What is the Official Dispatch form for requesting cancellation of export and import duties - Form 14/TXNK in Vietnam?

What is the Official Dispatch form for requesting cancellation of export and import duties - Form 14/TXNK in Vietnam?

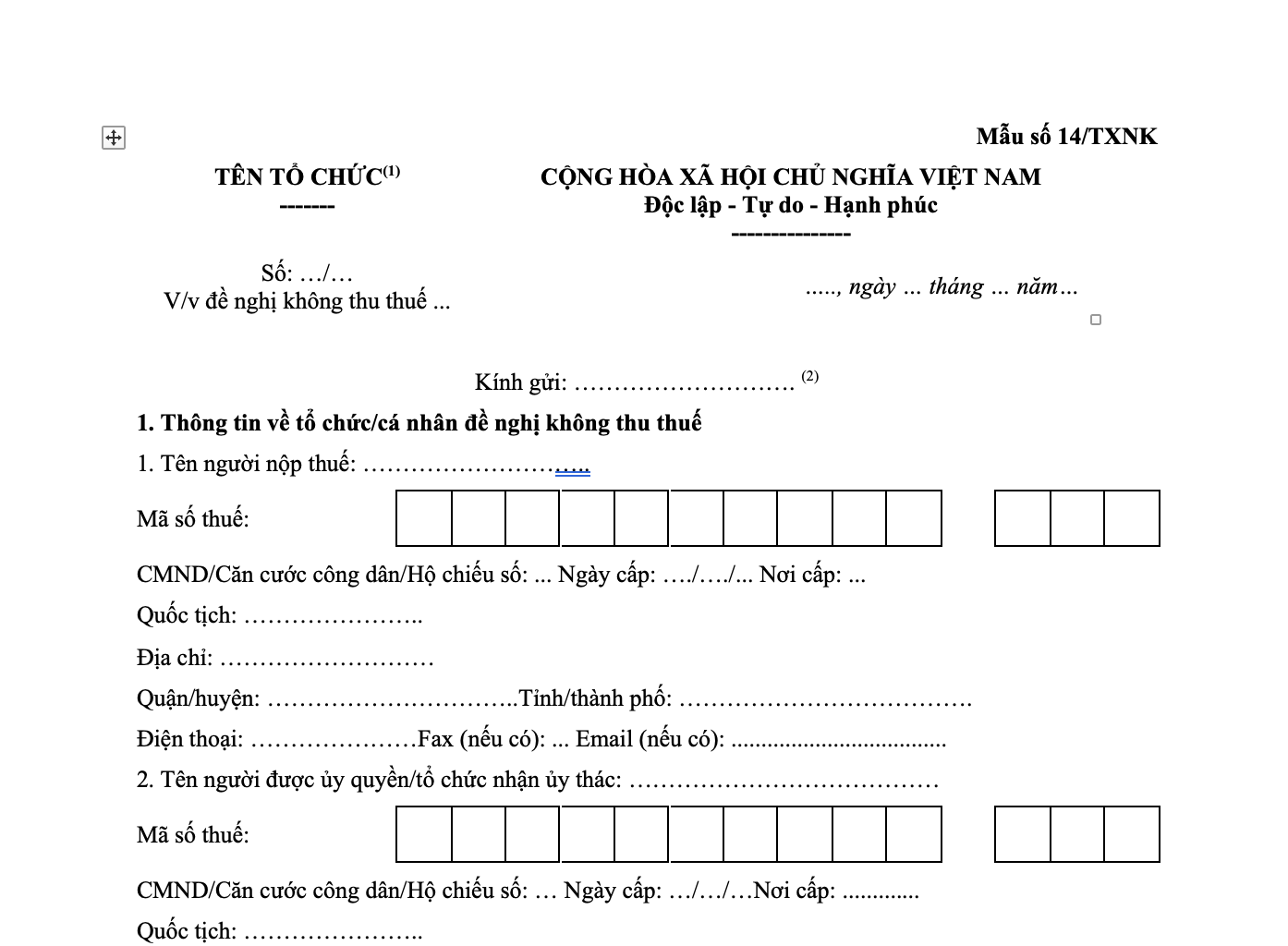

The Official Dispatch form for requesting cancellation of export and import duties - Form 14/TXNK in Vietnam is currently stipulated in Appendix 1 issued together with Circular 06/2021/TT-BTC.

