What is the latest PIT declaration authorization form in Vietnam in 2025? What are cases of PIT declaration authorization in Vietnam?

What is the latest PIT declaration authorization form in Vietnam in 2025?

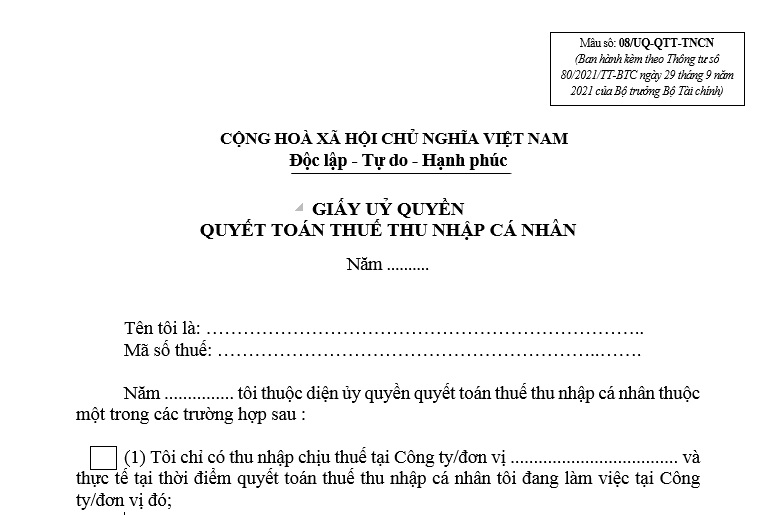

The latest Personal Income Tax (PIT) declaration authorization form for 2025 in use is Form No. 08/UQ-QTT-TNCN Appendix 2, issued in conjunction with Circular 80/2021/TT-BTC.

The latest PIT declaration authorization form for 2025 is as follows:

Download the latest PIT declaration authorization form for 2025...Download

What is the latest PIT declaration authorization form in Vietnam in 2025? (Image from the Internet)

What are cases of PIT declaration authorization in Vietnam?

According to the regulations at Section d.2 Point d Clause 6 Article 8 of Decree 126/2020/ND-CP and guided by the Tax Department of Soc Trang Province in Section 3 of Official Dispatch 154/CTSTR-KK...Download, individuals can authorize PIT finalization to organizations, individuals paying income in the following scenarios:

- Individuals with income from salaries, wages with employment contracts of 3 months or more at one place and actually working there at the time the income-paying organization or individual conducts PIT finalization, including cases where they haven't worked for a full 12 months in the calendar year. If individuals are employees transferred from the old organization to the new organization due to merger, consolidation, division, or change of enterprise type or if the old and new organizations are in the same system, the individuals can authorize PIT finalization to the new organization.

- Individuals with income from salaries, wages with employment contracts of 3 months or more at one place and actually working there at the time the income-paying organization or individual conducts PIT finalization, including cases where they haven't worked for a full 12 months in the calendar year; and have irregular income elsewhere averaging less than 10 million VND monthly for the year and have been subject to PIT withholding at a 10% rate if there's no PIT finalization request for this income portion.

Note: In case individuals with income from salaries, wages hold employment contracts of 3 months or more at one unit, and at the same time have irregular income not yet subject to tax withholding or insufficient tax withholding (including cases below taxation threshold and those reaching the threshold but not withheld), they cannot authorize organizations or individuals paying income to conduct PIT finalization on their behalf.

- Foreign individuals terminating their employment contracts in Vietnam without completing PIT finalization procedures with tax authorities must authorize the income-paying organization or another individual or organization for PIT finalization according to PIT regulations for individuals. If the income-paying organization or another individual or organization receives the authorization for finalization, they are responsible for any additional PIT payable or refund of overpaid tax for the individuals.

What does a PIT declaration authorization include?

Based on Article 43 of Tax Administration Law 2019 and Circular 80/2021/TT-BTC, which regulate the PIT finalization dossier, and in addition to Subsection 1 Section 4 of Official Dispatch 13762/CTHN-HKDCN in 2023 by Ha Noi Tax Department, which also provides guidance for PIT finalization as follows:

(1) For individuals finalizing PIT directly with tax authorities, the PIT finalization dossier includes:

- Personal Income Tax Finalization Declaration Form No. 02/QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Appendix of Family Circumstance Deduction Declaration for dependents Form No. 02-1/BK-QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Photocopies (photographs of originals) of certificates proving the tax withheld, temporarily paid for the year, tax paid overseas (if any). If the income-paying organization ceases operations and doesn't issue a tax deduction certificate to individuals, the tax authority will base on tax sector data to consider PIT finalization for individuals without requiring tax deduction certificates.

In cases where organizations or individuals paying income use electronic tax deduction certificates, the taxpayer uses a paper representation of the electronic tax deduction certificate (a paper version printed by the taxpayer converted from the original e-tax deduction certificate sent by the income-paying organization/individual).

- Photocopy of the Tax Deduction Certificate (clearly stating the tax declared on which income tax return) by the income-paying organization, or a Bank's document copy for tax paid overseas certified by the taxpayer in cases where, according to foreign law, the foreign tax authority doesn't issue a tax payment certificate.

- Photocopies of invoices and documents proving contributions to charitable, humanitarian, educational funds (if any).

- Documentation proving the amounts paid by foreign income-paying organizations in cases where individuals receive income from international organizations, embassies, consulates, and from abroad.

- Dependent registration documents as regulated in Point g, Clause 1, Article 9 of Circular 111/2013/TT-BTC as amended by Article 1 of Circular 79/2022/TT-BTC (if claiming deductions for dependents at the finalization time for dependents not yet registered).

(2) For organizations, individuals paying income, the PIT finalization dossier includes:

- Personal Income Tax Finalization Declaration Form No. 05/QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Appendix of detailed declaration for individuals calculating tax on a progressive basis Form No. 05-1/BK-QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Appendix of detailed declaration for individuals calculating tax on a flat rate Form No. 05-2/BK-QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Appendix of detailed declaration of dependents with family circumstance deduction Form No. 05-3/BK-QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

(3) In cases where individuals authorize the income-paying organization to finalize tax on their behalf, individuals must prepare a PIT declaration authorization form for the tax period 2024 according to Form No. 08/UQ-QTT-TNCN issued with Appendix 2 Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- How many parts does the format of e-invoices have? If individual businesses no longer use tax authority-ordered printed invoices in Vietnam, how long do they have to destroy them?

- Ministry of Finance of Vietnam guides early retirement policy under the Decree 178: What authority and responsibility does the Ministry of Finance of Vietnam have in fee and charge management in Vietnam?

- Can Tho City Tax Department provides guidance on the implementation of Decree 20 on related-party transactions

- Is it necessary to notify the supervisory tax authority when selecting a currency unit in accounting in Vietnam?

- When buying inventory in Vietnam, if the input VAT is deductible, which accounts should be recorded?

- What is the Form 01/XSBHDC on personal income tax declaration 2025 for multi-level marketing enterprises in Vietnam?

- How to download the advance payment slip form according to Circular 200? How to fill out the advance payment slip form in Vietnam?

- Is it mandatory to use a digital signature for e-tax transactions in Vietnam?

- Vietnam: Shall the TIN of the household business's representative be deactivated when the household business ceases operations?

- What is the guidance on looking up the 2025 PIT debts in Vietnam? Which agency has the authority to cancel tax debts in Vietnam?