What is the Form 06/TB-TDT on notification reminding submission of the tax declaration dossier in Vietnam?

What is the Form 06/TB-TDT on notification reminding submission of the tax declaration dossier in Vietnam?

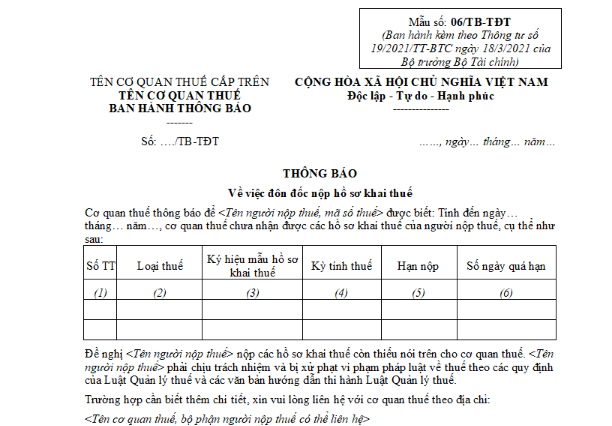

Based on the list of forms issued with Circular 19/2021/TT-BTC, the notification reminding submission of the tax declaration dossier will be Form 06/TB-TDT as follows:

>>> Download Form 06/TB-TDT - Latest notification reminding submission of the tax declaration dossier.

What is the Form 06/TB-TDT on notification reminding submission of the tax declaration dossier in Vietnam? (Image from the Internet)

When does the tax authority in Vietnam send notifications reminding submission of the tax declaration dossier?

Based on Clause 1, Article 19 of Circular 19/2021/TT-BTC the regulation is as follows:

Notification of failure to submit a tax declaration dossier

1. The tax authority shall send a notification reminding submission of the tax declaration dossier (according to Form 06/TB-TDT issued with this Circular) to the taxpayer as stipulated in Clause 2, Article 5 of this Circular within 5 (five) working days from the deadline for tax declaration submission, the extended deadline for tax declaration submission, or the deadline for providing explanations or supplementary documents according to the tax authority's notification, if the taxpayer has not submitted the tax declaration or not provided explanations or supplementary documents as required.

2. After 10 (ten) working days from the deadline for tax declaration submission, the extended deadline for tax declaration submission, or the deadline for providing explanations or supplementary documents according to the tax authority's notification, if the taxpayer has not submitted the tax declaration, the tax authority shall send a second notification reminding submission of the tax declaration dossier (according to Form 06/TB-TDT issued with this Circular) to the taxpayer as stipulated in Clause 2, Article 5 of this Circular. Simultaneously, the tax authority shall send the notification reminding submission of the tax declaration dossier to the taxpayer via postal service to the registered main office address or tax notification address provided by the taxpayer.

3. After 5 (five) working days from the time the General Department of Taxation's e-portal sends the second notification reminding submission of the tax declaration dossier (according to Form 06/TB-TDT issued with this Circular), if the taxpayer still fails to submit the tax declaration, the tax authority shall verify the taxpayer's operational status at the address registered with the business registration authority or tax authority to implement tax management regulations.

Thus, according to the above regulation, the tax authority sends the notification reminding submission of the tax declaration dossier within 5 (five) working days.

What are 5 methods of e-tax transactions in Vietnam?

Based on Clause 2, Article 4 of Circular 19/2021/TT-BTC regulating principles for e-tax transactions as follows:

Principles for e-tax transactions

2. Taxpayers can choose the following methods to conduct e-tax transactions through:

a) The General Department of Taxation's e-portal.

b) The national public service portal, the Ministry of Finance’s e-portal connected with the General Department of Taxation's e-portal.

c) The e-portal of other competent state agencies (excluding point b of this Clause) connected with the General Department of Taxation's e-portal.

d) T-VAN services provided by organizations approved by the General Department of Taxation to connect with the General Department of Taxation's e-portal.

đ) e-payment services of banks or intermediary payment service providers to conduct e-tax payments.

3. Registering to use an e-tax transaction method

a) Taxpayers conducting e-tax transactions through the General Department of Taxation's e-portal shall register for e-tax transactions as stipulated in Article 10 of this Circular.

b) Taxpayers conducting e-tax transactions through the national public service portal, the Ministry of Finance’s e-portal connected with the General Department of Taxation's e-portal shall register according to the guidelines of the system's managing agency.

c) Taxpayers conducting e-tax transactions through the e-portal of other competent state agencies connected with the General Department of Taxation's e-portal shall register according to the guidelines of the competent state agency.

d) Taxpayers conducting e-tax transactions through T-VAN service providers approved by the General Department of Taxation to connect with the General Department of Taxation's e-portal shall register for e-tax transactions as stipulated in Article 42 of this Circular.

During the same period, taxpayers may only choose to register and conduct one of the administrative tax procedures specified at point a, Clause 1, Article 1 of this Circular through the General Department of Taxation's e-portal, the national public service portal, the Ministry of Finance’s e-portal, or a T-VAN service provider (excluding cases mentioned in Article 9 of this Circular).

đ) Taxpayers choosing to make e-tax payments through the e-payment services of banks or intermediary payment service providers shall register according to the guidelines of the banks or intermediary payment service providers.

e) Taxpayers who have registered e-transactions with the tax authority must conduct transactions with the tax authority by e-means as stipulated at Clause 1, Article 1 of this Circular, except for cases specified in Article 9 of this Circular.

4. Changing the use of the e-tax transaction method

a) Taxpayers who registered to use the e-tax transaction method as stipulated at point b, Clause 3 of this Article can conduct e-tax transactions as stipulated at point a, Clause 2 of this Article without having to register as stipulated at point a, Clause 3 of this Article.

b) Taxpayers who registered to use the e-tax transaction method as stipulated at point d, Clause 3 of this Article when changing the method to conduct e-tax transactions as stipulated at points a and b of Clause 2 of this Article must register to stop using the e-tax transaction method as stipulated at point d, Clause 3 of this Article and register to use the e-tax transaction method as stipulated at points a and b, Clause 3 of this Article.

c) Taxpayers who registered to use the e-tax transaction method as stipulated at points c and đ, Clause 3 of this Article when changing the method to conduct e-tax transactions as stipulated at points a and b, Clause 2 of this Article must register to use the e-tax transaction method as stipulated at points a and b, Clause 3 of this Article.

...

Thus, 5 methods taxpayers can choose for e-tax transactions include:

[1] The General Department of Taxation's e-portal.

[2] The national public service portal, the Ministry of Finance’s e-portal connected with the General Department of Taxation's e-portal.

[3] The e-portal of other competent state agencies (excluding point b of this Clause) connected with the General Department of Taxation's e-portal.

[4] T-VAN services provided by organizations approved by the General Department of Taxation to connect with the General Department of Taxation's e-portal.

[5] e-payment services of banks or intermediary payment service providers to conduct e-tax payments.

- What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80?

- Vietnam: What does the supplementary personal income tax declaration dossier include?

- What are the educational requirements for tax agent employees in Vietnam?

- Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam?

- Which income of a Vietnamese non-resident is subject to personal income tax?

- What is the Form for declaring a 20% reduction in the VAT rate in Vietnam according to Decree 72?

- What are 3 types of tax explanation form for accountants in Vietnam? What is the penalty for late submission of VAT return in November 2024?

- Vietnam: Compilation of all Appendix 2 forms of Circular 80/2021/TT-BTC

- When is the timing for determining overpaid tax for offsetting or refunding in Vietnam?

- What are VAT calculation methods in Vietnam?