What is the Form 08/CK-TNCN Declaration of commitment to non-arising of personal income tax in Vietnam?

What is the Form 08/CK-TNCN Declaration of commitment to non-arising of personal income tax in Vietnam?

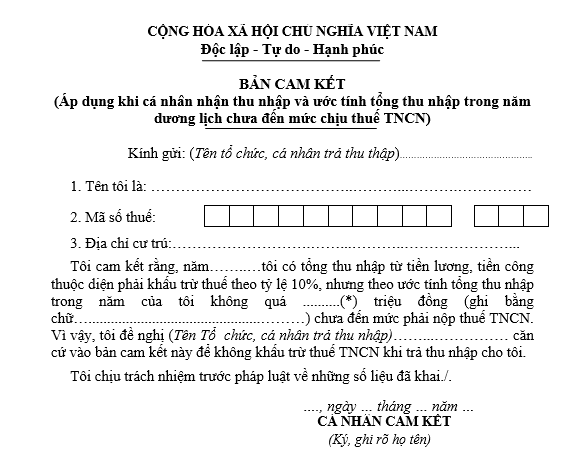

Form 08/CK-TNCN is a form issued along with Circular 80/2021/TT-BTC.

>> Download Download Form 08/CK-TNCN Declaration of Commitment to Non-Arising of Personal Income Tax

What is the Form 08/CK-TNCN Declaration of commitment to non-arising of personal income tax in Vietnam? (Image from Internet)

Who are personal income taxpayers in Vietnam?

According to Article 2 of the Law on Personal Income Tax 2007, taxpayers include:

- Personal income taxpayers are residents with taxable income as stipulated in Article 3 of the Law on Personal Income Tax 2007 arising inside and outside the territory of Vietnam, and non-residents with taxable income as stipulated in Article 3 of the Law on Personal Income Tax 2007 arising inside the territory of Vietnam.

- A resident is an individual who meets one of the following conditions:

+ Being present in Vietnam for 183 days or more within a calendar year or 12 consecutive months from the first day of presence in Vietnam;

+ Having a regular place of residence in Vietnam, including a registered permanent residence or a rented house in Vietnam under a term lease.

- A non-resident is an individual who does not meet the conditions stipulated in Clause 2, Article 2 of the Law on Personal Income Tax 2007.

What is the current personal exemption in Vietnam?

According to Article 19 of the Law on Personal Income Tax 2007 (amended and supplemented by Article 1 of Resolution 954/2020/UBTVQH14) as follows:

Personal exemption

1. The deduction for taxpayers is VND 11 million/month (VND 132 million/year);

2. The deduction for each dependent is VND 4.4 million/month.

2. The determination of the personal exemption for dependents shall be done according to the principle that each dependent is only accounted for one time reduction for one taxpayer.

3. Dependents are individuals whom the taxpayer is responsible for supporting, including:

a) Minor children; children with disabilities, unable to work;

b) Individuals without any income or with an income not exceeding the specified level, including adult children who are studying at university, college, secondary vocational school or vocational training; spouse without working ability; parents beyond working age or without working ability; others who are not able to live on their own whom the taxpayer must directly support.

the Government of Vietnam stipulates the income levels and declarations to determine the dependents eligible for the personal exemption.

Thus, currently, the deduction for taxpayers is VND 11 million/month (VND 132 million/year).

The deduction for each dependent is VND 4.4 million/month.

Vietnam: If there is no personal income tax to be incurred, is a declaration of commitment to non-arising of personal income tax needed?

According to Section 2 of Official Dispatch 2393/TCT-DNNCN in 2021 of the General Department of Taxation, the instructions are as follows:

Regarding the personal income tax declaration of organizations and individuals that do not arise taxable income payments

- At Clause 6, Article 1 of the Law amending and supplementing some articles of the Personal Income Tax Law dated November 22, 2012, it is stipulated:

“6. Article 24 is amended and supplemented as follows:

“Article 24. Responsibilities of organizations, individuals paying income, and responsibilities of individual taxpayers who are residents

1. The responsibilities for declaration, deduction, payment, and finalization of tax are stipulated as follows:

a) Organizations and individuals paying income are responsible for declaring, deducting, paying tax into the state budget, and finalizing tax for taxable income paid to taxpayers;

…”

- At Point 9.9, Clause 9, Appendix I - List of tax declaration dossiers issued along with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam, it is stipulated:

“9.9. Tax declaration dossier of organizations, individuals paying income and deducting tax on salaries and wages

a) Monthly, quarterly tax declaration dossiers

Personal income tax declaration (applicable to organizations, individuals paying income from salaries and wages) Form No. 05/KK-TNCN.”

Based on the above regulations, only cases where organizations and individuals arise in payment of taxable personal income are subject to personal income tax declarations. Therefore, if organizations and individuals do not arise in payment of taxable personal income, they are not subject to the adjustment of the Personal Income Tax Law. Organizations and individuals that do not arise in payment of taxable personal income in any month/quarter are not required to declare personal income tax for that month/quarter.

In cases where organizations and individuals do not arise in payment of taxable personal income, they are not subject to the adjustment of the Law on Personal Income Tax 2007.

Therefore, in any month/quarter where there is no payment of taxable personal income, individuals and organizations will not have to declare personal income tax for that month/quarter, equivalent to not needing to submit a declaration of commitment to non-arising of personal income tax.