What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80?

What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80?

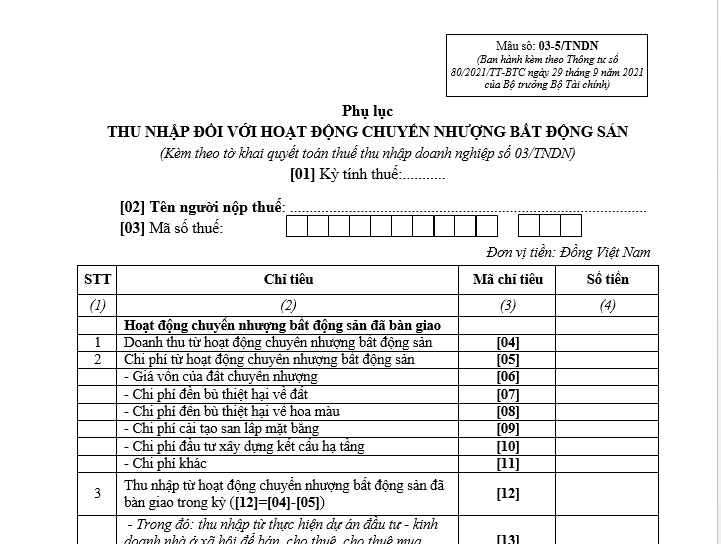

The Form for corporate income tax for real estate transfer is Form No. 03-5/TNDN Appendix 2 issued together with Circular 80/2021/TT-BTC.

Form No. 03-5/TNDN for corporate income tax for real estate transfer is formatted as follows:

The latest corporate income tax for real estate transfer...Download

What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80? (Image from the Internet)

What income from real estate transfer is subject to corporate income tax in Vietnam?

Based on Article 16 of Circular 78/2014/TT-BTC regulating the subjects liable for corporate income tax from real estate transfer as follows:

- Enterprises subject to income tax from real estate transfers include:

+ Enterprises of all economic components and industries that have income from real estate transfer;

+ Real estate businesses having income from land subleasing activities.

- Income from real estate transfer includes:

+ Income from transferring land use rights or land lease rights (including the transfer of projects associated with the transfer of land use rights or lease rights in accordance with the law);

+ Income from land subleasing activities of real estate businesses in accordance with the land law regardless of whether there is infrastructure or architectural works attached to the land;

+ Income from transferring houses, construction projects attached to land, including assets attached to those houses or constructions if the value of the asset is not separated when transferring regardless of whether there is a transfer of land use rights or lease rights;

+ Income from transferring assets attached to the land;

+ Income from transferring ownership or usage rights of housing.

- Income from land subleasing in real estate businesses does not include cases where the business only leases houses, infrastructure, or architectural works on the land.

What are regulations on real estate transfer expenses in Vietnam?

Pursuant to point b, clause 1, Article 17 of Circular 78/2014/TT-BTC regarding real estate transfer expenses. Specifically:

(1) Principles for determining expenses:

- Deductible expenses to determine taxable income from real estate transfer for the tax period must correspond to revenue calculated for taxable income and must meet the conditions of deductible expenses and not fall into non-deductible expenses as prescribed in Article 6 of this Circular.

- If the investment project is completed in stages and transferred gradually according to the completion progress, the general expenses for the project and direct expenses for the completed part of the project are allocated according to the square meter of the transferred land to determine taxable income for the transferred land area; these include expenses for internal roads, parks, water supply and drainage systems, electrical substations, compensation expenses for property on the land; Compensation, support, resettlement expenses, and implementation expenses for site clearance compensation approved by the competent authority that have not yet been deducted from the land levy, land rent; land levy, rent to be paid to the State budget, and other expenses related to land use or lease rights transfer.

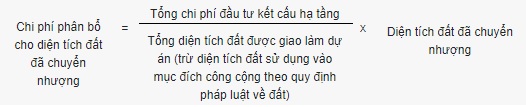

- The allocation of the above expenses is performed using the following formula:

If a part of the project area is not transferred and used for other business activities, the above-mentioned general expenses are also allocated to this area for monitoring, accounting, declaration, and payment of corporate income tax for other business activities.

If the enterprise engages in infrastructure construction investment activities over several years and only settles the value of infrastructure when all work is completed, the enterprise is allowed to temporarily allocate actual incurred infrastructure investment expenses according to the proportion of the transferred land area using the formula mentioned above and to accrue for the construction expenses of infrastructure corresponding to the recorded revenue when determining taxable income. After completing the construction investment process, the enterprise recalculates and adjusts the infrastructure investment cost that has been temporarily allocated and accrued for the transferred area according to the total infrastructure value. In the event of a tax overpayment compared to the taxable income from real estate transfer, the enterprise may deduct the overpaid tax from the tax payable for the next tax period or be refunded according to current regulations; if the paid tax is insufficient, the enterprise must fully pay the outstanding tax according to regulations.

(2) Deductible real estate transfer expenses include:

- The land transfer cost is determined according to the origin of the land use rights. Specifically:

+ For land granted by the State with land levy, lease payment, the cost is the actual land levy or lease payment paid to the State budget;

+ For land acquired from other organizations or individuals, it is based on the contract and legal payment documents upon receiving the land use or lease rights;

If there is no contract and legal payment document, the cost is calculated according to the price set by the People's Committee of the province or centrally-run city at the time the enterprise receives the real estate transfer.

+ For land originating from capital contribution, the cost is the value of land use or lease rights according to the asset valuation record when contributing capital;

+ In case the enterprise exchanges a project for land from the State, the cost is determined according to the value of the exchanged project, except for cases following specific regulations by competent state authorities.

+ The auction price in case of auctioning land use or lease rights;

+ For enterprise land originating from inheritance under civil law; or received as a gift, donation without determining the cost, the price is determined based on the types of land prices set by the People's Committee of the province or centrally-run city based on the Land Price Frame by the Government of Vietnam at the time of inheritance, gift, or donation.

If enterprise land was inherited, gifted, or donated before 1994, the cost is determined based on the types of land prices set by the People's Committee of the province or centrally-run city in 1994 based on the Land Price Frame according to Decree No. 87/CP dated August 17, 1994 of the Government of Vietnam.

+ For land mortgaged as a loan guarantee, land being auctioned to enforce court judgments, the transfer cost is determined according to each specific case guided by the points mentioned above.

- Compensation expenses for land damage.

- Compensation expenses for crop damage.

- Compensation, support, resettlement expenses, and the expenses to organize compensation, support, resettlement according to the law.

These compensation, reimbursement, support, resettlement expenses, and organization expenses are listed in a detailed record if invoices are unavailable, including: the name, address of the recipient; the amount of compensation, support; signature of the recipient, and are verified by the ward, commune authority where the land is compensated or supported following legal regulations on compensation, support, and resettlement when the State recovers land.

- Various fees and charges as prescribed by law related to land use rights.

- expenses for land improvement and site leveling.

- Infrastructure construction investment expenses such as roads, electricity, water supply, wastewater drainage, telecommunications...

- The value of infrastructure and architectural works on the land.

- Other incurred expenses related to the transferred real estate.

If an enterprise operates in multiple industries, it must separately account for the expenses. If expenses cannot be separately accounted for each activity, general expenses are allocated according to the ratio of real estate transfer revenue to the enterprise's total revenue.

Non-deductible expenses include those already paid by the State or financed by other capital sources.