What is the newest taxpayer registration certificate template in Vietnam?

What does information on a taxpayer registration certificate in Vietnam include?

Under Article 34 of the Tax Administration Law 2019 on issuance of taxpayer registration certificate:

Issuance of taxpayer registration certificate

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

d) Supervisory tax authority.

2. Tax authorities shall inform TINs to taxpayers instead of taxpayer registration certificates in the following cases:

a) An individual authorizes his/her income payer to apply for taxpayer registration on behalf of the individual and his/her dependants;

b) An individual applies for taxpayer registration through the tax declaration dossier;

c) An organization or individual applies for taxpayer registration so as to deduct and pay tax on taxpayers’ behalf;

d) An individual applies for taxpayer registration for his/her dependant(s).

3. In case the taxpayer registration certificate or TIN notification is lost or damaged, tax authorities shall reissue it within 02 working days starting from the date of receipt of the satisfactory application from the taxpayer as prescribed by law.

Thus, the taxpayer registration certificate includes the following information:

- Name of the taxpayer;

- TIN;

- Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

- Supervisory tax authority.

What is the newest taxpayer registration certificate template in Vietnam? (Image from the Internet)

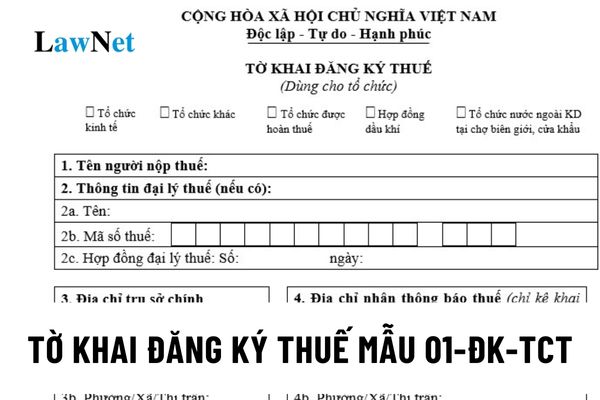

What is the newest taxpayer registration certificate template in Vietnam?

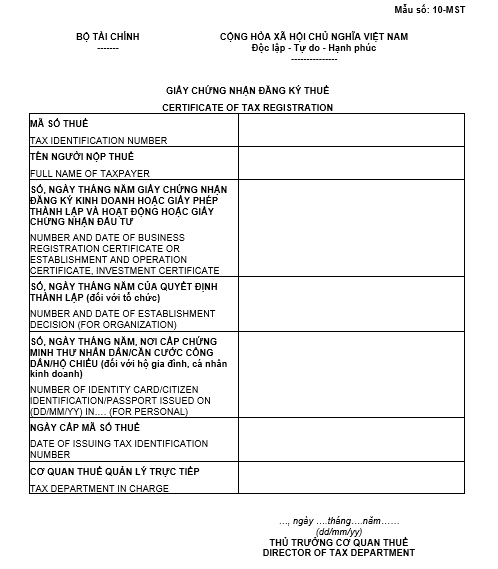

The taxpayer registration certificate template for organizations, household businesses, and individual businesses is Template No. 10-MST issued with Circular 105/2020/TT-BTC:

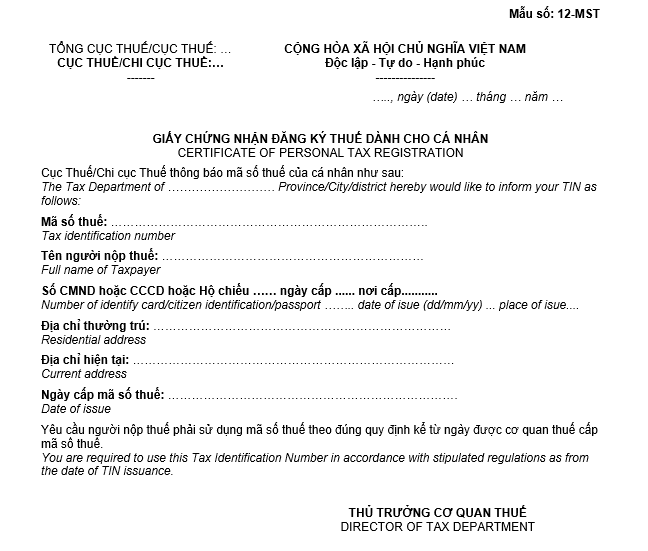

The taxpayer registration certificate template for individuals is Template No.12-MST issued with Circular 105/2020/TT-BTC:

Download Template No. 10-MST and Template No. 12-MST: Download

What are the responsibilities of the Ministry of Planning and Investment in the issuance of taxpayer registration certificates in Vietnam?

Pursuant to Article 15 of the Tax Administration Law 2019:

Duties, powers and responsibilities of Ministries, Ministry-level agencies, Governmental agencies

1. The Ministry of Finance shall be the authority in charge of assisting the Government in unifying state management of tax administration and have the following duties and powers:

a) Promulgating as authorized or proposing legislative documents on tax administration to a competent authority;

b) Organizing tax administration in accordance with this Law and other relevant provisions;

c) Organizing the formulation and implementation of the collection of state budget revenue;

d) Organizing audits and inspections on compliance with tax regulations and other relevant provisions;

dd) Acting against regulatory violations and settling complaints and denunciations related to the implementation of tax regulations as authorized;

e) Organizing tax-related international cooperation;

g) Cooperating with the Ministry of Planning and Investment and other relevant Ministries in providing guidance on independent appraisal of value of machinery, equipment and technological lines as prescribed in the Law on Investment.

...

6. The Ministry of Planning and Investment shall have the following responsibilities:

a) Directing and providing guidelines on the cooperation between competent authorities and tax authorities in granting and revoking certificates of enterprise registration, business registration, investment registration, taxpayer registration and other registrations of taxpayers via the interlinked single-window system;

b) Directing and providing guidelines to competent authorities on increasing the appraisal of investment projects so as to prevent price transfer and tax avoidance;

c) Directing and providing guidelines to competent authorities on increasing the inspection, audit and appraisal of quality and value of machinery, equipment and technology in service to operations of investment projects;

d) Directing and providing guidelines on the cooperation between competent authorities and tax authorities in conforming to regulations on preferential rewards for investment appropriate to tax regulations.

...

The Ministry of Planning and Investment has the responsibility to direct and provide guidelines on the cooperation between competent authorities and tax authorities in issuing taxpayer registration certificates for taxpayers according to the interlinked single-window system.

- What is the accounting database for export and import duties in Vietnam?

- Are ambulances subject to excise tax in Vietnam?

- What is the registration of the REX number in the preferential tariff treatment in Vietnam?

- Are foreign contractors required to pay personal income tax in Vietnam?

- Vietnam: What does the application for VAT refund include?

- What are cases where taxpayers self-determine the amount of tax exemption or reduction in Vietnam?

- What are cases of resource royalty distribution in Vietnam?

- What does the tax chargeoff dossier include? How long is the tax chargeoff period in Vietnam?

- May Vietnamese officials serve as tax agents?

- What are the tasks of tax accounting activities in Vietnam?