What are 3 types of tax explanation form for accountants in Vietnam? What is the penalty for late submission of VAT return in November 2024?

What are 3 types of tax explanation form for accountants in Vietnam?

Below are 3 types of tax explanation form as follows:

Note: The 3 samples below are for reference only

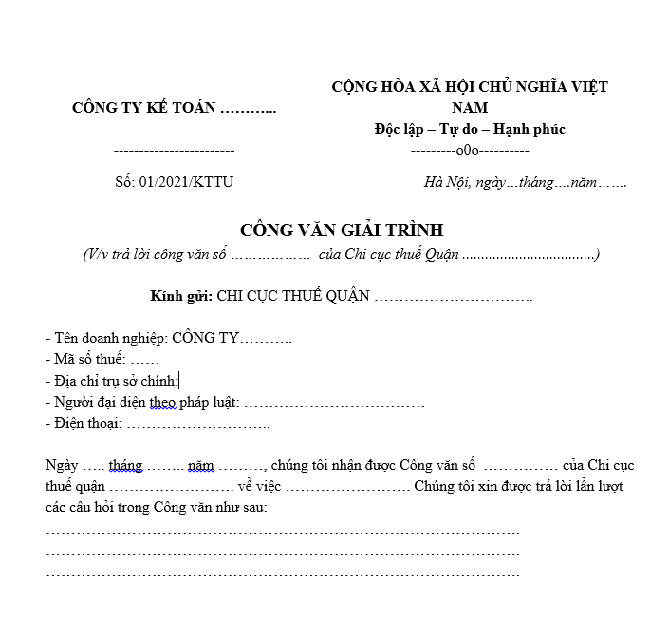

Sample No. 1.....download

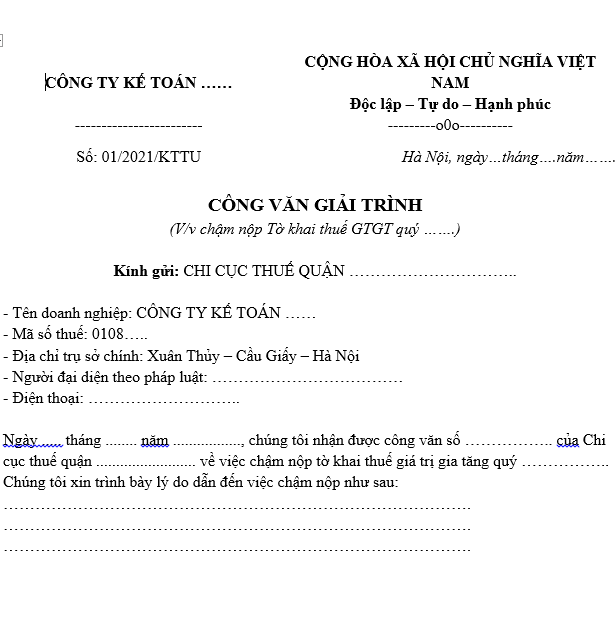

Sample No. 2...download

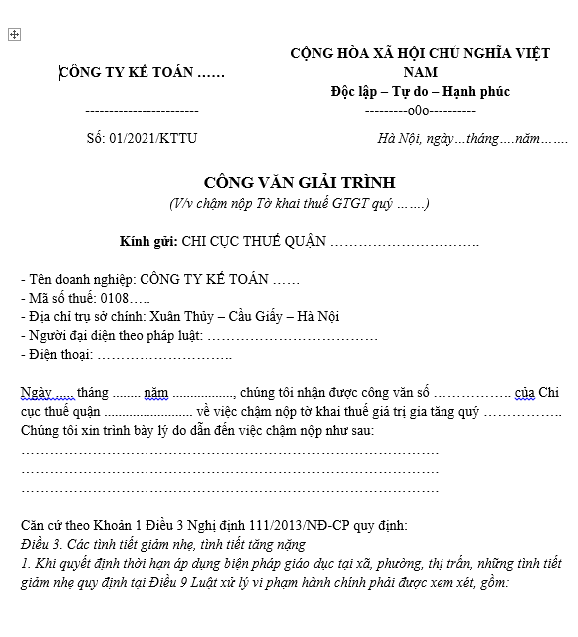

Sample No. 3....download

When shall a tax or invoice explanation form be submitted in Vietnam?

Based on Clause 1, Article 37 of Decree 125/2020/ND-CP stipulating cases where businesses must send a tax or invoice administrative violation explanation form, which includes:

- Administrative violations about tax and invoices being detected through tax inspections, audits, or electronic administrative violation recordings;

- Administrative violations stipulated at Articles 16, 17, 18; Clause 3, Article 20; Clause 7, Article 21; Articles 22 and 28 of Decree 125/2020/ND-CP, specifically including:

+ Acts of incorrect declaration leading to a shortfall in payable tax or increase in the exempt, reduced, or refundable tax amount;

+ Acts of tax evasion;

+ Administrative violations on tax concerning commercial banks or guarantors paying taxes;

+ Acts of printing/ordering to print invoices following the invoice form already issued by other entities or individuals, or ordering duplicate invoice numbers of the same invoice symbol.

+ Acts of giving or selling invoices;

+ Acts of illegitimately using invoices or illegitimate use of invoices.

What are 3 types of tax explanation form for accountants in Vietnam? What is the penalty for late submission of VAT return in November 2024? (Image from the Internet)

What is the penalty for late submission of VAT return in Vietnam in November 2024?

According to Article 13 of Decree 125/2020/ND-CP stipulating penalties for violations related to the deadline for submitting tax return dossiers as follows:

- A warning is issued for acts of late submission of tax return dossiers from 01 to 05 days with mitigating circumstances.

- A fine ranging from 2,000,000 VND to 5,000,000 VND for late submission of tax return dossiers from 01 to 30 days, except for cases stipulated in Clause 1 of this Article.

- A fine ranging from 5,000,000 VND to 8,000,000 VND for late submission of tax return dossiers from 31 to 60 days.

- A fine ranging from 8,000,000 VND to 15,000,000 VND for any of the following acts:

- Late submission of tax return dossiers from 61 to 90 days;

- Late submission from 91 days onward but without any payable tax arising;

- Non-submission of tax return dossiers but without any payable tax arising;

- Non-submission of annexes according to tax management regulations for enterprises with related transactions along with the corporate income tax settlement dossier.

- A fine ranging from 15,000,000 VND to 25,000,000 VND for late submission of tax return dossiers over 90 days from the deadline with a payable tax amount arising, and the taxpayer has already fully paid the payable tax and late payment interest to the state budget before the tax authority announces the decision on tax inspection or before the tax authority records the late submission of tax return dossiers according to Clause 11, Article 143 of the Law on Tax Administration.

Note: For the same administrative violation related to tax and invoices, the fine for organizations is double the fine for individuals.