What are regulations on determination and carry-forward of losses for corporate income tax in Vietnam?

What are regulations on determination and carry-forward of losses for corporate income tax in Vietnam?

Under Article 9 of Circular 78/2014/TT-BTC, amended and supplemented by Article 7 of Circular 96/2015/TT-BTC, the determination of losses and loss carryforward is regulated as follows:

- The loss incurred in a tax period is the negative difference of taxable income that does not include losses carried forward from previous years.

- Enterprises, after finalizing taxes and incurring losses, should carry forward the entire and continuous amount of loss to the taxable income (excluding exempted income) of subsequent years. The period for carrying forward losses is continuously no more than 5 years, starting from the year following the year of loss occurrence.

- Enterprises undergoing conversion of enterprise type, merger, consolidation, division, separation, dissolution, or bankruptcy must finalize taxes with the tax authority up to the point of decision on enterprise conversion, merger, consolidation, division, separation, dissolution, or bankruptcy made by a competent authority (except for cases not required to finalize taxes according to regulation). The losses incurred by enterprises before conversion, merger, or consolidation must be monitored in detail according to the year of occurrence and offset against the income of the same year for post-conversion, post-merger, post-consolidation, or be carried forward to subsequent years' income to ensure the principle of continuous loss carryforward not exceeding 5 years from the year following the year of incurrence.

What are regulations on determination and carry-forward of losses for corporate income tax in Vietnam? How to determine taxable income and taxable income for corporate income tax? (Image from the Internet)

How to determine taxable income and taxable income for corporate income tax in Vietnam?

According to Article 4 of Circular 78/2014/TT-BTC, amended and supplemented by Article 2 of Circular 96/2015/TT-BTC, taxable income and tax-calculation income are determined as follows:

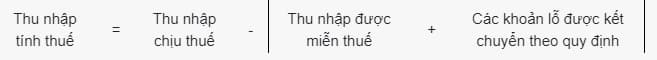

- Tax-calculation income in the taxable period is determined by taxable income minus tax-exempt income and losses carried forward from previous years according to regulations.

Tax-calculation income is determined by the following formula:

- Taxable income

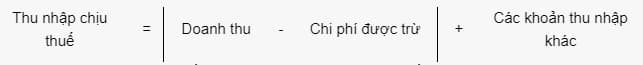

Taxable income in a taxable period includes income from production and business activities of goods and services and other income.

Taxable income in a taxable period is determined as follows:

What are the regulations on deductions and non-deductions when determining taxable income for corporate income tax in Vietnam?

According to Article 9 of the Corporate Income Tax Law 2008, amended and supplemented by Clause 5, Article 1 of the Amended Corporate Income Tax Law 2013 and Clause 3, Article 1 of the Law on Amendments to Tax Laws 2014, deductions and non-deductions in determining taxable income for Corporate Income Tax include:

Deductions:

- Enterprises are allowed to deduct all expenses when determining taxable income if they meet the following conditions:

+ Expenses actually incurred related to production and business activities of enterprises; expenses for vocational education activities; expenses for fulfilling national defense and security tasks of enterprises in accordance with the law.

+ Expenses with adequate invoices and documents as prescribed by law. For invoices for purchases of goods and services with a value of twenty million dong or more per transaction, payment vouchers without using cash must be obtained, except where payment vouchers without cash are not required according to regulations.

Non-Deductions:

- Expenses that do not meet the conditions stipulated in Clause 1 of this Article, except for the portion of loss value due to natural disasters, epidemics, and other force majeure cases not compensated.

- Fines due to administrative violations;

- Expenses compensated by other financial sources;

- Management expenses allocated by foreign enterprises to their permanent establishments in Vietnam exceeding the calculated level according to the allocation method as regulated by Vietnamese law;

- Excess provisions according to the law on reserves;

- Interest expenses on loans for production and business borrowed from non-credit organizations or non-economic organizations exceeding 150% of the basic interest rate announced by the State Bank of Vietnam at the time of borrowing;

- Fixed asset depreciation not conforming to the law;

- Pre-allocations to expenses not conforming to the law;

- Salaries, wages of private business owners; remuneration paid to the founders of the enterprise who do not directly manage production, business; salaries, wages, other expense accounts for employees that have not been actually paid or have no invoices or documents as required by law;

- Interest expenses on loans corresponding to the deficit in charter capital;

- Deducted input value-added tax, value-added tax paid under the deduction method, Corporate Income Tax;

Donations, except for donations for education, healthcare, scientific research, overcoming the aftermath of natural disasters, building Great Unity houses, gratitude houses, houses for policy beneficiaries according to the law, donations under state programs for localities with special economic - social difficulties;

- Contributions to voluntary pension funds or funds with social welfare characteristics, purchasing voluntary pension insurance for employees exceeding the level prescribed by law;

- Expenses of business activities: banking, insurance, lotteries, securities, and certain other specific business activities as regulated by the Minister of Finance.

- Foreign currency expenses, when determining taxable income, must be converted to Vietnamese Dong at the average transaction exchange rate in the interbank foreign currency market announced by the State Bank of Vietnam at the time of incurring expenses in foreign currencies.

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?