Download the Official Dispatch form for requesting cancellation of export and import duties - Form 14/TXNK in Vietnam: Here

What is the Official Dispatch form for requesting cancellation of export and import duties - Form 14/TXNK in Vietnam? (Image from the Internet)

What are the procedures for cancellation of import duty on re-imported exports and export duty on re-exported imports in Vietnam?

According to Article 13 of Circular 06/2021/TT-BTC, the procedures for cancellation of import duty on re-imported exports stipulated in Article 33 of Decree 134/2016/ND-CP, and the procedures for cancellation of export duty on re-exported imports stipulated in Article 34 of Decree 134/2016/ND-CP are as follows:

(1). Responsibilities of the tax payer

- Fully, accurately, and truthfully declare the contents of the application for cancellation of export and import duties and be responsible for the declared contents.

+ In case of cancellation of import duty on re-imported exports according to Article 33 of Decree 134/2016/ND-CP, the taxpayer shall send an official dispatch proposing cancellation of export and import duties via the System using Form 6 Appendix 2 issued together with Circular 06/2021/TT-BTC, or a paper copy using Form 14/TXNK Appendix 1 issued together with Circular 06/2021/TT-BTC: 01 original copy; documents stipulated in Article 33 of Decree 134/2016/ND-CP including:

++ Payment proof for exported goods in cases where payment has been made: 01 photocopy certified by the proposing authority;

++ Export contract, entrusted export contract if it is in the form of entrusted export (if any): 01 photocopy certified by the proposing authority;

++ Commercial invoice under the export contract for goods that are exported then re-imported (except for exports into free trade zones, implemented according to point a.1.4 Clause 1 Article 13 of Circular 06/2021/TT-BTC: 01 photocopy certified by the proposing authority;

++ Invoice of the exporter under the law on invoices for exports to free trade zones that have to be re-imported: 01 photocopy certified by the proposing authority;

++ Goods to be re-imported because they have been refused by foreign customers or are unclaimed according to the carrier's notice must include a notice from the foreign customer or an agreement with the foreign customer about receiving back the goods or a notice from the carrier about the unclaimed goods stating the reason, quantity, type of returned goods: 01 photocopy certified by the proposing authority. In cases of force majeure or when the taxpayer themselves discover errors in the goods that need to be re-imported, this document is not required but the reason for re-importing the goods must be clearly stated in the official dispatch proposing cancellation of export and import duties;

++ Exports by organizations or individuals in Vietnam to organizations or individuals abroad via postal and international express delivery services but cannot be delivered to the recipient and must be re-imported must have an additional notice from the postal enterprise or international express delivery service about the failed delivery: 01 photocopy certified by the proposing authority;

+ In case of cancellation of export duty for re-exported imported goods stipulated in Article 34 of Decree 134/2016/ND-CP, the taxpayer shall send an official dispatch proposing cancellation of export and import duties via the System using Form 6 Appendix 2 issued together with Circular 06/2021/TT-BTC, or a paper copy using Form 14/TXNK Appendix 1 issued together with Circular 06/2021/TT-BTC: 01 original copy; documents stipulated in Article 34 of Decree 134/2016/ND-CP including:

++ Invoice of the exporter under the law on invoices for goods imported then exported to free trade zones: 01 photocopy certified by the proposing authority;

++ Commercial invoice under the export contract for imported goods that are subsequently exported abroad (except for exports into free trade zones, implemented according to point a.2.1 Clause 1 Article 13 of Circular 06/2021/TT-BTC: 01 photocopy certified by the proposing authority;

++ Commercial invoice under the import contract for goods that need to be re-exported to the foreign owner: 01 photocopy certified by the proposing authority; accompanied by an agreement to return the goods to the foreign party: 01 photocopy certified by the proposing authority;

++ Export contract for imported goods resold abroad or into free trade zones; entrusted export contract if it is in the form of entrusted export: 01 photocopy certified by the proposing authority;

++ Import contract for imported goods; entrusted import contract if it is in the form of entrusted import; payment proof for imported goods in cases where payment has been made: 01 photocopy certified by the proposing authority;

++ Notice from the postal enterprise or international express delivery service about the failed delivery: 01 photocopy certified by the proposing authority;

++ Confirmation document from the shipping service about the quantity and value of goods purchased from the key importing enterprise that have been properly supplied to foreign ships accompanied by a payment proof list from foreign shipping companies: 01 original;

- Explain and supplement information on time to the customs authority where the cancellation of export and import duties amount arises.

