What are guidelines for filling out Form No. 01/PLI on employment report for the last 6 months of 2024 in Vietnam? Is the hazardous duty allowance for employees subject to personal income tax in Vietnam?

What are guidelines for filling out Form No. 01/PLI on employment report in the last 6 months of 2024 in Vietnam?

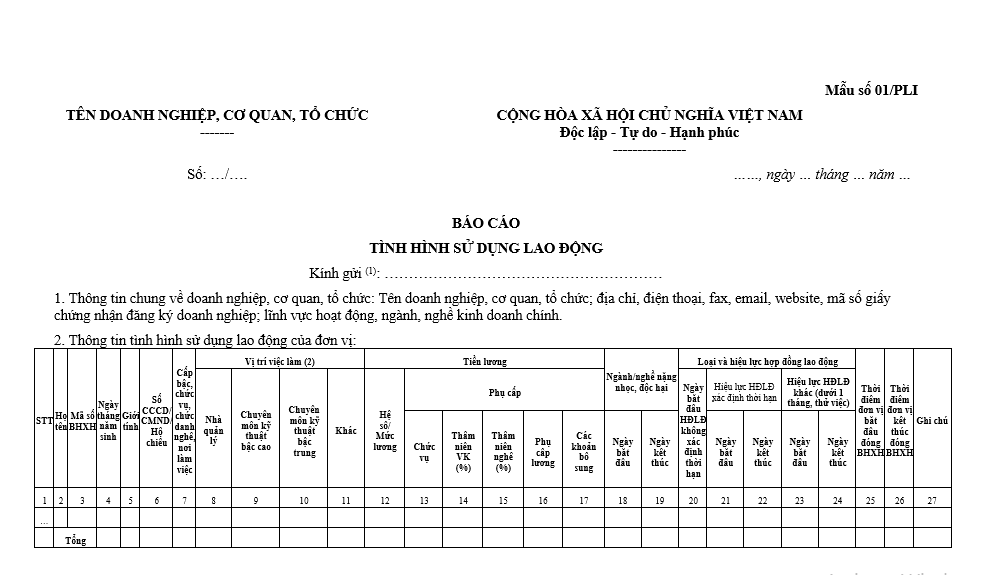

The employment report form according to Form No. 01/PLI, applicable for the first 6 months of 2024, is currently regulated in Appendix I issued with Decree 145/2020/ND-CP. This report form is used by enterprises to periodically report on their labor situation, enabling governmental agencies to monitor and evaluate labor utilization at different times, thus implementing necessary adjustments and support.

Form No. 01/PLI on employment report. Download here

Information Declaration Section of the Report Recipient Unit:

Fill in information regarding the Department of Labor, War Invalids and Social Affairs; the district, town social insurance agencies where the enterprise or branch, representative office is located ([1]).

Job Position Classification:

Column (8) Manager: Mark "X" for employees holding leadership, management positions at various levels and sectors, from central to local (commune).

Column (9) High-level Technical Specialization: Mark "X" for employees requiring a professional degree from university and above in fields such as science, engineering, medicine, education, business, information technology, law, culture, and society.

Column (10) Mid-level Technical Specialization: Mark "X" for employees with a degree from college or intermediate levels in fields like science, engineering, medicine, business, law, information technology, culture, and education.

The filler must identify the job position of each employee and mark "X" in the appropriate box.

Other labor-related information:

- Salary and allowances: Enter the salary and allowances as agreed in the labor contract. If not agreed upon, leave blank.

- Type and validity of the labor contract: Specify the type of contract (fixed-term, indefinite-term) and contract validity period.

- Heavy, hazardous occupations: Mark if the employee is engaged in heavy, hazardous occupations.

- Social insurance contribution period: Enter the start and end time of social insurance contributions if any, according to the contract and actual insurance contributions by the employee.

Information is for reference purposes only.

What are guidelines for filling out Form No. 01/PLI on employment report for the last 6 months of 2024 in Vietnam? Are enterprises required to finalize personal income tax for employees in Vietnam? (Image from the Internet)

Do employees have a responsibility to submit employment reports in Vietnam?

According to Article 12 of the Labor Code 2019, it stipulates the responsibilities for employment management by employers as follows:

Responsibilities for employment management by the employer

1. Establish, update, manage, and utilize the employment management record in paper or electronic form and present it upon request by competent state agencies.

2. Report labor utilization within 30 days from the commencement of operation, periodically report changes in labor during operation to the specialized labor agency under the provincial People's Committee, and notify the social insurance agency.

3. The Government of Vietnam shall stipulate details for this Article.

Accordingly, through the above regulation, employees are not responsible for submitting a employment report.

Vietnam: Is the hazardous duty allowance for employees subject to personal income tax (PIT)?

Based on Clause 2, Article 2 of Circular 111/2013/TT-BTC, which prescribes taxable income as follows:

Taxable incomes

...

2. Income from wages and salaries

Income from wages and salaries is what the employee receives from the employer, including:

a) Wages, salaries, and amounts of similar nature in monetary or non-monetary forms.

b) Allowances and subsidies, except for the following allowances and subsidies:

b.1) Monthly preferential allowances and one-time allowances as prescribed by law for people with meritorious services.

b.2) Monthly and one-time allowances for individuals participating in resistance, national protection missions, international tasks, and young volunteers who have completed their missions.

b.3) National defense and security allowances; allowances for the armed forces.

b.4) Hazardous and dangerous allowances for sectors, occupations, or jobs at workplaces with hazardous, dangerous conditions.

b.5) Attraction allowances, regional allowances.

b.6) Unexpected hardship allowances, labor accident allowances, occupational disease allowances, maternity benefit, convalescence benefits after childbirth, reduced work capacity allowances, one-time retirement allowances, monthly survivorship allowances, severance allowances, unemployment allowances, and other allowances as prescribed by the Labor Code and Social Insurance Law.

b.7) Allowances for social protection beneficiaries as prescribed by law.

b.8) Service allowances for senior leadership.

...

Accordingly, hazardous and dangerous allowances for employees working in sectors, occupations, or jobs with hazardous, dangerous conditions will not be included in taxable personal income (PIT).

- Are hazardous allowances subject to personal income tax in Vietnam?

- Shall the TIN be deactivated due to bankrupcy in Vietnam?

- What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

- Vietnam: Is tax liability imposed when failing to present accounting books?

- What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

- Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

- What is the guidance on first-time taxpayer registration for foreign subcontractors who directly declare and pay contractor tax in Vietnam?

- What are cases where a 10% PIT is withheld in Vietnam?

- How to submit the dependant registration application for persons with income from wages and salaries in Vietnam?

- What are guidelines for first-time taxpayer registration for dependants declared directly at the tax authority in Vietnam?