What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

Form 01/CT-KTT is a document form used for amendments to the information of tax accounting books, which is issued along with Circular 111/2021/TT-BTC.

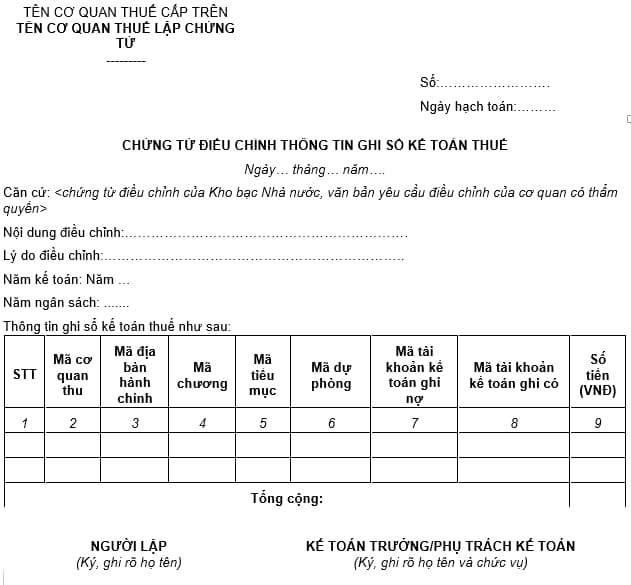

The Form 01/CT-KTT for amendments to the information of tax accounting books is formatted as follows:

Download Form 01/CT-KTT here.

Form 01/CT-KTT for amendments to the information of tax accounting books is prepared by the Tax Accounting Department to record tax accounting bookss when it is necessary to adjust figures in tax accounting reports to comply with government budget accounting information of the State Treasury, as prescribed or requested by competent authorities, or due to errors or omissions identified by tax authorities and approved by the General Department of Taxation for adjustment in the tax accounting books.

What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam? (Image from the Internet)

What are guidelines for writing the application for amendments to the information of tax accounting books in Vietnam?

Based on Section III Appendix II issued together with Circular 111/2021/TT-BTC, the guidelines for writing Form 01/CT-KTT for amendments to the information of tax accounting books are as follows:

(1) General Information:

- Number: Record the document number prepared by the accounting department, generated by the Tax Accounting Subsystem when creating the document in the application.

- Date of entry: Determined according to the provisions in Clause 2, Article 8 Circular 111/2021/TT-BTC.

- Date...Month...Year...: Record the date, month, and year the tax accounting document was prepared.

- Basis: Clearly state the number and date of the State Treasury's adjustment document or the document from the competent authority.

- Content, reason for adjustment: Record the content and reason for adjustment according to the adjustment document from the State Treasury or the document from the competent authority or the approval from the General Department of Taxation.

- Accounting year: Record the year in which the error occurred that needs amendments to the information of, only recorded in cases where accounting errors from previous years need amendments to the information of this year and need to be reported in the accounting reports of the adjusted year.

- Budget year: Only record in cases where accounting errors from previous years need amendments to the information of this year, and need to be reported in this year's tax accounting report with the value “01”.

(2) Adjustment Information:

Column 1: Serial number.

Columns 2,3,4,5,6,7: Tax authority code, administrative area code, program code, sub-item code, debit account code, credit account code of the adjustment item.

Column 8: Corresponding amount according to the tax authority code, administrative area code, program code, sub-item code, debit account code, credit account code of the adjustment item.

Note: The accounting document for tax recording is prepared by the Tax Accounting Department in the system, and the Chief Accountant/Accounting Supervisor for tax signs the document, clearly stating the adjustment basis and authorized adjustment documents attached.

When are tax accounting documents prepared in Vietnam?

According to Clause 2, Article 16 of Circular 111/2021/TT-BTC, the cases for creating tax accounting documents are regulated as follows:

Tax Accounting Documents

- Tax accounting documents must be implemented according to the correct content, method of preparation, and document signing as prescribed by the Law on Accounting, and must contain all information as guided in Clause 2, Article 12 of this Circular. Tax accounting documents reflect information on amounts receivable, received, remaining receivables, reimbursed, remaining reimbursements, exempted, reduced, suspended debts, or canceled debts established in certain cases as prescribed in Clause 2 of this Article.

2. Cases of Preparing Tax Accounting Documents

a) When the tax authority needs to adjust the state budget revenue data as requested by the State Treasury or competent authority, where the adjustment information only affects tax accounting report data and does not change taxpayer obligations in the Taxpayer Obligation Management Subsystem.

b) When policy changes lead to adjustments in tax accounting report data without changing taxpayer obligations.

- List of Tax Accounting Documents

The list, forms, and methods for preparing tax accounting documents are specified in Appendix II issued with this Circular.

Thus, tax accounting documents are prepared in the following cases:

- When the tax authority needs to adjust the state budget revenue data as requested by the State Treasury or competent authority, where the adjustment information only affects tax accounting report data and does not change taxpayer obligations in the Taxpayer Obligation Management Subsystem.

- When policy changes lead to adjustments in tax accounting report data without changing taxpayer obligations.