What are the penalties for violations against regulations on the taxpayer registration deadlines in Vietnam?

When is the deadline for initial taxpayer registration in Vietnam?

According to Article 33 of the Tax Administration Law 2019, the deadline for initial taxpayer registration is stipulated as follows:

- For taxpayers who combine taxpayer registration with business registration, the statute of limitations for taxpayer registration is the statute of limitations for business registration as prescribed by law.

- For taxpayers directly registered with tax authorities, the statute of limitations for taxpayer registration is 10 working days starting from the day on which:

+ the certificate of household business registration, establishment and operation license, investment registration certificate or establishment decision is granted;

+ the taxpayer inaugurates business operation for organizations that are not required to apply for business registration and household businesses and individual businesses that are required to apply for business registration but yet to be granted the business registration certificate;

+ the responsibility to deduct and pay tax on behalf of individuals arises; organizations paying tax on behalf of individuals according to business cooperation contracts and/or agreements;

+ the contract with the foreign contractor and/or subcontractors who directly declare and pay tax to tax authorities; the petroleum contract or agreement is concluded;

+ personal income tax is incurred;

+ tax refund in claimed;

+ other amounts payable to the state budget are incurred.

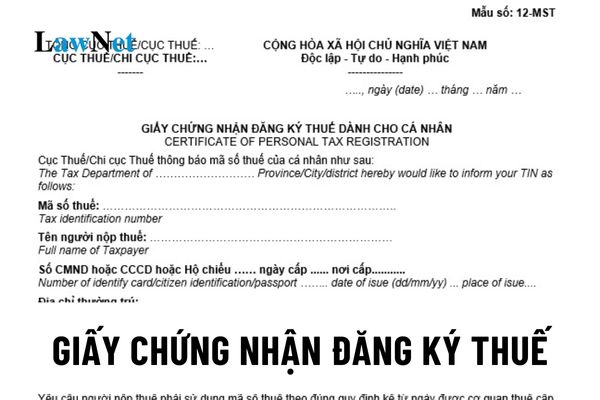

- In case an individual does not have a TIN, his/her income payer shall apply for taxpayer registration on his/her behalf in no later than 10 working days starting from the date tax liabilities are incurred; in case a dependant of a taxpayer does not have a TIN, the income payer shall apply for taxpayer registration for the dependant in no later than 10 working days starting from the date the taxpayer applies for dependant exemption as prescribed by law.

What are the penalties for violations against regulations on the taxpayer registration deadlines in Vietnam? (Image from the Internet)

What are the penalties for violations against regulations on the taxpayer registration deadlines in Vietnam?

According to Article 10 of Decree 125/2020/ND-CP which stipulates penalties for violations against regulations on the taxpayer registration deadlines:

- A warning shall be issued for delaying the taxpayer registration from 1 to 10 days beyond the prescribed deadline with mitigating circumstances.

- A fine ranging from 1,000,000 VND to 2,000,000 VND shall be imposed for delaying the taxpayer registration from 1 to 30 days beyond the prescribed deadline, except for cases falling under the caution penalty.

- A fine ranging from 3,000,000 VND to 6,000,000 VND shall be imposed for delaying the taxpayer registration from 31 to 90 days beyond the prescribed deadline.

- A fine ranging from 6,000,000 VND to 10,000,000 VND shall be imposed for delaying the taxpayer registration 91 days or more beyond the prescribed deadline.

Note: According to Clause 4, Article 7 of Decree 125/2020/ND-CP, the above fines apply to organizations. For individual violations, the fine shall be half the amount applicable to organizations.

What is the statute of limitations for executing a decision on the imposition of penalties for violations against regulations on the taxpayer registration deadlines in Vietnam?

Under Article 40 of Decree 125/2020/ND-CP:

Statute of limitations for execution of tax or invoice-related administrative penalty charge decisions

1. Statute of limitations for execution of tax or invoice-related administrative penalty charge decisions shall be 01 year from the decision-issuing date. Upon expiry of the aforesaid execution statute of limitations, if the tax authority has not yet transmitted or sent the administrative penalty charge decision to the violating entity or person under the provisions of Article 39 herein, that decision shall become inactive.

If the administrative penalty charge decision requires the enforcement of any remedy, such remedy shall be enforced as usual.

2. If the sanctioned entity or person deliberately evades or defers execution of the decision, the statute of limitations for execution of the penalty charge decision shall start from the date of termination of the act of evasion or deferment.

3. If the tax authority has transmitted or sent the administrative penalty charge decision to the violating entity or person as provided in Article 39 herein, but the sanctioned entity or person has not yet paid or has not fully paid fines, back taxes or deferred amounts, tax authorities must track amounts not yet paid on tax administration systems and apply measures to enforce recovery of outstanding taxes under regulations in order to fully collect amounts payable into the state budget.

Thus, the statute of limitations for executing a decision on the imposition of penalties for violations against regulations on the taxpayer registration deadlines in Vietnam is 1 year from the date of the penalty decision.

Note: If the administrative penalty charge decision requires the enforcement of any remedy, such remedy shall be enforced as usual.

If the sanctioned entity or person deliberately evades or defers execution of the decision, the statute of limitations for execution of the penalty charge decision shall start from the date of termination of the act of evasion or deferment.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?