What is the retail invoice template? When shall retail invoice be used in Vietnam?

What is the retail invoice template in Vietnam?

Currently, the law does not specify a format for retail invoices in Word file format.

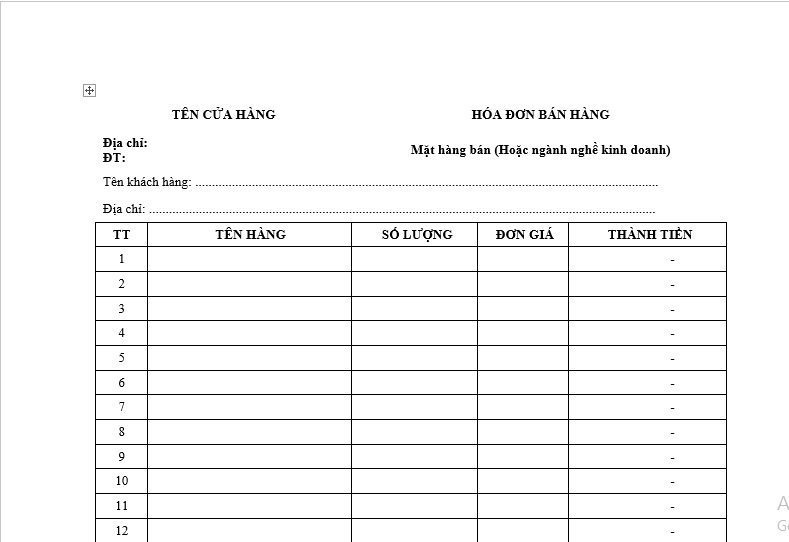

Therefore, individuals and organizations acting as sellers can refer to the Word file template of the retail invoice below:

Download the retail invoice template Word: Download

What is the retail invoice template in Vietnam? (Image from the Internet)

When shall retail invoice be used in Vietnam?

Currently, the existing law does not provide a specific definition for a retail invoice. However, in practice, this type of invoice is commonly used in transactions involving the sale of goods and services with small values. This type of invoice is often used in grocery stores, supermarkets, and restaurants. To be specific, based on Clause 2, Article 8 of Decree 123/2020/ND-CP, it is stipulated as follows:

Types of Invoices

Invoices specified in this Decree include the following types:

- Value-added tax invoice is for organizations declaring VAT by the deduction method used in activities such as:

a) Sale of goods, provision of services domestically;

b) International transportation activities;

c) Export to free trade zones and other cases regarded as exports;

d) Export of goods and services abroad.

2. Sales invoice is for organizations and individuals such as:

a) Organizations and individuals declaring and calculating VAT by the direct method used in activities such as:

- Sale of goods, provision of services domestically;

- International transportation activities;

- Export to free trade zones and other cases regarded as exports;

- Export of goods and services abroad.

b) Organizations and individuals in the free trade zone upon selling goods, providing services domestically and when selling goods, providing services between organizations and individuals within the free trade zone and abroad, should clearly state "For organizations and individuals in the free trade zone" on the invoice.

...

Thus, a retail invoice is a type of sales invoice used when the seller issues an accounting document to the buyer during transactions. This type of invoice often has little legal value and is not managed by tax authorities.

How to Store and Retain Invoices and Documents?

Based on Article 6 of Decree 123/2020/ND-CP, it is stipulated as follows:

Storage and Management of Invoices and Documents

1. Invoices and documents must be preserved, retained ensuring:

a) Safety, security, integrity, completeness, without alteration throughout the storage duration;

b) Stored for the correct and sufficient period as stipulated by accounting law.

2. Electronic invoices and documents are stored using electronic means. Entities, organizations, and individuals may select and apply a form of protection and storage of electronic invoices and documents suitable to their activity characteristics and technological capabilities. Electronic invoices and documents must be ready to be printed or accessed when required.

3. Printed invoices by tax authorities, printed documents, or self-printed documents must be preserved and stored as follows:

a) Unissued invoices and documents are kept in storage according to document preservation policies having value.

b) Issued invoices and documents in accounting units are stored according to the regulations on storage and preservation of accounting documents.

c) Issued invoices and documents in organizations, households or individuals not being accounting units are stored and preserved as their personal assets.

Thus, the storage and management of invoices and documents are carried out as follows:

- Invoices and documents must be preserved and stored ensuring:

+ Safety, security, integrity, completeness, without alteration throughout the storage duration;

+ Stored for the correct and sufficient period as stipulated by accounting law.

- Electronic invoices and documents are stored using electronic means. Entities, organizations, and individuals may select and apply a form of protection and storage of electronic invoices and documents suitable to their activity characteristics and technological capabilities. Electronic invoices and documents must be ready to be printed or accessed when required.

- Printed invoices by tax authorities, printed documents, or self-printed documents must be preserved and stored as follows:

+ Unissued invoices and documents are kept in storage according to document preservation policies having value.

+ Issued invoices and documents in accounting units are stored according to the regulations on storage and preservation of accounting documents.

+ Issued invoices and documents in organizations, households or individuals not being accounting units are stored and preserved as their personal assets.