What are the procedures for taxpayer registration of transferor, acquired or consolidating organizations in Vietnam?

What are the procedures for taxpayer registration of transferor, acquired or consolidating organizations in Vietnam?

Based on Subsection 26, Section 2, Part 2 of the Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 regarding the procedure for conducting taxpayer registration for transferor, acquired or consolidating organizations as follows:

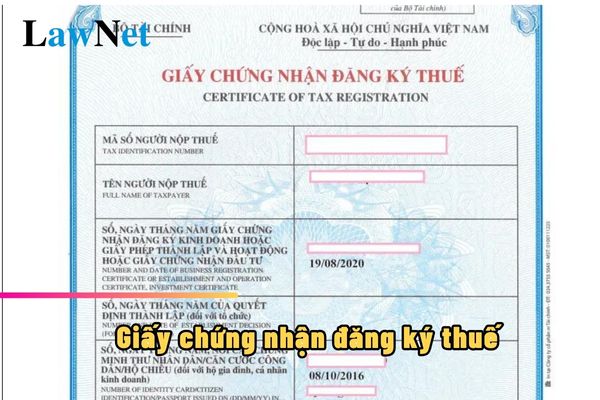

Step 1: transferor, acquired or consolidating organizations must carry out taxpayer registration procedures with the tax authorities within 10 working days from the date stated on the establishment and operation license or an equivalent license, as stipulated in the Tax Administration Law 2019 and Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance.

Economic organizations (excluding cooperatives) defined in points a and b, clause 2, Article 4 of Circular 105/2020/TT-BTC submit taxpayer registration documents to the Tax Department where the headquarters are located.

Other organizations as specified in Points c and n, clause 2, Article 4 of Circular 105/2020/TT-BTC submit taxpayer registration documents to the Tax Department where the organization is headquartered if established by central or provincial-level agencies; at the District Tax Department where the organization is headquartered if established by district-level agencies or where the cooperative is headquartered.

- For electronic taxpayer registration documents: Taxpayers access the electronic information portal chosen by the taxpayer (the electronic information portal of the General Department of Taxation/Government agencies’ electronic information portals, including the national public service portal, ministerial or provincial public service portal, as prescribed by the single-window mechanism) to fill, attach required electronic documents (if any), sign electronically, and send to the tax authorities via the chosen electronic information portal.

Taxpayers submit documents (taxpayer registration documents concurrently with business registration documents under the one-stop-shop mechanism) to the competent state management authority as prescribed. The competent state management authority will send the received taxpayer information to the tax authority via the electronic portal of the General Department of Taxation.

Step 2: Tax authorities receive:

- For changes in taxpayer registration information on paper:

+ In case documents are submitted directly to the tax authority: Tax officials receive and stamp the receipt on the taxpayer registration documents, clearly stating the receipt date, the number of documents according to the checklist for the taxpayer registration documents submitted directly to the tax authority. Tax officials issue a receipt note specifying the date of result return and processing time for received documents.

+ In case taxpayer registration documents are sent via postal services: Tax officials stamp the receipt, record the receipt date on the documents, and note the tax authority’s document number.

Tax officials review the taxpayer registration documents. If the documents are incomplete and require explanation or additional information, the tax authority will notify the taxpayer using form No. 01/TB-BSTT-NNT in Appendix 2 issued along with Decree 126/2020/ND-CP within 2 (two) working days from the date of receiving the documents.

- For electronic taxpayer registration documents:

The tax authority will receive and handle the documents through the electronic portal of the General Department of Taxation, checking and processing the documents via the tax authority’s electronic data processing system.

+ Receiving documents: The electronic portal of the General Department of Taxation sends a receipt notification to the taxpayer via the chosen electronic portal (General Department of Taxation electronic portal/state agency’s electronic portal, or TVAN service provider) within 15 minutes of receiving the taxpayer’s electronic taxpayer registration documents.

+ Checking and processing documents: The tax authority will review and process the taxpayer’s documents as per tax registration regulations and return the processing results through the chosen electronic portal.

++ If documents are complete and in accordance with procedures, and results need to be returned: The tax authority sends the processing results to the chosen electronic portal by the deadline specified in Circular 105/2020/TT-BTC.

