What is the form of employment report in the last 6 months of 2024? Are bonuses for employees deductible expenses for CIT calculation in Vietnam?

Vietnam: What is the form of employment report in the last 6 months of 2024?

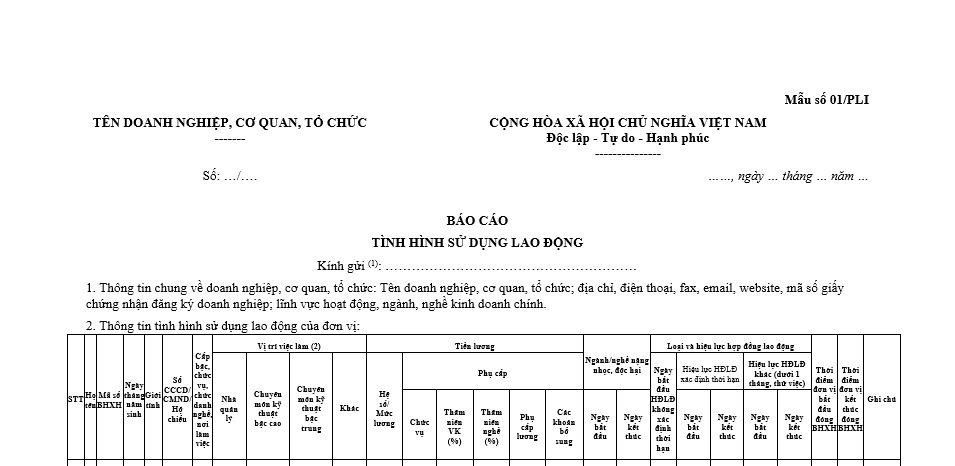

Pursuant to Appendix 1 issued together with Decree 145/2020/ND-CP, it is stipulated that the template for the report on employment use in the last 6 months of 2024 by enterprises, agencies, and organizations is Form No. 01/PLI.

The template is as follows:

Template for the Report on the Employment Situation in the Last 6 Months of 2024...Download

Vietnam: What is the form of employment report in the last 6 months of 2024? (Image from the Internet)

Are bonuses for employees deductible expenses for CIT calculation in Vietnam?

Pursuant to clause 2.6, article 2, Article 6 of Circular 78/2014/TT-BTC (amended by Article 4 of Circular 96/2015/TT-BTC and clause 2, article 3 of Circular 25/2018/TT-BTC) states the following:

Expenses Deductible and Non-deductible for Taxable Income Calculation

...

- Non-deductible expenses when determining taxable income include:

...

Salary, wages, and reward payments to employees in the following cases:

a) Payments accounted into business production costs but not actually disbursed or lacking documentation according to the law.

b) Reward payments without specific conditions and levels described in one of the following documents: Employment contract; Collective labor agreement; Financial regulations of the Company, Corporation, Group; Reward regulations by the Chairman of the Board of Directors, CEO, or Director as per the company's financial regulations.

- For contracts with foreign employees that include school fees for the employee's children in Vietnam from preschool to high school as wages and with full legal documentation, these are deductible expenses when calculating corporate income tax.

- For employment contracts mentioning housing costs paid by the company for the employee, with full legal documentation, these costs are deductible when calculating corporate income tax.

- In cases of agreements where Vietnamese companies cover lodging costs for foreign experts during their work in Vietnam, these costs paid by the Vietnamese company are deductible when calculating corporate income tax.

c) Salary, wages, and allowances pending payment to employees past the deadline for annual tax finalization, unless a separate wage reserve fund is established for the next fiscal year. The annual reserve level is decided by the company but should not exceed 17% of the implemented wage fund.

Implemented wage fund is the total wages actually paid during the tax finalization year up to the final submission date (excluding the previous year's wage reserve fund expenditure).

Wage reserve fund establishment must ensure no operational losses post-reserve formation, otherwise, the reserve should not fulfill 17%.

If after 6 months from the fiscal year's end the reserve is unused or only partially used, the company must adjust the following fiscal year's expenses accordingly.

Example 9: When filing the 2014 tax finalization, Company A set a wage reserve fund of 10 billion VND; by June 30, 2015 (for companies on the calendar year), only 7 billion VND was spent. Thus, Company A must reduce 3 billion VND from 2015 wage expenses.

d) Salaries of sole proprietorship owners, LLC owners (single-member owned by one individual); payments to founding members, board members not directly involved in operations.

...

Thus, reward payments for employees will be considered deductible for CIT purposes if they are specified in terms of conditions and entitlements in documents such as:

- Employment contracts;

- Collective labor agreements;

- Financial regulations of the Company, Corporation, Group;

- Reward regulations.

Additionally, if specified, the unit only needs a reward decision and payment voucher to validate the expense as reasonable for corporate income tax.

Furthermore, accounting and actual payments must be conducted within the fiscal year before corporate income tax finalization for inclusion in the financial year's records.

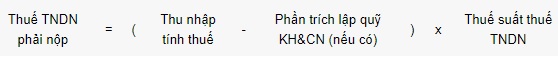

What is the formula for calculating Corporate Income Tax in Vietnam?

Based on clause 1, Article 3 of Circular 78/2014/TT-BTC (amended by Article 1 of Circular 96/2015/TT-BTC), the formula for calculating corporate income tax is as follows:

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?