What is the 2025 Commitment form for individuals who have only one residential house for personal income tax exemption in Vietnam?

Is the income from transfer of house received by individuals who have only one residential house taxable in Vietnam in 2025?

Pursuant to the provisions of Clause 2, Article 4 of the Law on Personal Income Tax 2007, income from the transfer of houses, rights to use homestead land, and assets attached to homestead land of individuals in cases where an individual owns only one house, homestead land is tax-exempt income.

However, according to Point b, Clause 1, Article 3 of Circular 111/2013/TT-BTC (amended by Clause 1, Article 12, Circular 92/2015/TT-BTC) regarding tax-exempt personal income:

Tax-exempt income

- Pursuant to Article 4 of the Law on Personal Income Tax, Article 4 of Decree No. 65/2013/ND-CP, tax-exempt income includes:

...

b) Income from the transfer of houses, rights to use homestead land, and assets attached to homestead land of individuals in cases where the transferor has only one house, homestead land right in Vietnam.

b.1) Individuals transferring houses, rights to use homestead land exempt from tax as guided at point b, clause 1 of this Article must simultaneously meet the following conditions:

b.1.1) Only own one house or right to use one parcel of land (including cases with houses or constructions attached to that parcel) at the time of transfer. Specifically:

b.1.1.1) Determination of ownership of houses, rights to use homestead land is based on the Certificate of land use rights, ownership of houses, and other assets attached to the land.

b.1.1.2) In the case of transferring a house with joint ownership or homestead land with joint use rights, only individuals without ownership of houses or rights to use homestead land elsewhere are exempt from tax; individuals with joint ownership or use rights but possessing other houses or rights to use homestead land are not exempt.

b.1.1.3) If a husband and wife have joint ownership of a house and rights to use homestead land as their only asset, but one spouse has separate houses or homestead land, only the spouse without separate assets is exempt when transferring joint property; the spouse with separate assets is not exempt.

b.1.2) Hold ownership of houses or rights to use homestead land for at least 183 days by the time of transfer.

The date for determining ownership of houses or rights to use homestead land is the issuance date of the certificate of land use rights, house ownership, and other assets attached to the land. For reissuance or exchange under land law, the ownership date is based on the previous certificate before reissuance or exchange.

b.1.3) Transfer the entire house or homestead land.

When an individual possesses or jointly possesses the only house and right to use homestead land but transfers only a part, that portion transferred is not tax-exempt.

b.2) The exemption of tax for the sole house or homestead land transferred is self-declared by the property seller, who assumes responsibility. If discrepancies are found, tax collection and penalties for violating tax laws as per tax management law will apply.

b.3) Transfers of houses or constructions established in the future are not eligible for personal income tax exemption as guided at point b, clause 1 of this Article.

In situations where the seller only owns a single house in Vietnam, they will be exempt from personal income tax if they meet the following conditions:

- The individual only owns one house or the right to use one parcel of land (including cases with houses or constructions attached to that parcel) at the time of transfer.

- Hold ownership of the house or rights to use homestead land for at least 183 days by the time of transfer.

- Transfer the entire house or homestead land.

Determination of whether a house, land is the only asset is performed by the transferring individual through self-declaration and responsibility-taking. Discrepancies will lead to tax recovery, potential travel bans, and fines for violations.

Note:

+ Tax exemption for the sole house or homestead land transferred is self-declared by the property seller and is their responsibility. Discrepancies will be handled by tax collection and fines for tax law violations as regulated by tax management law.

+ Transfers of houses or constructions established in the future are not eligible for personal income tax exemption.

What is the 2025 Commitment form for individuals who have only one residential house for personal income tax exemption in Vietnam? (Image from the Internet)

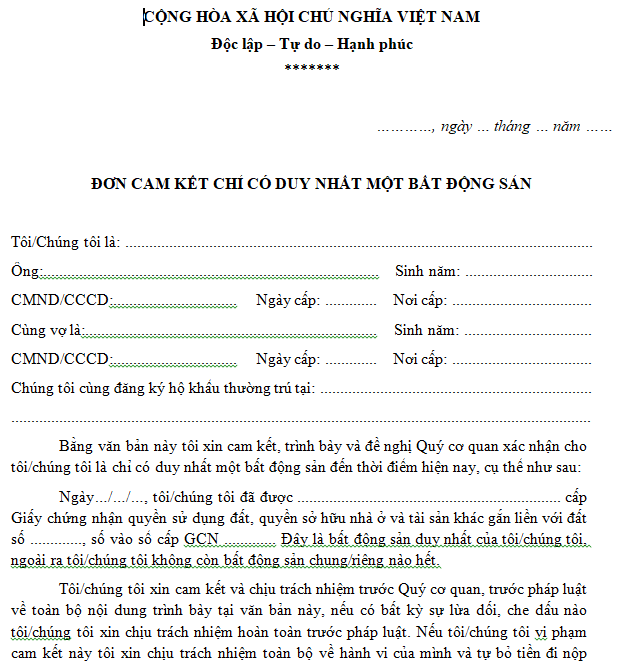

What is the 2025 Commitment form for individuals who have only one residential house for personal income tax exemption in Vietnam?

Currently, the law does not specify a form for the Commitment form for individuals who have only one residential house for Personal Income Tax Exemption, you may refer to the following sample form:

DOWNLOAD >> the 2025 Commitment form for individuals who have only one residential house for personal income tax exemption in Vietnam

How is personal income tax determined for income from real estate transfer in Vietnam?

According to Clause 4, Article 12 of Circular 111/2013/TT-BTC (amended by Article 17, Circular 92/2015/TT-BTC), the personal income tax calculation for income from real estate transfer is determined as follows:

Personal income tax payable = Transfer price x Tax rate 2%

Note: In the case of jointly owned property transfer, the tax obligation is individually calculated for each taxpayer based on property ownership ratio. The basis for ownership ratio determination includes legal documents such as initial capital contribution agreements, wills, or court division decisions... In the absence of such documentation, each taxpayer's tax obligation is determined on an average basis.

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?