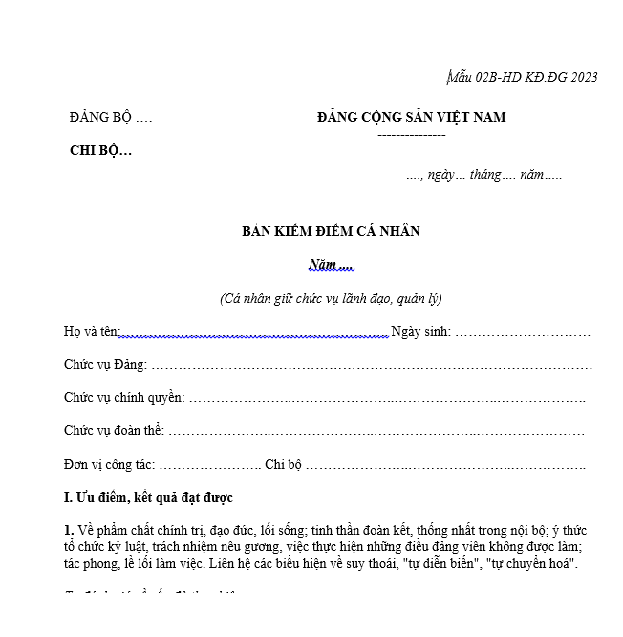

For members of Communist Party of Vietnam at the end of 2024 who hold leadership or management positions, the report is issued with Guidance 25-HD/BTCTW 2023 and should be written using form 02B-HD KD.DG 2023.

form 02B-HD KD.DG 2023 ....Download

Thus, according to the above regulations, members of Communist Party of Vietnam assessed at the end of 2024 should use form 02A-HD KD.DG 2023 and form 02B-HD KD.DG 2023.

What is the self-assessment form for members of Communist Party of Vietnam in Vietnam at the end of 2024? What is the membership fee rate for members of Communist Party of Vietnam receiving social insurance benefits? (Image from the Internet)

What is the membership fee rate for members of Communist Party of Vietnam receiving social insurance benefits?

Based on Section 1 of Part B of the regulations on membership fee policies issued with Decision 342/QD-TW 2010, there are specific provisions on subjects and monthly membership fee contributions. Specifically:

The monthly income of a Communist Party member, which is used to calculate membership fee contributions, includes: salary, allowances; wages; subsistence expenses; and other income. members of Communist Party of Vietnam who can determine their regular income contribute membership fees based on a percentage of their monthly income (before income tax deductions); members who find it difficult to determine their income will have specific monthly contribution rates set for each category.

| Contribution Subjects | Monthly membership fee rate |

| members of Communist Party of Vietnam in administrative agencies, political-social organizations, armed forces units | Monthly contribution of 1% of salary, allowances, wages, and subsistence expenses |

| members of Communist Party of Vietnam receiving social insurance benefits | Monthly contribution of 0.5% of the social insurance salary |

| members of Communist Party of Vietnam working in enterprises, public service providers, economic organizations | Monthly contribution of 1% of salary, wages, and other income from the unit’s salary fund |

| Other members of Communist Party of Vietnam in the country (including agricultural, rural members, student members...) | Monthly contribution from VND 2,000 to VND 30,000. For members above working age, the contribution rate is 50% of members within working age. |

| members of Communist Party of Vietnam studying, working abroad: | |

| (1) Members working at Vietnamese representative offices abroad; students funded by foreign agreements or state budget | Monthly contribution of 1% of the monthly subsistence expenses. |

| (2) Self-funded overseas students; members on labor export; members accompanying family, self-employed members abroad | Monthly contribution from 2 to 5 USD |

| (3) Members who are owners or co-owners of businesses, markets, service shops | Minimum monthly contribution of 10 USD |

| Members with special difficult circumstances | If applying for exemption or reduction of membership fee contribution, the cell party committee will consider and report to the grassroots party committee for a decision. |

Party members from all the above-mentioned subjects are encouraged to voluntarily contribute higher membership fees than required, subject to the agreement of the cell.

What is the classicication for members of Communist Party of Vietnam at year-end?

According to Guidance 25-HD/BTCTW 2023, specific provisions on year-end classicication for members of Communist Party of Vietnam are outlined in Article 12 of Regulation 124-QD/TW 2023 as follows:

- Excellent completion of duties

- Good completion of duties

- Completion of duties

- Failure to complete duties

If faults or violations occur before the assessment year but by the time of assessment, the competent authority decides to impose disciplinary action, the higher-level committee shall adjust the assessment rating down to failure to complete duties, based on the disciplinary action and the violation’s timing.

In cases where individuals self-discover and remedy consequences, it is necessary to carefully consider factors such as motive, nature, level of violation, and circumstances for an appropriate reassessment decision.

The decision to cancel the previous assessment result and recognize a new result will be done according to Form 03 in Guidance 25-HD/BTCTW, while instructing relevant agencies to cancel content related to commendation and rewards (if any) to ensure consistency with current regulations.

- Is an information technology center subject to VAT in Vietnam?

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?

- Who shall receive tax consultation results from the tax advisory councils of communes in Vietnam?

- What is the time limit for imposion of administrative penalties on tax evasion in Vietnam?

- What activities are included in the National E-commerce Week and Online Shopping Day of Vietnam - Online Friday 2024? Are incomes from business on e-commerce platforms taxable?

- What is the timeline for the National E-commerce Week and Online Shopping Day of Vietnam - Online Friday 2024? Do persons selling goods online have to pay taxes?