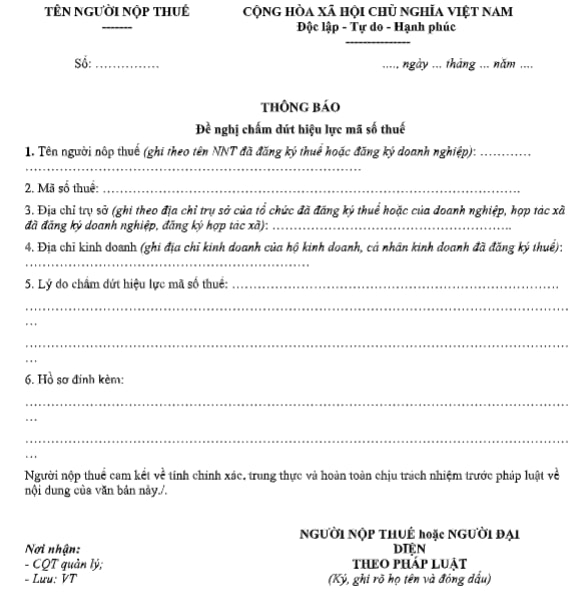

What is the Form No. 24/DK-TCT: Request for TIN deactivation form in Vietnam?

What is the Form No. 24/DK-TCT: Request for TIN deactivation form in Vietnam?

The request for TIN deactivation form is the form No. 24/DK-TCT issued along with Circular 105/2020/TT-BTC as prescribed in Article 38, Article 39 of the Law on Tax Administration 2019.

Download Form No. 24/DK-TCT - Request for TIN deactivation form: Here

What is the Form No. 24/DK-TCT request for TIN deactivation form in Vietnam? (Image from the Internet)

Application and procedures for TIN deactivation at the tax authority in Vietnam

(1) Application for TIN deactivation

In case an electronic transaction account has not been registered and a digital signature is not available, the taxpayer shall directly perform the procedures at the tax authority.

Pursuant to Article 14 of Circular 105/2020/TT-BTC stipulating the application for TIN deactivation for taxpayers directly registering with the tax authority:

(1) The request for TIN deactivation form is stipulated in form No. 24/DK-TCT issued along with Circular 105/2020/TT-BTC as prescribed in Article 38, Article 39 of the Law on Tax Administration 2019

(2) Other documents (if any):

- For business households; business individuals; business location of business households, business individuals as prescribed at point i Clause 2 Article 4 of Circular 105/2020/TT-BTC, the application is:

A copy of the decision to revoke the Business Household Registration Certificate (if any).

(2) Procedures:

Pursuant to Clause 6, Article 39; Clause 3, Article 41 of the Law on Tax Administration 2019 stipulating the deactivation of the validity of the TIN, the responsibility for handling the registration application of the taxpayer is as follows:

Step 1: The taxpayer directly registers with the tax authority and submits the application for deactivation of the TIN to the directly managing tax authority within 10 working days from the date of the document terminating the operation or business deactivation or contract deactivation date.

Step 2: The tax authority handles the registration application in accordance with the following regulations:

- In case the application is complete, a notice of acceptance of the application shall be issued and the time limit for processing the registration application is no later than 3 working days from the date of receipt of the complete application;

- In case the application is not complete, a notice shall be sent to the taxpayer no later than 2 working days from the date of receipt of the application.

Principles for TIN deactivation in Vietnam

Pursuant to Article 39 of the Law on Tax Administration 2019 stipulates as follows:

Deactivation of the validity of the TIN

1. A taxpayer registering concurrently with enterprise registration, cooperative registration, business registration shall deactivate the validity of the TIN when they fall into one of the following cases:

a) Deactivation of business activities or dissolution, bankruptcy;

b) Being revoked of the enterprise registration certificate, cooperative registration certificate, business registration certificate;

c) Being divided, merged, or consolidated.

2. A taxpayer directly registering with the tax authority shall deactivate the validity of the TIN when they fall into one of the following cases:

a) Deactivation of business activities, no longer incurring tax obligations for non-business organizations;

b) Being revoked of the business registration certificate or equivalent license;

c) Being divided, merged, or consolidated;

d) Being notified by the tax authority that the taxpayer is not operating at the registered address;

dd) An individual dies, is missing, or loses civil act capacity as prescribed by law;

e) Foreign contractor upon the conclusion of the contract;

g) Contractor, investor participating in oil and gas contracts upon the conclusion of the contract or transferring all rights to participate in the oil and gas contract.

3. Principles for the deactivation of the validity of the TIN are as follows:

a) The TIN shall not be used in economic transactions from the date the tax authority announces the deactivation of its validity;

b) The TIN of an organization once deactivated cannot be reused, except as stipulated in Article 40 of this Law;

c) The TIN of a business household, business individual upon deactivation is not deactivated for the representative of the business household and is used to fulfill other tax obligations of that individual;

d) Upon deactivation of the TIN of an enterprise, economic organization, other organization, or individual, the substituted TIN shall also be deactivated;

dd) When the managing unit’s TIN is deactivated, so must its dependent units’ TINs be deactivated.

The taxpayer TIN deactivation must ensure the following 5 principles:

- The TIN shall not be used in economic transactions from the date the tax authority announces the deactivation of its validity;

- The TIN of an organization once deactivated cannot be reused, except as stipulated in Article 40 of the Law on Tax Administration 2019;

- The TIN of a business household, business individual upon deactivation is not deactivated for the representative of the business household and is used to fulfill other tax obligations of that individual;

- Upon deactivation of the TIN of an enterprise, economic organization, other organization, or individual, the substituted TIN shall also be deactivated;

- When the managing unit’s TIN is deactivated, so must its dependent units’ TINs be deactivated.

- What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80?

- Vietnam: What does the supplementary personal income tax declaration dossier include?

- What are the educational requirements for tax agent employees in Vietnam?

- Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam?

- Which income of a Vietnamese non-resident is subject to personal income tax?

- What is the Form for declaring a 20% reduction in the VAT rate in Vietnam according to Decree 72?

- What are 3 types of tax explanation form for accountants in Vietnam? What is the penalty for late submission of VAT return in November 2024?

- Vietnam: Compilation of all Appendix 2 forms of Circular 80/2021/TT-BTC

- When is the timing for determining overpaid tax for offsetting or refunding in Vietnam?

- What are VAT calculation methods in Vietnam?