Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam?

Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam?

Based on Article 8 of Decree 126/2020/ND-CP, the regulations are as follows:

Taxes Declared Monthly, Quarterly, Annually, Separately, And Tax Finalization

1. Taxes and other state budget collections managed by the tax authority declared monthly include:

a) Value-added tax, personal income tax. Taxpayers meeting criteria under Article 9 of this Decree may opt for quarterly filing.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, excluding resource tax specified at point e of this clause.

đ) State budget fees and charges (excluding fees and charges collected by the Socialist Republic of Vietnam's diplomatic missions abroad, as stipulated in Article 12 of this Decree; customs fees; fees on transiting goods, luggage, and transport vehicles).

e) For the exploitation and sale of natural gas: Resource tax; corporate income tax; specific tax for the Vietnam-Russia Joint Venture “Vietsovpetro” at Block 09.1 under the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the Russian Federation signed on December 27, 2010, regarding continued cooperation in geological exploration and petroleum extraction on the continental shelf of the Socialist Republic of Vietnam within the framework of the Vietnam-Russia Joint Venture “Vietsovpetro” (hereinafter referred to as Vietsovpetro Joint Venture at Block 09.1); profits shared with the host country.

2. Taxes and other state budget collections declared quarterly include:

a) Corporate income tax for foreign airlines, foreign reinsurance.

b) Value-added tax, corporate income tax, personal income tax for credit institutions or third parties authorized by the credit institution to exploit collaterals on behalf of the taxpayers with collaterals.

...

Therefore, tax declaration for the exploitation of collaterals during the pending processing period is conducted quarterly.

Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam? (Image from the Internet)

When to submit tax declaration dossiers for use of collateral pending settlement in Vietnam?

Based on Article 44 of the Tax Administration Law 2019, the provisions are as follows:

Deadline for Submitting Tax Declaration Dossiers

1. The deadline for submitting tax declaration dossiers for taxes declared monthly or quarterly is specified as follows:

a) No later than the 20th day of the following month if declared and paid monthly;

b) No later than the last day of the first month of the subsequent quarter for quarterly declarations.

2. The deadline for submitting tax declaration dossiers for taxes calculated annually is specified as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month from the end of the calendar year for personal income tax finalization dossiers of individuals directly finalizing tax;

c) No later than December 15 of the preceding year for presumptive tax declaration dossiers of business households, individuals paying presumptive tax; for new business households, individuals, the deadline is no later than 10 days from the business start date.

3. The deadline for submitting tax declaration dossiers for taxes declared and paid per obligation occurrence is no later than the 10th day from the tax obligation occurrence date.

4. The deadline for submitting tax declaration dossiers for cessation of activities, contract termination, or business reorganization is no later than the 45th day from the event occurrence date.

5. The Government regulates the deadline for submitting tax declaration dossiers for agricultural land use tax; non-agricultural land use tax; land levy; land rental, water surface rental; mineral exploitation rights fee; water resource exploitation rights fee; registration fee; license fee; collections into the state budget per regulations on management and use of public assets; international profit reports.

6. The deadline for submitting tax declaration dossiers for import and export goods follows the Customs Law.

7. In case taxpayers declare taxes electronically on the last day of the tax declaration submission period and the tax portal encounters technical issues, taxpayers submit electronic tax declaration dossiers and payment documents on the next day after the tax portal resumes operation.

Therefore, the deadline for submitting tax declaration dossiers for use of collateral pending settlement is no later than the last day of the first month of the subsequent quarter after the tax obligation arises.

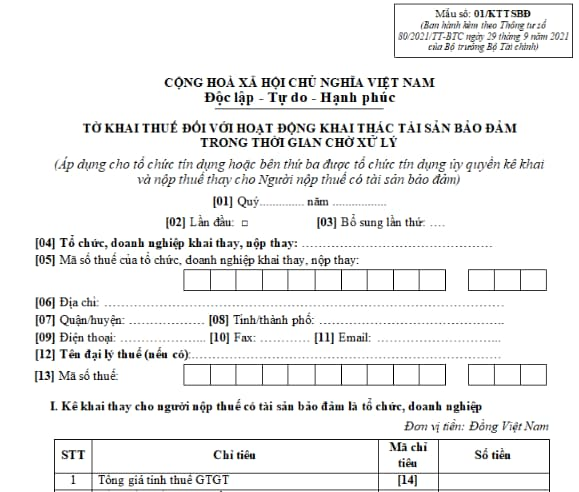

Which form is the tax declaration form for use of collateral pending settlement in Vietnam?

The Tax Declaration Form for use of collateral pending settlement is form number 01/KTTSBD as stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC, in the following format:

Download Form 01/KTTSBD Tax Declaration for use of collateral pending settlement: Here.