Are natural aquatic resources exempt from severance tax in Vietnam?

Are natural aquatic resources exempt from severance tax in Vietnam?

Pursuant to Article 9 of the 2009 Law on Severance Tax (amended by Clause 2, Article 4 of the 2014 Law on Amendments to Tax Laws), the objects exempted from severance tax are as follows:

[1] Taxpayers who encounter natural disasters, fires, or unexpected accidents causing loss to declared and paid resources are considered for tax exemption and reduction for the lost resources; in case tax has been paid, the paid tax amount may be refunded or deducted from the severance tax payable in the following period.

[2] Exempt from tax for natural aquatic resources.

[3] Exempt from tax for branches, tops, firewood, bamboo, rattan, rattan segments, calamus, giang, tranh, vầu, lồ ô harvested by individuals for personal use.

[4] Exempt from tax for natural water used for hydropower production by households or individuals for personal use.

[5] Exempt from tax for natural water exploited by households or individuals for personal use.

[6] Exempt from tax for land exploited and used on-site on allocated or leased land; land exploited for leveling, constructing security, military, or dike projects.

[7] Other circumstances of tax exemption or reduction as regulated by the Standing Committee of the National Assembly.

Additionally, the objects exempted from severance tax are also guided in Clause 1, Article 10 of Circular 152/2015/TT-BTC:

Severance Tax Exemption

Cases of severance tax exemption as prescribed in Article 9 of the Law on Severance Tax and Article 6 of Decree No. 50/2010/ND-CP, include:

1. Severance tax exemption for organizations and individuals exploiting natural aquatic resources.

2. Severance tax exemption for organizations and individuals exploiting branches, tops, firewood, bamboo, rattan, rattan segments, calamus, giang, tranh, vầu, lồ ô harvested by individuals for personal use.

3. Severance tax exemption for organizations and individuals exploiting natural water for hydropower production serving household personal use or individual personal use.

4. Severance tax exemption for natural water exploited by households or individuals for personal use.

5. Severance tax exemption for land exploited by organizations or individuals on-site on allocated or leased land; land exploited for leveling, constructing security, military, or dike projects.

Land exploited and used on-site exempted from tax at this point includes sand, stone, and gravel mixed in the soil but not specifically identified and used in a rough form for leveling, construction; in case of being transported elsewhere for use or sale, severance tax must be paid according to the regulations.

6. Other cases of severance tax exemption, the Ministry of Finance shall coordinate with related Ministries and sectors to report to the Government of Vietnam for submission to the Standing Committee of the National Assembly for consideration and decision.

Therefore, natural aquatic resources is exempt from severance tax.

Are natural aquatic resources exempt from severance tax in Vietnam? (Image from the Internet)

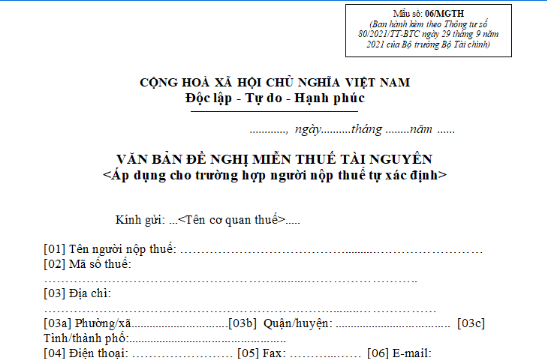

What is the severance tax exemption request form for individuals exploiting natural aquatic resources?

The form for requesting severance tax exemption is prescribed in Section 7, Appendix 1 issued with Circular 80/2021/TT-BTC as Form No. 06/MGTH:

>> Download the latest severance tax exemption request form for individuals exploiting natural aquatic resources.

*Note: This form applies to cases where the taxpayer self-determines.

What are the procedures for severance tax exemption for individuals exploiting natural aquatic resources in Vietnam?

Pursuant to the provisions at point b, Clause 2, Article 51 of Circular 80/2021/TT-BTC, the procedures and dossiers for tax exemption for individuals allowed to exploit bamboo for personal use are regulated as follows:

Step 1: Prepare the tax exemption request document

Individuals wishing to exploit natural aquatic resources shall prepare a tax exemption request document according to Form No. 06/MGTH issued with Appendix 1 Circular 80/2021/TT-BTC.

>> Download the latest severance tax exemption request form for individuals exploiting natural aquatic resources.

Step 2: Obtain document verification

After preparing the tax exemption request document according to the prescribed form, individuals need to bring the application to the People's Committee at the commune level where they reside to obtain verification.

Step 3: Submit the document to the Tax Department

Individuals who wish to exploit bamboo for personal use shall send the verified tax exemption request document from the People's Committee to the Tax Department where they reside.

The severance tax exemption request document must be submitted once before exploitation to the Tax Department.

*Note: Individuals are not required to prepare monthly severance tax declarations and annual severance tax finalizations.