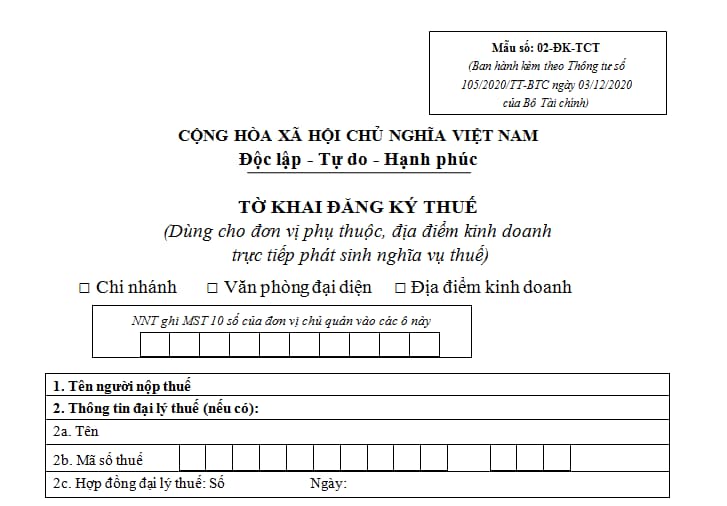

What are the instructions for declaring the application form for taxpayer registration made in Form No. 02-DK-TCT in Vietnam?

Where to download the application form for taxpayer registration - Form No. 02-DK-TCT in Vietnam?

The application form for taxpayer registration - Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC applies to dependent units and business locations directly incurring tax liability as follows:

>> Download the application form for taxpayer registration - Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC: Download

What are the instructions for declaring the application form for taxpayer registration made in Form No. 02-DK-TCT in Vietnam? (Image from the Internet)

What are the instructions for declaring the application form for taxpayer registration made in Form No. 02-DK-TCT in Vietnam?

Instructions for declaring Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC are as follows:

