What is the Gregorian calendar date for the 4th day of the 2025 Tet holiday in Vietnam? What is the detailed tax report submission schedule in Vietnam for February 2025?

What is the Gregorian calendar date for the 4th day of the 2025 Tet holiday in Vietnam?

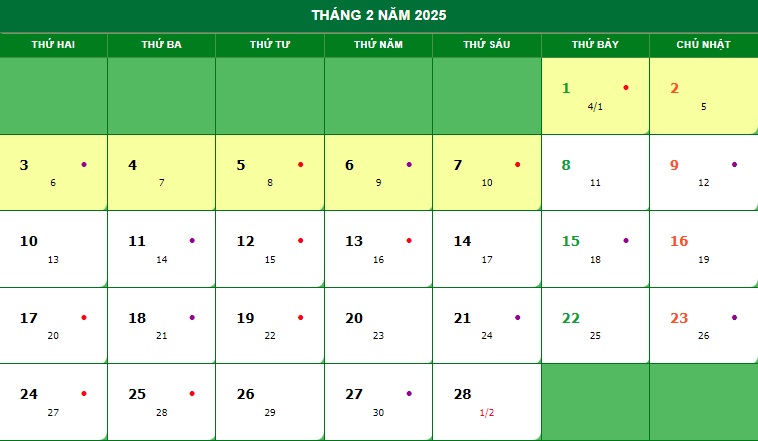

Based on the Perpetual Calendar for February 2025 as follows:

Accordingly, the 4th day of the Lunar New Year will fall on Saturday, February 1, 2025 (that is, the 4th day of the first lunar month of 2025 corresponds to February 1, 2025, in the Gregorian calendar).

What is the Gregorian calendar date for the 4th day of the 2025 Tet holiday in Vietnam? (Image from the Internet)

What is the detailed tax report submission schedule in Vietnam for February 2025?

The detailed tax report submission schedule for February 2025 is as follows:

| Date | Report | Legal Basis |

| February 3, 2025 | Payment of the 2025 annual license fee | Clause 1, Article 10 Decree 126/2020/ND-CP Clause 1, Article 1 Decree 91/2022/ND-CP (The deadline is January 30, 2024, but this date is the 2nd day of the Lunar New Year, so it is postponed to the next working day) |

| February 3, 2025 | Provisional Corporate Income Tax for Q4/2024 | Clause 1, Article 55 Tax Administration Law 2019 Clause 1, Article 1 Decree 91/2022/ND-CP (The deadline is January 30, 2024, but this date is the 2nd day of the Lunar New Year, so it is postponed to the next working day) |

| February 3, 2025 | VAT Declaration for Q4/2024 | Clause 1, Article 44 Tax Administration Law 2019 Clause 1, Article 1 Decree 91/2022/ND-CP (The deadline is January 30, 2024, but this date is the 2nd day of the Lunar New Year, so it is postponed to the next working day) |

| February 3, 2025 | Personal Income Tax Declaration for Q4/2024 | Clause 1, Article 44 Tax Administration Law 2019 Clause 1, Article 1 Decree 91/2022/ND-CP (The deadline is January 30, 2024, but this date is the 2nd day of the Lunar New Year, so it is postponed to the next working day) |

| February 20, 2025 | VAT Declaration for January 2025 | Clause 1, Article 44 Tax Administration Law 2019 |

| February 20, 2025 | Personal Income Tax Declaration for January 2025 | Clause 1, Article 44 Tax Administration Law 2019 |

What are the fines for late submission of tax declarations in Vietnam?

Based on Article 13 Decree 125/2020/ND-CP regulating fines for late submission of tax declarations as follows:

- A warning for submitting tax declaration documents late by 1 to 5 days with mitigating circumstances.

- A fine ranging from VND 2,000,000 to VND 5,000,000 for submitting tax declaration documents late by 1 to 30 days.

- A fine ranging from VND 5,000,000 to VND 8,000,000 for submitting tax declaration documents late by 31 to 60 days.

- A fine ranging from VND 8,000,000 to VND 15,000,000 for one of the following actions:

+ Submitting tax declaration documents late by 61 to 90 days;

+ Submitting tax declaration documents late by 91 days or more without incurring tax payable;

+ Not submitting tax declaration documents but not incurring tax payable;

+ Not submitting appendices according to tax administration regulations for enterprises with related party transactions accompanied by corporate income tax finalization dossiers.

- A fine ranging from VND 15,000,000 to VND 25,000,000 for submitting tax declaration documents more than 90 days late from the deadline, incurring tax payable, and the taxpayer has paid the full tax amount and late payment to the state budget before the tax authority announces the decision to inspect or audit or before the tax authority makes a record on the late submission of tax declaration documents according to clause 11, Article 143 Tax Administration Law 2019.

If the fine according to this point is greater than the taxable amount on the tax declaration, the maximum fine shall equal the taxable amount but not less than the average fine of the range specified in clause 4, Article 13 Decree 125/2020/ND-CP.

Note: The above fines apply to organizations. The fine for individuals with the same violation is half the penalty for organizations based on clause 5, Article 5 Decree 125/2020/ND-CP.

What are the remedial measures when imposing penalties for administrative violations in tax administration in Vietnam?

According to Article 138 Tax Administration Law 2019, forms of punishment, fines, and remedial measures are prescribed as follows:

Forms of punishment, fines, and remedial measures

- Forms of administrative penalties for tax administration include:

a) Warning;

b) Fine.

- The fine level for administrative penalties in tax administration is regulated as follows:

a) The maximum fine for the violation prescribed in Article 141 of this Law follows the provisions of the law on handling administrative violations;

b) A fine of 10% on the amount of tax underdeclared or overdeclared in cases of exemption, reduction, refund, non-collection of tax for the violation prescribed at point a, clause 2, Article 142 of this Law;

c) A fine of 20% on the amount of tax underdeclared or overdeclared in cases of exemption, reduction, refund, non-collection of tax for the violation prescribed in clause 1 and points b, c clause 2, Article 142 of this Law;

d) A fine ranging from 1 to 3 times the evaded tax amount for the violation prescribed in Article 143 of this Law.

- Remedial measures in administrative penalties for tax administration include:

a) Requiring full payment of evaded or underpaid taxes;

b) Requiring full payment of incorrectly exempted, reduced, refunded, or non-collected taxes.

- The Government of Vietnam provides detailed regulations for this Article.

Thus, the remedial measures in administrative penalties for tax administration include:

- Requiring full payment of evaded or underpaid taxes;

- Requiring full payment of incorrectly exempted, reduced, refunded, or non-collected taxes.