What is the definition of fixed tax in Vietnam? What are the instructions for determining the presumptive revenue and fixed tax?

What is the definition of fixed tax in Vietnam?

According to Article 3 of Circular 40/2021/TT-BTC:

Definitions

In addition to the terms defined by the Law on Tax Administration, tax Laws and relevant Decrees, the terms below are construed as follows for the purpose of this Circular:

1. “household business” means a business or manufacture facility the established by an individual or members of a household who take responsibility with all of their property for its business operation as prescribed in Article 79 of the Government’s Decree No. 01/2021/ND-CP dated 04/01/2021 on enterprise registration and its guiding, amending or replacing documents (if any). In case the household business is registered by household members, one of them shall be authorized as the household business’ representative. The individual who registers the household business, the person authorized by household members as the household business’ representative shall be the household business owner. Households doing agriculture, forestry, aquaculture, salt production, street vendors, peddlers, merchant traders, travelling vendors, seasonal traders, low-earners are not required to apply for household business registration, except in conditional business lines. The People’s Committees of provinces shall specify the levels of lower incomes in their provinces.

2. A “large-scale” household business or individual business means a household business or individual business that satisfies the highest criteria for revenue and employees of extra-small enterprises. To be specific: A household business or individual business in aquaculture, forestry, aquaculture, industry, construction has an annual average number of at least 10 employees participating in social insurance or has a total revenue in the preceding year of at least 3 billion VND; a household business or individual business in the field of commerce or services has an annual average number of at least 10 employees participating in social insurance or has a total revenue in the preceding year of at least 10 billion VND.

...

8. “household businesses and individual businesses paying fixed tax” are household businesses and individual businesses that fail to comply with or fully comply with regulations on accounting, invoices and documents, except household businesses and individual businesses paying tax under periodic or separate declarations.

9. “fixed tax” means a fixed amount of tax and other amounts payable to state budget by household businesses and individual businesses that have to pay fixed tax determined by tax authorities as prescribed in Article 51 of the Law on Tax Administration.

...

The fixed tax means a fixed amount of tax and other amounts payable to state budget by household businesses and individual businesses that have to pay fixed tax .

What is the definition of fixed tax in Vietnam? What are the instructions for determining the presumptive revenue and fixed tax? (Image from the Internet)

What is the basis for determining the fixed tax payable for household businesses paying fixed taxes in Vietnam?

According to Clause 1, Article 13 of Circular 40/2021/TT-BTC, the basis for determining the fixed tax includes:

a) The tax declaration dossier prepared by the taxpayer according to the revenue estimate and fixed tax of the tax year;

b) Database of the tax authority;

c) Opinions of the Tax Advisory Council of the commune;

d) Result of information disclosure and receipt of feedbacks from Tax Advisory Council, the People’s Committee, the People’s Council, Fatherland Front of the commune, the taxpayer, other organizations and individuals.

Disclosure of information about the fixed tax payer means the tax authority disclosing information and receiving feedbacks about the presumptive revenue and fixed tax by the fixed tax payer as per regulations. The first information disclosure mentioned in Clause 5 of Article 13 of Circular 40/2021/TT-BTC is meant to seek opinions about the revenue and estimated fixed tax; the second information disclosure mentioned in Clause 9 of Article 13 of Circular 40/2021/TT-BTC is meant to seek opinions about the revenue and official fixed tax payable in the tax year.

The enquiry can be posted at the tax authority, sent to the taxpayer, sent to the People’s Committee, the People’s Council, Fatherland Front of the commune; or posted on the website of tax authorities.

What are the instructions for determining the presumptive revenue and fixed tax in Vietnam?

According to Clause 4, Article 13 of Circular 40/2021/TT-BTC, the determination of presumptive revenue and fixed tax is as follows:

(1) Presumptive revenue and fixed tax shall be determined by calendar year or month in case of seasonal business that is stable throughout a year.

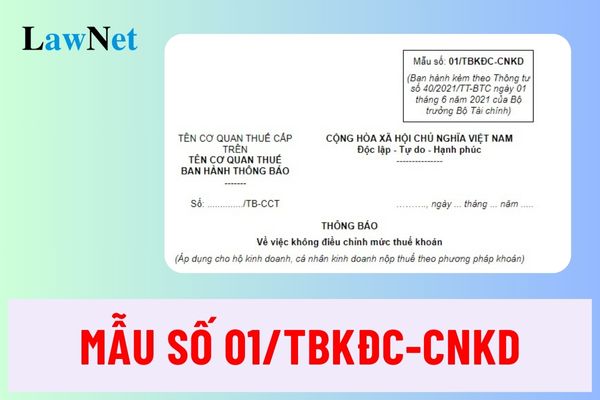

(2) The fixed tax payer shall determine the presumptive revenue themselves using tax form No. 01/CNKD enclosed herewith. In case the fixed tax payer fails to determine the fixed tax, submit the tax declaration dossier or the fixed tax is not reasonable, the tax authority shall impose the presumptive revenue and fixed tax in accordance with Article 51 of the Tax Administration Law 2019.

(3) The tax declaration dossier submitted by the fixed tax payer, the tax authority’s database shall be the basis for public survey, seeking opinions from Tax Advisory Council, and for Provincial Department of Taxation to review tax books at the sub-department of taxation.

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?