What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam?

Coefficient K is a parameter or threshold limit used to manage risks associated with invoicing. It is determined by the ratio of the total value of goods sold to the total value of inventory and purchased goods.

According to Official Dispatch 2392/TCT-QLRR of 2023 from the General Department of Taxation regarding the inspection of electronic invoices, the General Department of Taxation has developed functionalities in the electronic invoicing application to control electronic invoices and prevent fake invoicing.

Key functionalities include:

- The system automatically monitors the total value of goods sold on issued invoices compared to the threshold, calculated as K times the total value of inventory and purchased goods.

- The system provides warnings based on the K parameter.

Thus, Coefficient K is understood as a parameter or threshold used to check invoicing beyond a safety threshold. It is based on the ratio of the total value of goods sold on invoices to the total value of inventory and purchased goods.

If the taxpayer exceeds this threshold, a warning will be issued, and they will be placed on the "List of Taxpayers Subject to Invoice Monitoring Beyond Safety Threshold."

What is the explanation form for tax coefficient K in Vietnam?

Currently, there is no specific regulation on the template for an explanation official dispatch for Tax Coefficient K. However, one can refer to a sample template as follows:

Template for an explanation official dispatch for Tax Coefficient K...Download

What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam? (Image from the Internet)

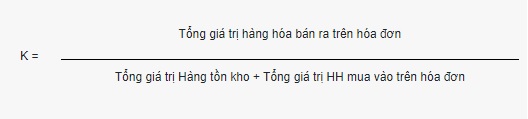

What is the formula for calculating coefficient K in Vietnam?

According to Official Dispatch 2392/TCT-QLRR of 2023, Coefficient K is used to control the total value of goods sold on issued invoices relative to the input threshold, calculated using the following formula:

When a business exceeds the input threshold value calculated as K times the total value of inventory and purchased goods, the system will issue an invoice warning and put it on the management list.

What is the administrative penalty for using illegal invoices in Vietnam?

According to Article 28 Decree 125/2020/ND-CP, the administrative penalty for using illegal invoices is specified as follows:

Penalty for Using Illegal Invoices, Illegally Using Invoices

- A fine ranging from VND 20,000,000 to VND 50,000,000 shall be imposed on the act of using illegal invoices, as specified in Article 4 of this Decree, except in cases specified at point e, clause 1, Article 16, and point d, clause 1, Article 17 of this Decree.

- Remedial measures: Cancellation of used invoices.

Additionally, according to clause 4, Article 7 of Decree 125/2020/ND-CP specifies:

Forms of Penalties, Remedial Measures, and Principles for Applying Fine Levels for Violations in Tax and Invoice Administration

...

- Principles for applying fine levels

a) The fine level specified in Articles 10, 11, 12, 13, 14, 15, clauses 1, 2 of Article 19, and Chapter III of this Decree applies to organizations.

For individual taxpayers such as households and business households, the fine level shall apply as for individuals.

...

And also according to clause 5, Article 5 of Decree 125/2020/ND-CP which stipulates:

Principles for Administrative Penalties in Tax and Invoice Matters

...

- For the same administrative violation regarding tax and invoices, the fine level for organizations is twice the level for individuals, except for violations specified in Articles 16, 17, and 18 of this Decree.

Thus, according to regulations, organizations using illegal invoices may face administrative penalties ranging from VND 20,000,000 to VND 50,000,000.

For individuals committing such violations, the administrative penalty may range from VND 10,000,000 to VND 25,000,000.

Note: The administrative penalty for using illegal invoices as stated above does not apply in the following cases:

- Using illegal invoices to account for the value of purchased goods and services, reducing tax payable or increasing tax refunds, tax exemptions or reductions, but when the tax authority audits or inspects and the buyer proves the illegal use of invoices is due to the seller's fault, and the buyer has fully accounted as per regulations.

- Using illegal invoices to declare taxes to reduce tax payable or increase tax refunds, tax exemptions, or reductions.