What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam?

What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam?

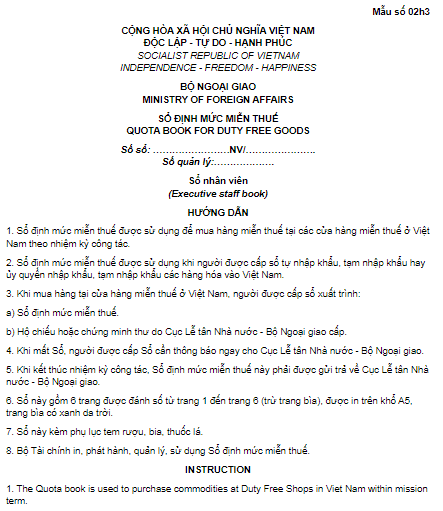

Under Appendix 7 of the forms/templates for tax exemption, tax reduction, tax refund, and non-taxation issued together with Decree 18/2021/ND-CP, the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam is specified as follows:

>>> Download the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam.

What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam? (Image from the Internet)

Which authorities have the power to issue duty-free allowance books to diplomatic officers in Vietnam?

Under Point c, Clause 8, Article 5 of Decree 134/2016/ND-CP, the procedure for issuing the duty-free allowance books is as follows:

Power to issue the duty-free allowance book or increase allowance therein

Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books made in Template No. 02h1 Download or Template No. 02h2 Download or Template No. 02h3 Download to the entities mentioned in Point a and Point b Clause 1 of this Article 1 within 05 working days from the day on which adequate documents are received.

Customs Departments of provinces where the organizations mentioned in Clause 1 of this Article are located shall issue duty-free allowance books Template No. 02h4 Download or Template No. 02h5 Download to the entities mentioned in Point c and Point d Clause 1 of this Article within 05 working days from the day on which adequate documents are received.

The Ministry of Foreign Affairs shall monitor and issue duty-free allowance book to the entities granted diplomatic immunity and privileges mentioned in Point c Clause 1 of this Article if they have been issued with duty-free allowance books by the Ministry of Foreign Affairs before the effective date of this Decree.

After a duty-free allowance book is issued, the issuing authority mentioned in this Point shall update the General Department of Customs with information in the duty-free allowance book via the National Single-window Information Portal.

Thus, the Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books to diplomatic officers.

Is an international treaty required in the application for issuing duty-free allowance books to diplomatic officers in Vietnam?

Under clause 8 Article 5 Decree 134/2016/ND-CP, the procedure for issuing the duty-free allowance books is as follows:

Procedures for issuance of duty-free allowance book or increase of allowance therein

- Application submitted by an organization shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 01 or Form No. 01a in Appendix VII hereof: 01 original copy;

Notice of the establishment of the representative agency in Vietnam after the duty-free allowance book is issued for the first time: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance on automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the organizations specified in Point c, Point d Clause 1 of this Article): 01 photocopy.

- Application submitted by an individual shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 02 or Form No 02i in Appendix VII hereof: 01 original copy;

The ID card issued by the Ministry of Foreign Affairs (for the individuals specified in Point a, Point b Clause 1 of this Article: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance for automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The work permit or a legally equivalent document issued by a competent authority if the applicant is a member of an international organization or non-governmental organization (for persons mentioned in Point d Clause 1 of this Article): 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the entities specified in Point c, Point d Clause 1 of this Article): 01 photocopy.

Thus, the application for issuing the duty-free allowance books to diplomatic officers in Vietnam must include an international treaty or agreement between the Government of Vietnam and foreign non-governmental organizations.

- Is submitting the tax declaration after 90 days without incurring tax considered tax evasion in Vietnam?

- What are 04 sample notices on the 2025 Tet Holiday schedule for enterprises in Vietnam? Is the lucky money considered a deductible expense for corporate income tax calculation in Vietnam?

- From July 1, 2025, what are regulations on handling of the residual input VAT at the end of a month/quarter in Vietnam?

- When is a business establishment not eligible for VAT deduction in Vietnam from July 1, 2025?

- From July 1, 2025, will TINs be replaced by personal identification numbers in Vietnam?

- Is Circular 86 on taxpayer registration promulgated in Vietnam?

- What is the Gregorian calendar date for the 4th day of the 2025 Tet holiday in Vietnam? What is the detailed tax report submission schedule in Vietnam for February 2025?

- What day is the 2nd day of the 2025 Tet holiday in Vietnam? What procedures related to the fixed tax of 2024 have deadlines on the 2nd day of the 2025 Tet holiday in Vietnam?

- How to determine taxable personal income from real estate transfer in Vietnam? Which income is exempted from personal income tax in Vietnam?

- If the VAT rate stated on the invoice is lower than the prescribed rate, at which rate should VAT be declared and paid in Vietnam?