What are the cases of using the PIT declaration form - Form 04/TKQT-TNCN in Vietnam?

What are the cases of using the PIT declaration form - Form 04/TKQT-TNCN in Vietnam?

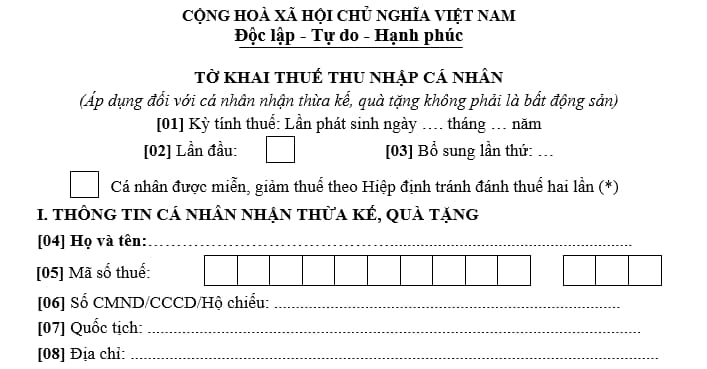

Under Appendix 2 issued together with Circular 80/2021/TT-BTC, the PIT declaration form - Form 04/TKQT-TNCN applies to individuals receiving inheritance or gifts that are not real estate:

Download the PIT declaration form - Form 04/TKQT-TNCN: Here

What are the cases of using the PIT declaration form - Form 04/TKQT-TNCN in Vietnam? (Image from Internet)

What does taxable income from real estate transfer in Vietnam include?

Under Clause 5, Article 2 of Circular 111/2013/TT-BTC, taxable income from real estate transfer includes the following incomes:

- Incomes from transferring rights to use land.

- Incomes from transferring rights to use land and property on the land. Property on the land includes:

+ Houses, including future houses.

+ Infrastructure and constructions on the land, including off-the-plan constructions.

+ Other property on land includes agriculture, forestry and fishery products (such as plants and animals).

- Incomes from transferring ownership of houses, including future houses.

- Incomes from transferring rights to use land, rights to rent water surface.

- Incomes from capital investment by real estate to establish enterprises or increase capital of enterprises as prescribed by law.

- Incomes from delegating the management of real estate, if the person delegated to manage real estate has the right to transfer real estate or rights similar to those of the real estate owner.

- Other incomes from real estate transfer in any shape or form.

What is the PIT rate on income from real estate transfer in Vietnam in Vietnam?

Under Article 12 of Circular 111/2013/TT-BTC amended by Article 17 of Circular 92/2015/TT-BTC, the basis for calculating personal income tax on real estate transfer is as follows:

Basis for calculating tax on incomes from real estate transfer

The basis for calculating tax on incomes from real estate transfer is the price of each transfer and tax rate.

...

2. Tax rate

Tax on real estate transfer is 2% of the transfer price or sublease price.

3. Time for taxing real estate transfer is determined as follows:

- If the transfer contract does not require the buyer to pay tax on behalf of the seller, the taxing time is the effective date of the transfer contract as prescribed by law;

- If the transfer contract requires the buyer to pay tax on behalf of the seller, the taxing time is time of registration of the right to own or right to use the real estate. In case the person receives an off-the-plan house or land use right associated with off-the-plan constructions, the taxing time is the time the person submits tax declaration documents to the tax authority.

4. Tax calculation

a) PIT on income from real estate transfer is calculated as follows:

PIT payable

=

Transfer price

x

2% tax

b) In case the transferred real estate in under a co-ownership, the tax liability incurred by each taxpayer is proportional to their portions of real estate ownership. The basis for determining the portion of ownership is legal documents such as the initial capital contribution agreements, the testament, or the decision on division made by the court, etc. If no legitimate documents are provided, the tax liability incurred by each taxpayer shall be evenly divided.”

Thus, the basis for calculating tax on incomes from real estate transfer is the price of each transfer and tax rate.

The personal income tax rate for real estate transfers is 2% of the transfer price or sublease price.

Moreover, the tax calculation time for real estate transfers is determined as follows:

- If the transfer contract does not require the buyer to pay tax on behalf of the seller, the taxing time is the effective date of the transfer contract as prescribed by law;

- If the transfer contract requires the buyer to pay tax on behalf of the seller, the taxing time is time of registration of the right to own or right to use the real estate.

- In case the person receives an off-the-plan house or land use right associated with off-the-plan constructions, the taxing time is the time the person submits tax declaration documents to the tax authority.

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?