| Instructions for declaring Form No. 02-DK-TCT (1). Name of the taxpayer: Clearly and fully write the name of the organization in uppercase according to the Establishment Decision or Establishment and Operation License or equivalent documents issued by a competent authority (for Vietnamese organizations) or Business Registration Certificate (for organizations from neighboring countries conducting business activities at border markets, border gates, markets in economic zones at the border gate of Vietnam). (2). Tax agent information: Fully write the information of the tax agent in cases where the tax agent signs a contract with the taxpayer to carry out taxpayer registration procedures on behalf of the taxpayer according to the provisions of the Law on Tax Administration. (3). Address of the head office: Write the full address of the taxpayer including house number, alley, lane, street/village/hamlet, ward/commune/commune-level town, district/district-level town/city under province, province/city of the taxpayer. If there is a telephone number, fax number, clearly state the area code - telephone number/fax number according to the address information: - Head office address of the organization. - Address of the business location in border markets, border gates, and economic zones for organizations from countries sharing a land border with Vietnam. - Address where oil and gas exploration and exploitation activities take place for oil contracts. - The taxpayer must provide accurate and complete email information. This email address is used as an electronic transaction account with the tax authority for electronic taxpayer registration documents. (4). Tax notice address: If the taxpayer is an organization with a receiving address for tax notices different from the head office address stated in item 3 above, clearly state the address for receiving tax notices for the tax authority to contact. (5). Establishment decision: - For taxpayers who are organizations with an establishment decision: Clearly state the decision number, date of issuance, and the issuing authority. * For contractors and investors participating in oil contracts: Clearly state the contract number, contract signing date, leave the issuing authority section blank. (6). Establishment and operation licenses or equivalent documents issued by a competent authority: Clearly state the number, issuance date, and issuing authority of the Business Registration Certificate issued by a neighboring country with a land border with Vietnam (for taxpayers who are organizations from countries sharing a land border with Vietnam conducting business activities at border markets, border gates, economic zones at the border gate of Vietnam), Establishment and Operation License or equivalent license issued by a competent authority (for taxpayers who are Vietnamese organizations). For the information on the "issuing authority" of the Business Registration Certificate: state the name of the country sharing a land border with Vietnam that issued the Business Registration Certificate (Laos, Cambodia, China). (7). Main business activities: State according to the business activities on the Establishment and Operation License or equivalent license issued by a competent authority (for taxpayers who are Vietnamese organizations) and Business Registration Certificate (for taxpayers who are organizations from countries sharing a land border with Vietnam conducting business activities at border markets, border gates, economic zones at the border gate of Vietnam). Note: only write one main actual business activity. (8). Charter capital: - For taxpayers of the type of Limited Liability Company, Joint Stock Company, or Partnership: State according to the charter capital on the Establishment and Operation License or equivalent license issued by a competent authority or capital source on the Establishment Decision (clearly state the type of currency, classify the capital source by the owner, the proportion of each type of capital source in the total capital). - For taxpayers who are sole proprietorships: State according to the investment capital on the Establishment and Operation License or equivalent license issued by a competent authority (clearly state the type of currency). - For taxpayers who are organizations from countries sharing a land border with Vietnam and other organizations: If the Establishment Decision, Business Registration Certificate, etc. has capital, state it; if not, leave this information blank. (9). Date of commencement of business activities: Declare the date the taxpayer actually starts operating if different from the TIN issuance date. (10). Type of economy: Mark X in one of the corresponding boxes. (11). Accounting method of business results: Mark X in one of the two boxes of this item. (12). Fiscal year: Specify from the starting date, month of the accounting year to the ending date, month of the accounting year according to the calendar year or fiscal year. (13). Information about the superior unit or directly managing unit: Clearly state the name, TIN of the direct superior unit managing the dependent unit. (14). Information about the legal representative/proprietor: Declare detailed information of the legal representative for the organization (for economic organizations and other organizations except sole proprietorships) or information of the proprietor. (15). VAT calculation method: The organization self-marks X in one of the corresponding boxes. (16). Information about related units: - If the taxpayer has dependent units, mark X in the "Has dependent units" box, then it is necessary to declare in the "List of dependent units" form number BK02-DK-TCT. - If the taxpayer has business locations, dependent warehouses without business functions, mark X in the "Has dependent business locations, warehouses" box, then it is necessary to declare in the "List of business locations" form number BK03-DK-TCT. - If the taxpayer has foreign contractors, subcontractors, mark X in the "Has foreign contractors, subcontractors" box, then it is necessary to declare in the "List of foreign contractors, subcontractors" form number BK04-DK-TCT. - If the taxpayer has oil contractors, investors, mark X in the "Has oil contractors, investors" box, then it is necessary to declare in the "List of oil contractors, investors" form number BK05-DK-TCT (for oil contracts). (17). Other information: Clearly state the full name, personal TIN, contact phone number, and email of the Director and Chief Accountant of the taxpayer. (18). Status before economic organization restructuring (if any): If the taxpayer is an economic organization undergoing restructuring of the previous economic organization, mark X in one of the cases: merger, consolidation, division, separation and specify the previously assigned TINs of the merged, consolidated, divided, separated economic organizations. (19). Section for the taxpayer or the legal representative of the taxpayer to sign and clearly state their full name: The taxpayer or the legal representative must sign, clearly state their full name in this section. (20). Stamp of the taxpayer: In case the taxpayer has a seal at the time of taxpayer registration, it must be stamped in this section. In case the taxpayer does not have a seal at the time of taxpayer registration, it is not required to stamp on the tax declaration form. When the taxpayer comes to receive the result, they must supplement the stamping for the tax authority. (21). Tax agent staff: In case the tax agent declares on behalf of the taxpayer, declare this information. |

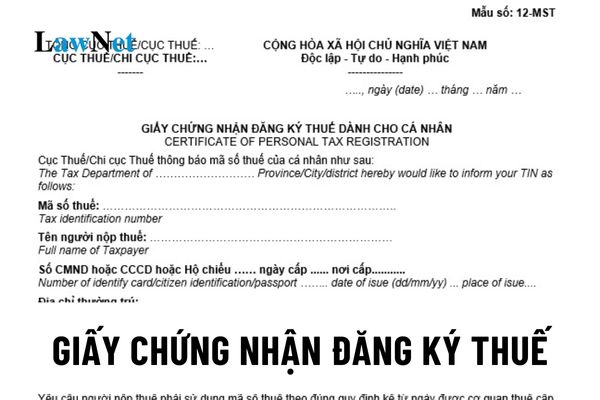

What contents does a taxpayer registration certificate in Vietnam include?

Under Article 34 of Tax Administration Law 2019 regulating the issuance of taxpayer registration certificates:

Issuance of taxpayer registration certificate

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

d) Supervisory tax authority.

2. Tax authorities shall inform TINs to taxpayers instead of taxpayer registration certificates in the following cases:

a) An individual authorizes his/her income payer to apply for taxpayer registration on behalf of the individual and his/her dependants;

b) An individual applies for taxpayer registration through the tax declaration dossier;

c) An organization or individual applies for taxpayer registration so as to deduct and pay tax on taxpayers’ behalf;

d) An individual applies for taxpayer registration for his/her dependant(s).

3. In case the taxpayer registration certificate or TIN notification is lost or damaged, tax authorities shall reissue it within 02 working days starting from the date of receipt of the satisfactory application from the taxpayer as prescribed by law.

Thus, the taxpayer registration certificate will include the following contents:

- Name of the taxpayer;

- TIN;

- Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

- Supervisory tax authority.

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?