- Comply with the tax handling decisions of the customs authority according to the provisions of law on tax management.

(2). Responsibilities of the customs authority

- The customs authority where the cancellation of export and import duties amount arises shall receive and process the dossier through the System. In case of receiving a paper dossier, the customs authority shall stamp the date and enter it in the log.

- Within 03 working days from the date of receiving the application for cancellation of export and import duties, the customs authority shall inform the taxpayer about the acceptance of the dossier and the processing time for the proposed cancellation of export and import duties dossier through the System using Form 3 Appendix 2 issued together with Circular 06/2021/TT-BTC, in case of a paper dossier, inform using Form 04/TXNK Appendix 1 issued together with Circular 06/2021/TT-BTC.

In case explanations or supplements are needed, the customs authority shall inform the taxpayer through the System using Form 4 Appendix 2 issued together with Circular 06/2021/TT-BTC, in case of a paper dossier, inform using Form 05/TXNK Appendix I issued together with Circular 06/2021/TT-BTC.

- Procedure for cancellation of export and import duties:

+ In case the customs declaration for the first export-import of the re-imported or re-exported batch does not give rise to the proposed refundable tax amount and the taxpayer submits the cancellation of export and import duties dossier at the time of customs procedures:

The customs authority where the tax amount arises requested for cancellation of export and import duties shall verify the dossier and inspect the goods if there are sufficient grounds to determine that the re-imported goods are the same as the previously exported goods, and the re-exported goods are the same as the previously imported goods, shall issue a Decision for cancellation of export and import duties within the customs procedure time. The customs procedure time is stipulated in Article 23 of Customs Law 2014.

+ In case the customs declaration for the first export-import of the re-imported or re-exported batch gives rise to the proposed refundable tax amount:

++ In case the re-imported or re-exported goods are not processed through the same port as the first export-import:

The customs authority where the re-imported or re-exported customs declaration is registered shall issue a Decision for cancellation of export and import duties after the customs authority where the tax amount arises requested for refund has verified the eligibility for tax refund for the first export-import goods batch. The paid taxes for re-imported or re-exported goods shall be treated as overpaid taxes according to Article 10 of Circular 06/2021/TT-BTC.

++ In case the re-imported or re-exported goods are processed through the same port as the first export-import:

The customs authority where the re-imported or re-exported goods receive the procedure for cancellation of export and import duties after completing the tax refund procedures for the first export-import goods batch.

+ In case the customs declaration for the first export-import does not give rise to the proposed refundable tax amount but the taxpayer has paid taxes for the re-imported or re-exported customs declaration and submits the cancellation of export and import duties proposal dossier after the goods have been cleared:

++ The taxpayer submits the cancellation of export and import duties proposal dossier according to point a Clause 1 Article 13 of Circular 06/2021/TT-BTC.

++ The customs authority processes the cancellation of export and import duties for the re-imported or re-exported goods according to point a, point b Clause 2 Article 13 of Circular 06/2021/TT-BTC.

++ The paid taxes for re-imported or re-exported goods shall be treated as overpaid taxes according to Article 10 of Circular 06/2021/TT-BTC.

- Authority to issue the Decision for cancellation of export and import duties

The head of the Customs Department where the customs declaration for export-import results in the tax amount proposed for cancellation has the authority to issue the cancellation of export and import duties decision.

What are the cases where import and export duties are not collected in Vietnam?

According to Article 37 of Decree 134/2016/ND-CP, supplemented by Clause 19 Article 1 of Decree 18/2021/ND-CP, the cases where import and export duties are not collected in Vietnam include:

- Unpaid duties on goods that are eligible for duty refund prescribed in Articles 33, 34, 35, 36, 37 of Decree 134/2016/ND-CP shall be cancelled.

- Duties on goods that are exempt from export and import duties prescribed in Articles 33, 34 of Decree 134/2016/ND-CP shall be canceled.

- Are hazardous allowances subject to personal income tax in Vietnam?

- Shall the TIN be deactivated due to bankrupcy in Vietnam?

- What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

- Vietnam: Is tax liability imposed when failing to present accounting books?

- What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

- Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

- What is the guidance on first-time taxpayer registration for foreign subcontractors who directly declare and pay contractor tax in Vietnam?

- What are cases where a 10% PIT is withheld in Vietnam?

- How to submit the dependant registration application for persons with income from wages and salaries in Vietnam?

- What are guidelines for first-time taxpayer registration for dependants declared directly at the tax authority in Vietnam?