++ If documents are incomplete or not in accordance with procedures, the tax authority sends a notification of rejection to the chosen electronic portal within 2 (two) working days from the date on the acknowledgment receipt.

What are procedures for taxpayer registration of transferor, acquired or consolidating organizations in Vietnam? (Image from the internet)

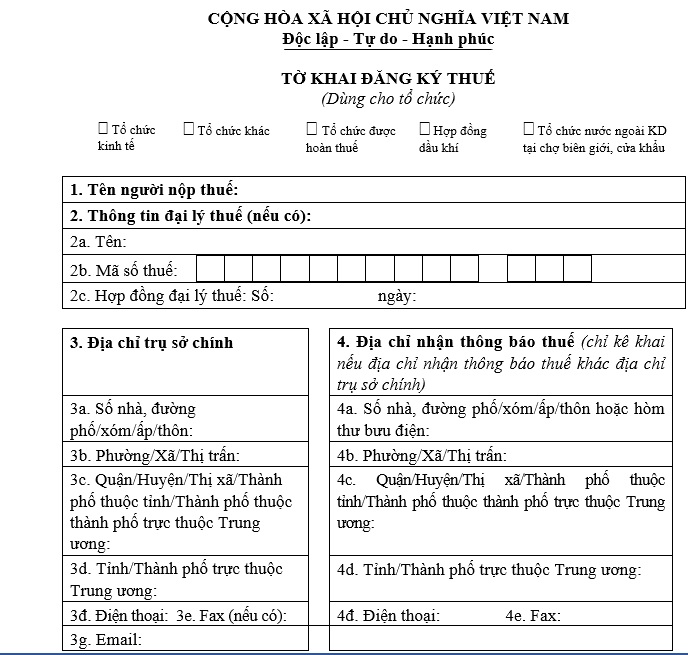

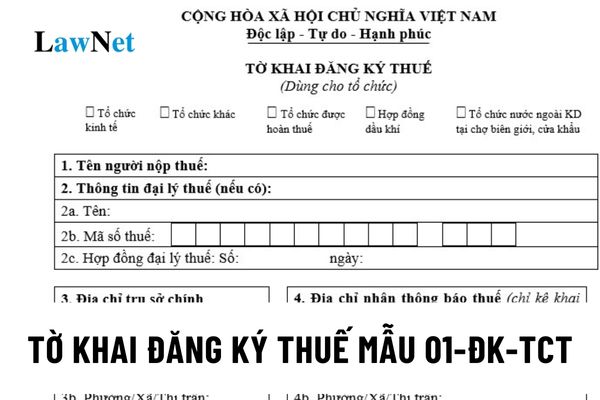

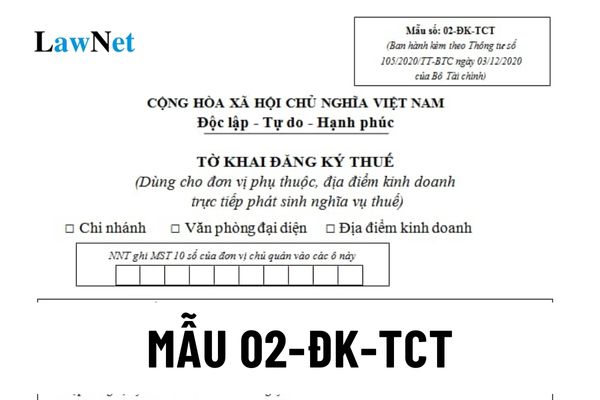

Where to download the taxpayer registration form for transferor, acquired or consolidating organizations in Vietnam?

Transferor, acquired or consolidating organizations should fill out the taxpayer registration form No. 01-DK-TCT issued along with Circular 105/2020/TT-BTC.

>> Download the taxpayer registration form for transferor, acquired or consolidating organizations: Download

What is the processing time for taxpayer registration procedures for transferor, acquired or consolidating organizations in Vietnam?

Based on Subsection 26, Section 2, Part 2 of the Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 regarding processing time:

The processing time for taxpayer registration procedures for transferor, acquired or consolidating organizations is 3 (three) working days from the date the tax authority receives the complete taxpayer registration documents as prescribed.

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?